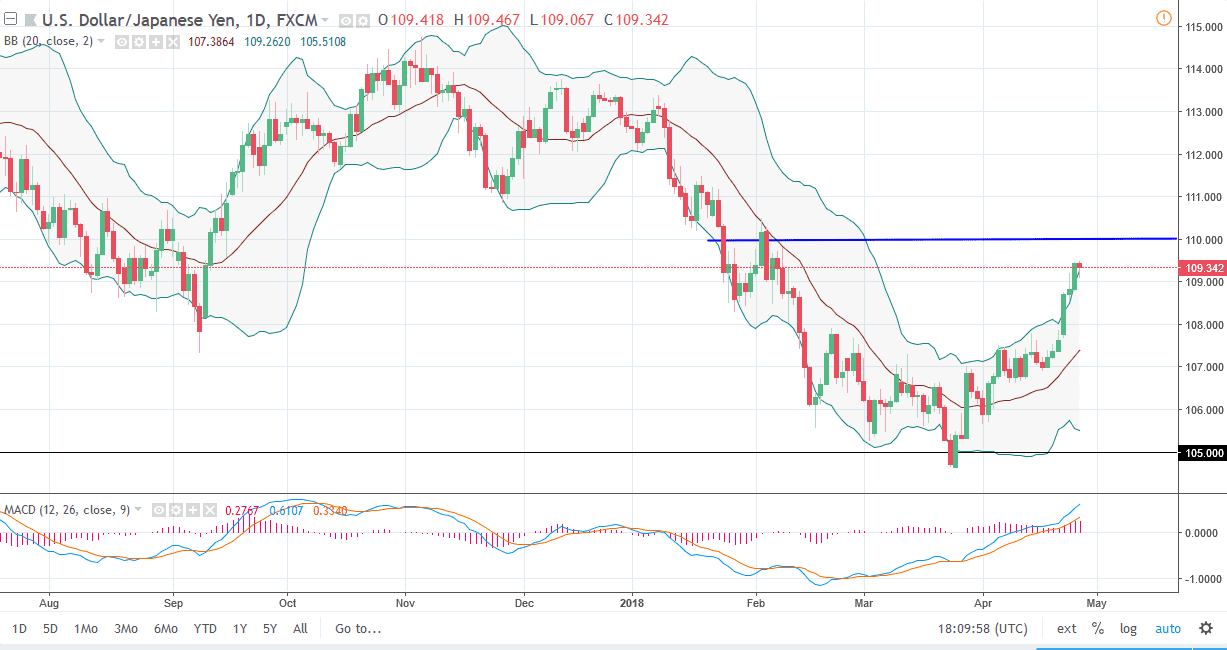

USD/JPY

The US dollar has initially pulled back during the trading session on Thursday but found enough support around the 109 level to turn around and form a hammer. The hammer of course is a very bullish sign, and I think that the market will probably go to the 110 level above which is resistance. If we broke above the 110 handle, the market would more than likely go looking towards the 112-level next. If we break down below the bottom of the hammer for the session, I think we could pull back to the 108-level looking for support. Ultimately, the market will follow interest rate expectations out of the United States, based upon what’s going on in the 10-year note. I think that we are bullish, but it may take several attempts to break above the 110 handle.

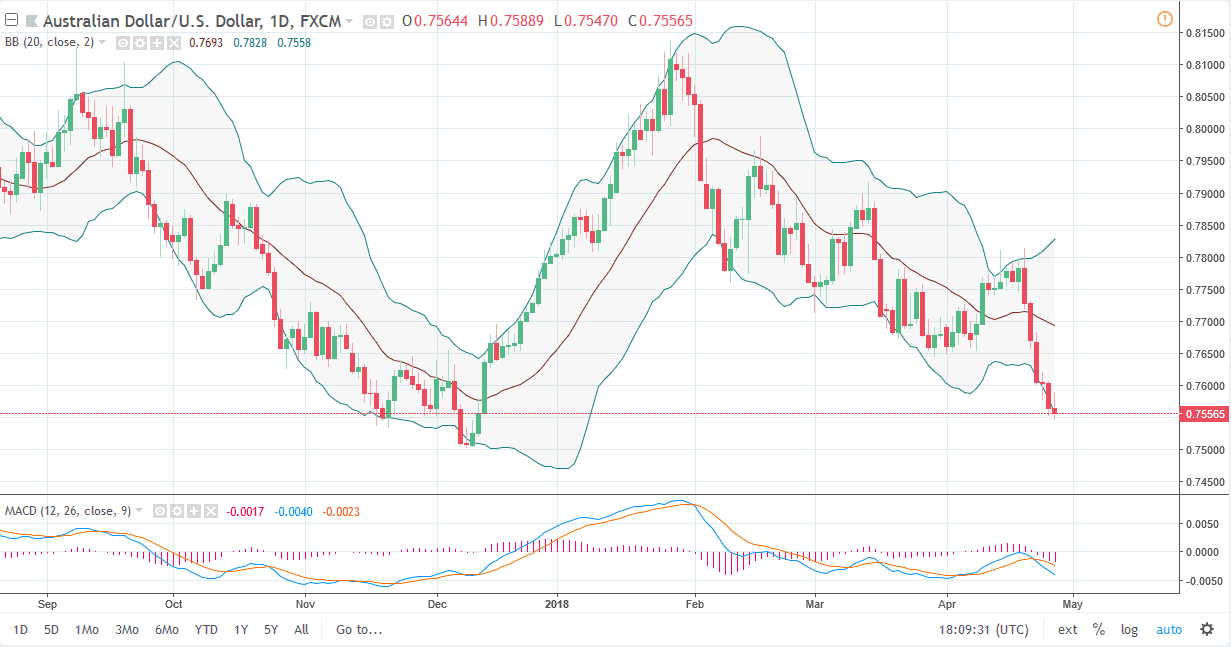

AUD/USD

The Australian dollar initially tried to rally during the trading session on Thursday but found enough resistance at the 0.76 level to turn around and form a shooting star. The shooting star looks likely as a sign that we will continue to be bearish pressure, perhaps reaching down to the 0.75 level. If we break down below that level, we are free to go much lower. I think that the 0.76 level is continuing to offer a significant resistance, and if we break above that level it’s likely that the market could continue to go higher, perhaps reaching towards the 0.70 level. Remember that the US dollar is being driven by the bond market right now, as we are starting to see higher yields coming out of America. That puts bearish pressure on gold as well, which is yet another reason that this market continues to fall.