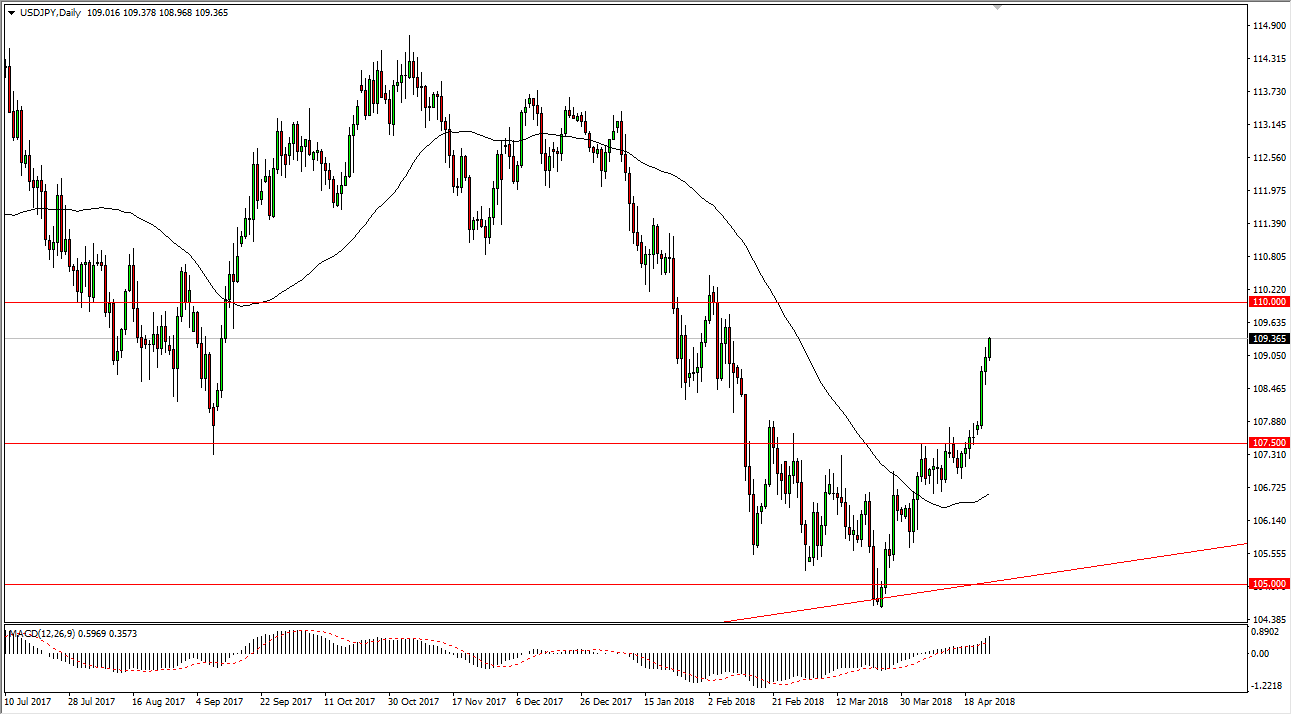

USD/JPY

The US dollar continued to show strength during the trading session on Wednesday, and of course it was no different against the Japanese yen. It looks as if we are going to try to go to the 110 level above, which is resistance. This is based upon the interest rates rising in the United States, as the 10 year note flirts with 3%. I believe that if we can break above the 110 level, the market should continue to go much higher. In the short term, I think that we will get small pullbacks, but those pullbacks should be value opportunities. The 107.50 level underneath should be massive support, and I think that value hunters will be interested in buying this market every time we dip. If we can break above the 110 level, the market should go towards the 113.50 level.

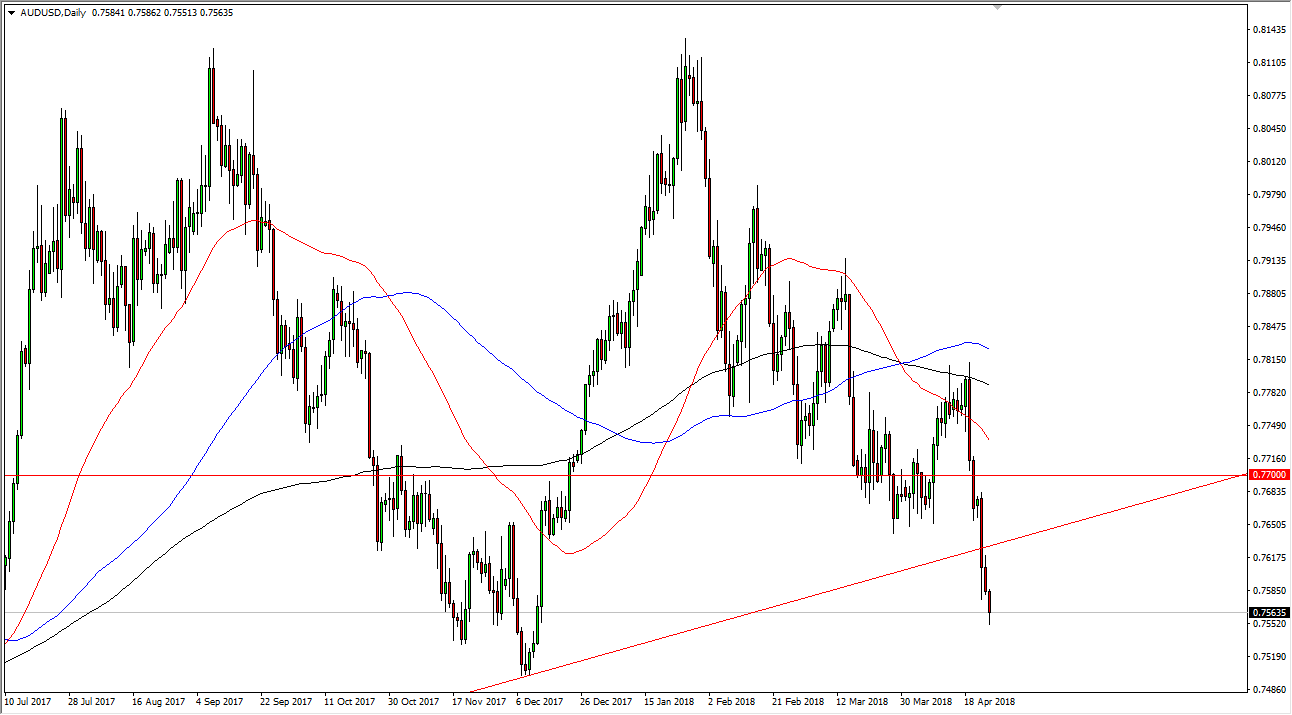

AUD/USD

The Australian dollar fell again during trading on Wednesday, as we continue to see downward pressure with higher interest rates in America. This has put bearish pressure on gold as well, and that of course has a bit of a negative effect on the Aussie. I think that we will eventually see an attempt to rally, but I think it’s not until we break above the uptrend line, and perhaps even the 0.77 level that buying can be taken with any type of faith. I think that the market is likely to reach towards the 0.75 level underneath, and then towards the 0.7250 level.

I believe that the market should continue to be driven by interest rates in the United States, which of course have traders looking to buy the greenback itself. I think that the breaking below of an uptrend line is a major signal that perhaps we could drop drastically, as the uptrend line goes back to late 2015.