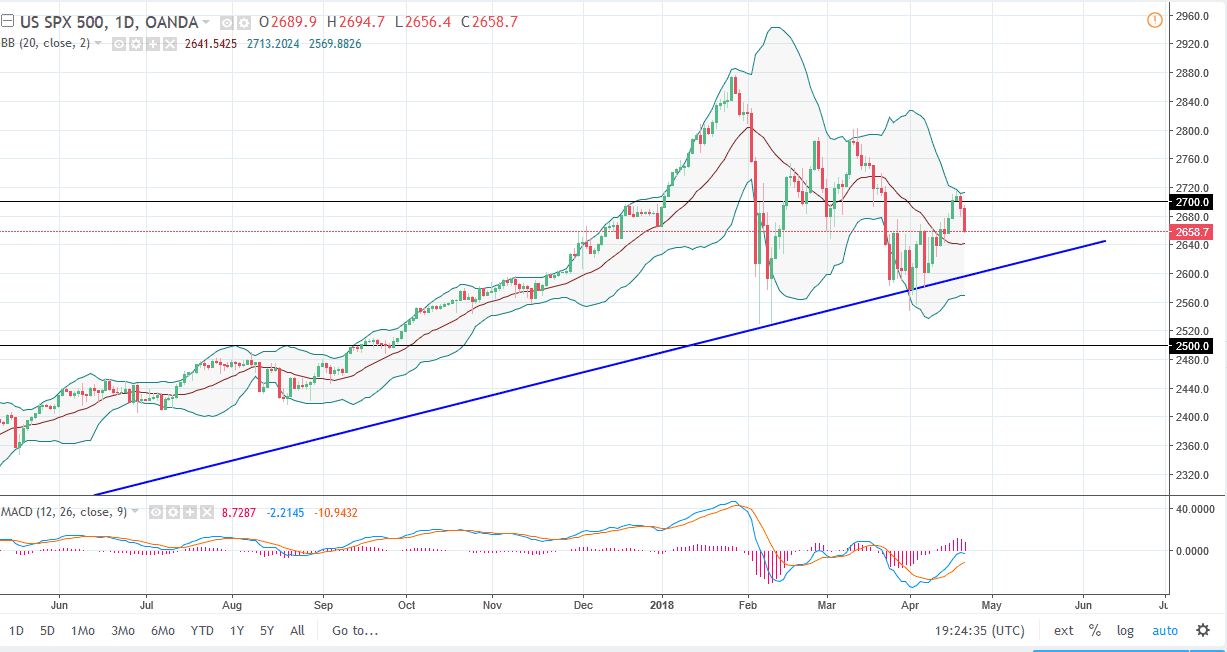

S&P 500

The S&P 500 rolled over during the trading session on Friday as stock markets in general fell. Interest rates in the United States are starting to work against stocks, and we have drifted down to the 2660 handle. However, there is a major uptrend line just below, which can be found closer to the 2600 level. Beyond that, there is also a significant amount of noise between here and there, so I think it’s only a matter of time before the buyers get involved. I would wait for some type of supportive candle to take advantage of a bounce, and at that point start buying. I don’t have any interest in shorting this market until we break down below the uptrend line, something that doesn’t look very likely to happen. Expect volatility, but longer-term I believe that we will find buyers returning on a value proposition.

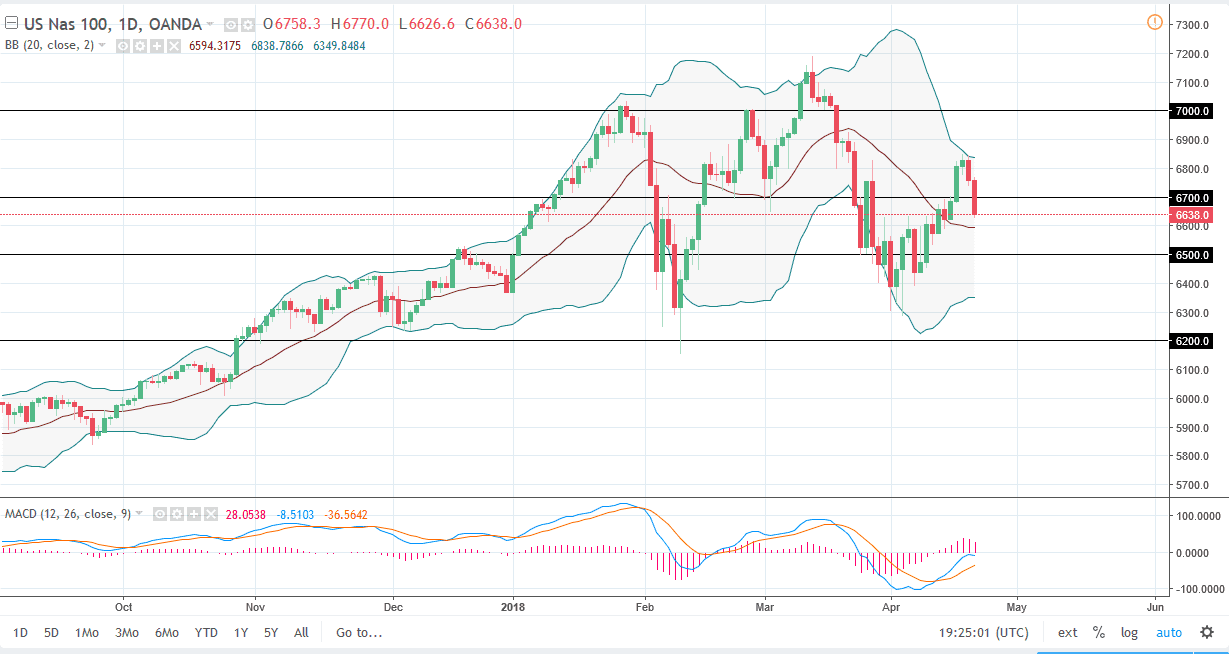

NASDAQ 100

The NASDAQ 100 also broke down during the trading session, breaking down below the 6700 level. In fact, we were approaching the 6600 level after that. I think there is a massive amount of support down at the 6500 level though, so given enough time I anticipate that buyers will return and start picking up value. Remember that these markets are based upon risk appetite in general, so I think that the headlines around the world will continue to move the stock markets more than anything else. Certainly, earnings have been decent enough to keep the market to flow, but higher interest rates and of course concerns about a trade war or perhaps even an escalation of the shooting war in Syria continue to plague markets overall. I suspect we will find value underneath though, but we need to be patient and wait for that to show itself.