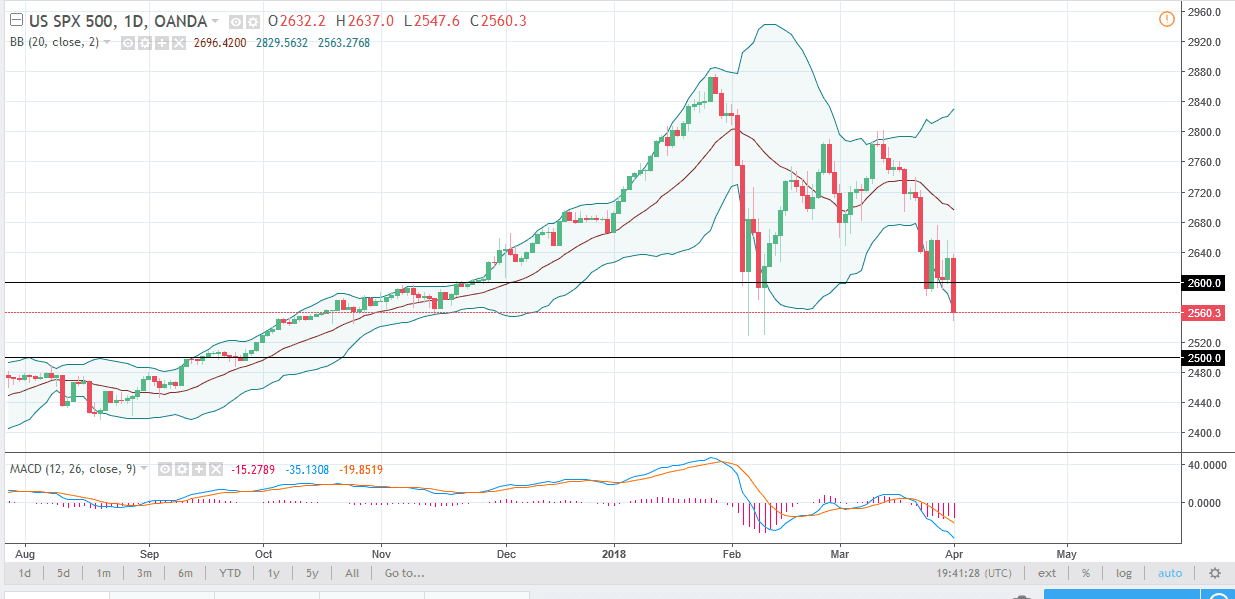

S&P 500

The S&P 500 broke down significantly during the trading session on Monday, clearing to a fresh, new low. There is a significant amount of support just below though, especially near the 2550 level. Beyond there, we should see a significant amount of support at the 2500 level as well. There continues to be a lot of fear when it comes to the potential of a trade war, as well as an underlying weakness that we have seen for a while. I think that the 2500 level being broken to the downside would probably send this market reeling, and down to extraordinarily low levels. I think that between now and Friday, we will continue to dance around, so I’m not looking to put a lot of money into the market, as we could get sudden swings and volatility until we get the jobs number. Once we get that hurdle out of the way, the market might be able to make up its mind.

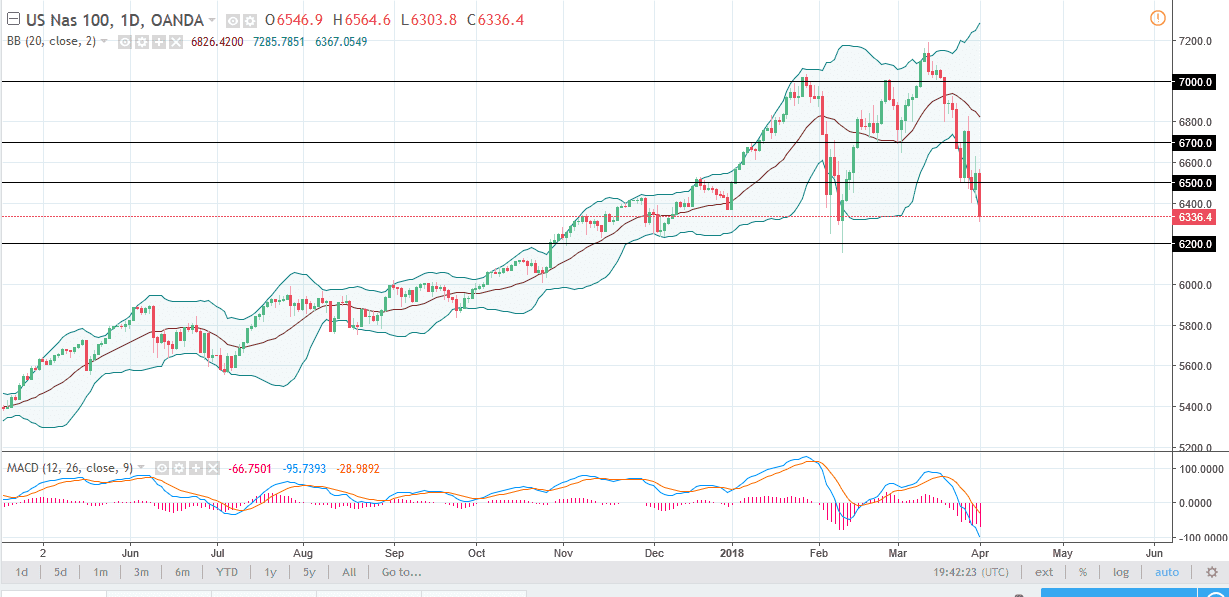

NASDAQ 100

The NASDAQ 100 broke down significantly during the trading session as well, reaching down towards the 6350 handle. This level offered a bit of support, but I think that the real support is closer to the 6200-level underneath. I believe that the market will continue to be very noisy, and it certainly looks as if traders are willing to jump out as soon as something that is either implied or happens. If we were to break above the top of the candle for the session on Friday, that might bring in more momentum, sending the market towards the 6800 level, possibly even the 7000 level. If we were to break down below 6200, that could unwind this market rather drastically. Either way, keep your position size small. There’s obviously going to be a lot danger out there.