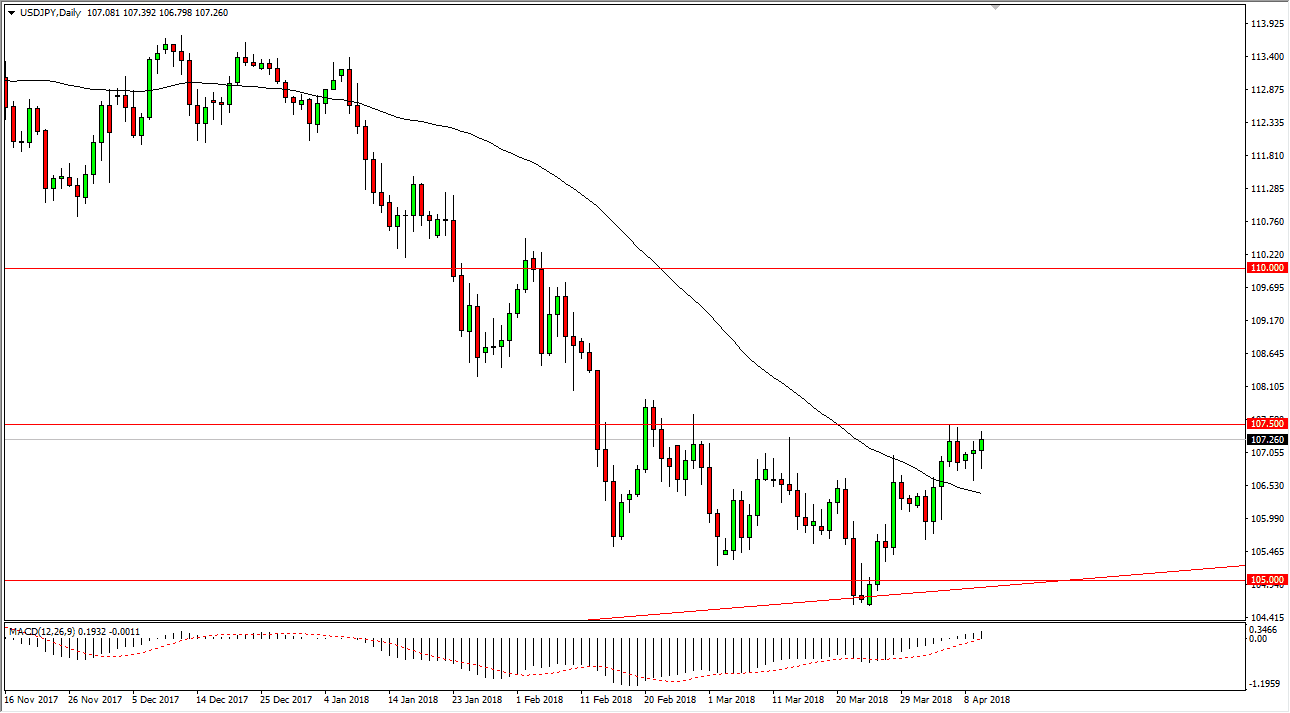

USD/JPY

The US dollar fell initially during trading on Tuesday, but as the Chinese have gone the extra mile earlier in the day as the Chinese have tried to cool tensions between themselves and the Americans. If we can break above the 107.50 level, the market should then go to the 108 handle. The market breaking above the 108 level would be a bullish sign, sending this market towards the 110 handle after that. If we pull back from here, I believe that the 106.50 level should be supportive. A breakdown below that level would send this market towards the 105-level underneath. The 105 level is massive support, not only due to the large, round, psychologically significant number, but the uptrend line at that level is also important. Ultimately, this is a market that continues to offer value on these dips.

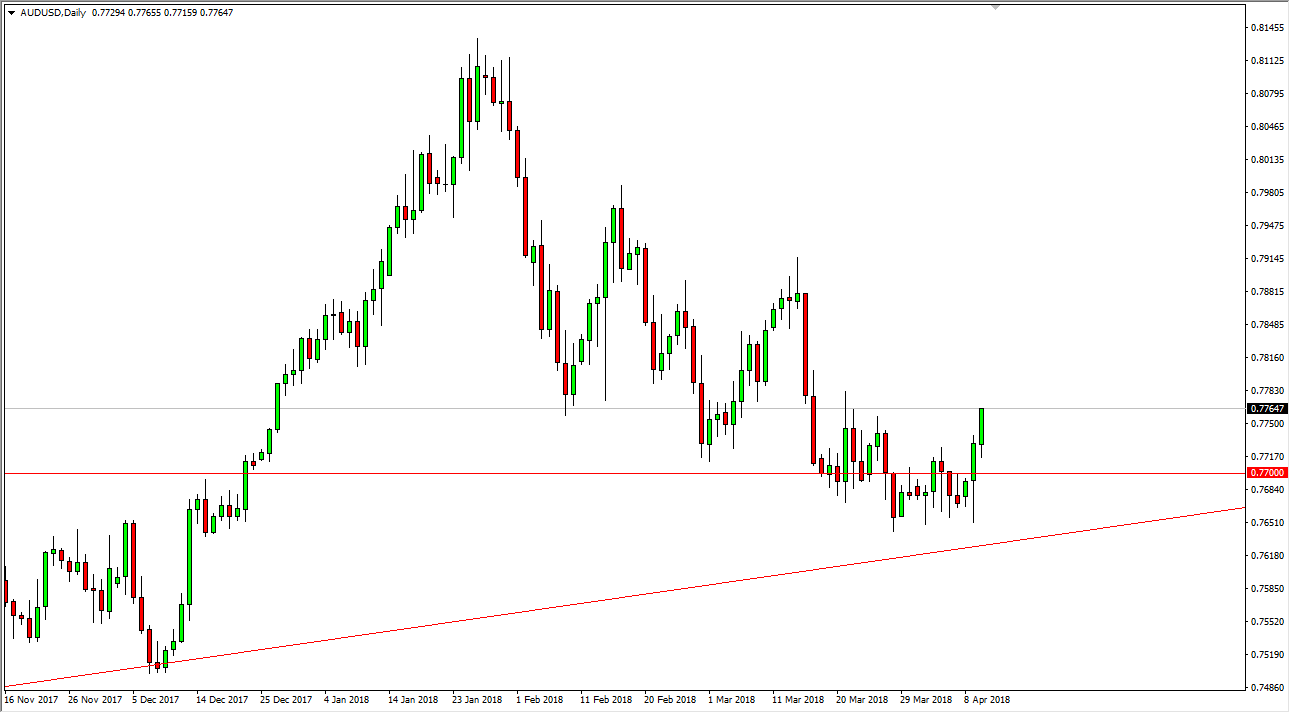

AUD/USD

The Australian dollar initially pulled back a bit during the trading on Tuesday but found enough bullish pressure to turn things around and break above the 0.7750 level. The Chinese look to be tempering the rhetoric as far as a trade war with America is concerned, and that directly affects the Australian dollar as it is so sensitive to the Asian markets. Pullbacks should continue to be buying opportunities with the 0.77 level offered support. Beyond that, the uptrend line underneath is the bottom of the up-trending channel, going back to the end of 2015. I believe that ultimately, we will go to the 0.81 level, but it is going to take a lot of effort to finally get to that level. I believe buying dips continues to be the way forward, and if gold takes off, that should help the Aussie over the longer term.