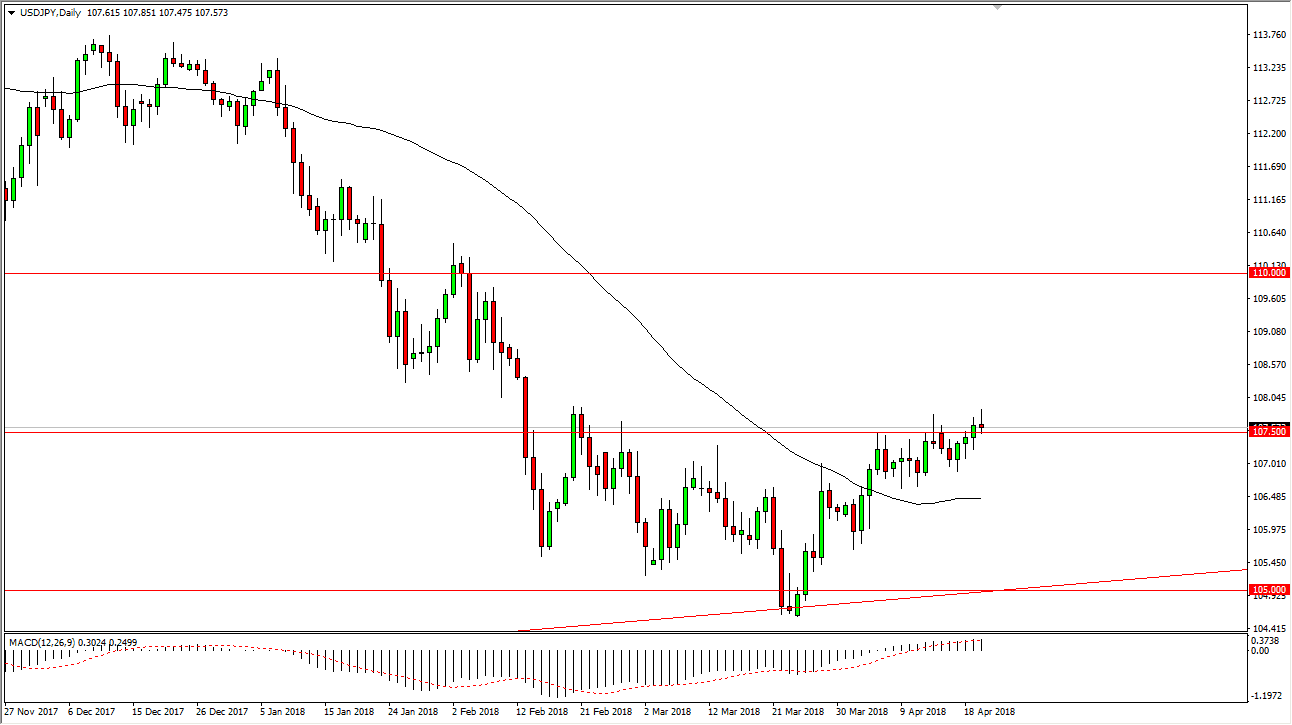

USD/JPY

The US dollar broke out a bit during the trading session on Friday against the Japanese yen but turned around to form a shooting star. While the candlestick itself is a negative sign, I think that the longer-term play is to buy dips. I think if we can break above the top of the shooting star for the Friday session, extensively the 108 handle, we should continue to go higher and look towards the 110 level. The alternate scenario of course is that we break down below the bottom of the shooting star and go looking for support below, which I suspect shows up somewhere near the 107 handle. Remember that this market is highly influenced by the overall risk appetite of the global economic markets, so pay attention to the S&P 500 and other stock markets as to the directionality. I believe that the market will eventually break out, but it could be a bit noisy in the meantime.

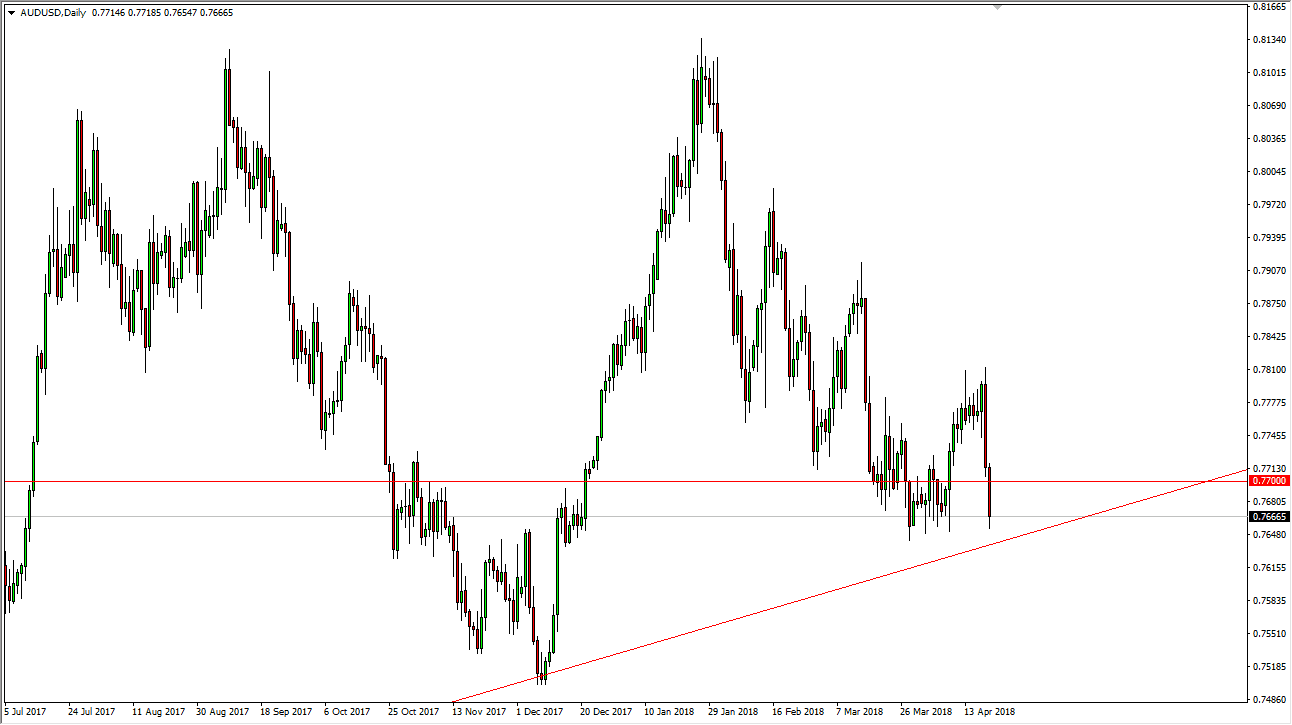

AUD/USD

The Australian dollar fell again during the day on Friday, reaching down towards the 0.7650 level. However, there is a major uptrend line just below, so I think it should keep this market afloat. The uptrend line should be respected, and we did start to see signs of that towards the end of the session. If we break down below the uptrend line, basically the 0.76 level, I think that the market could online rather viciously. This is because the trendline goes back to the end of 2015, and a turnaround from there would of course be a bit of a surprise. If we can break above the 0.77 handle, I think that the buyers will come back in and push the Aussie higher. Remember to keep an eye on the gold markets as the correlation is high.