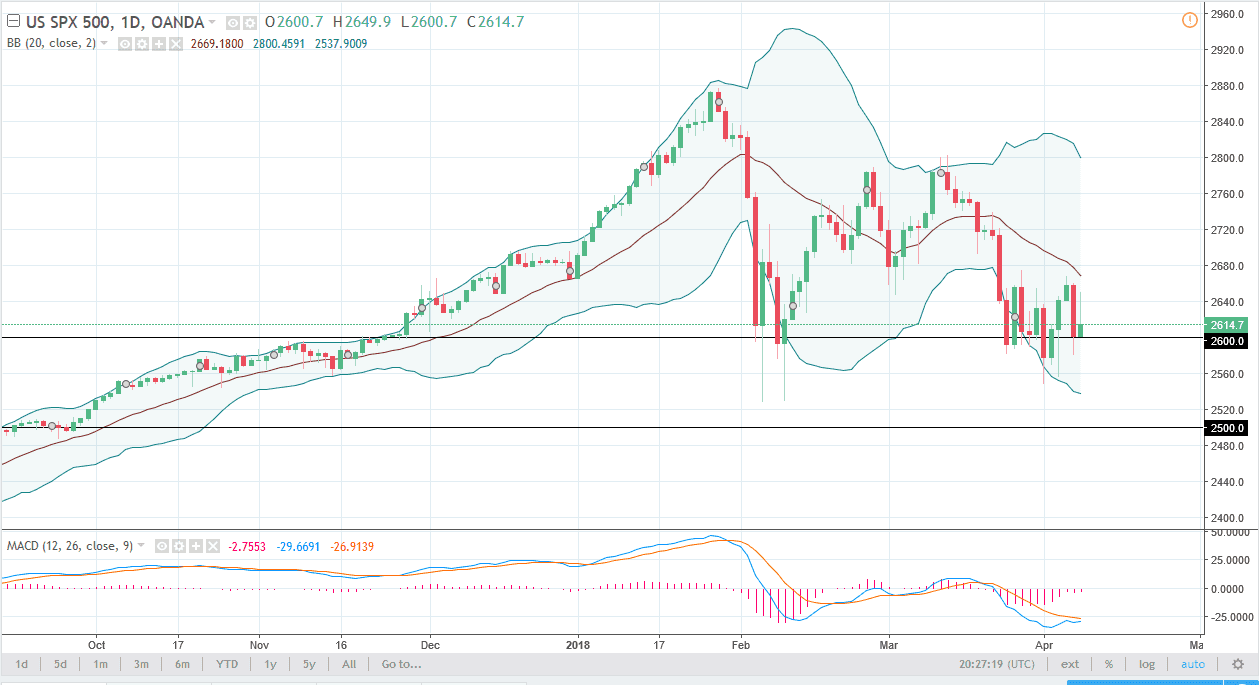

S&P 500

The S&P 500 initially rallied during the session on Monday, extending to the 2650 handle. We found enough resistance or roll over though, and later in the day it was revealed that the FBI was raiding the office of Donald Trump’s personal attorney, and that accelerated the selloff late in the day. However, I think that we are looking at is a continuation of consolidation in a market that has been trying to figure out where to go next. I believe the volatility will continue to be a major issue, but if we were to turn around and break above the 2680 handle, I think that the S&P 500 could go higher. Alternately, if we break down below the 2600 level, we could drift down to the 2550 handle, perhaps even the 2500 level. A breakdown below the 2500 level would be catastrophic.

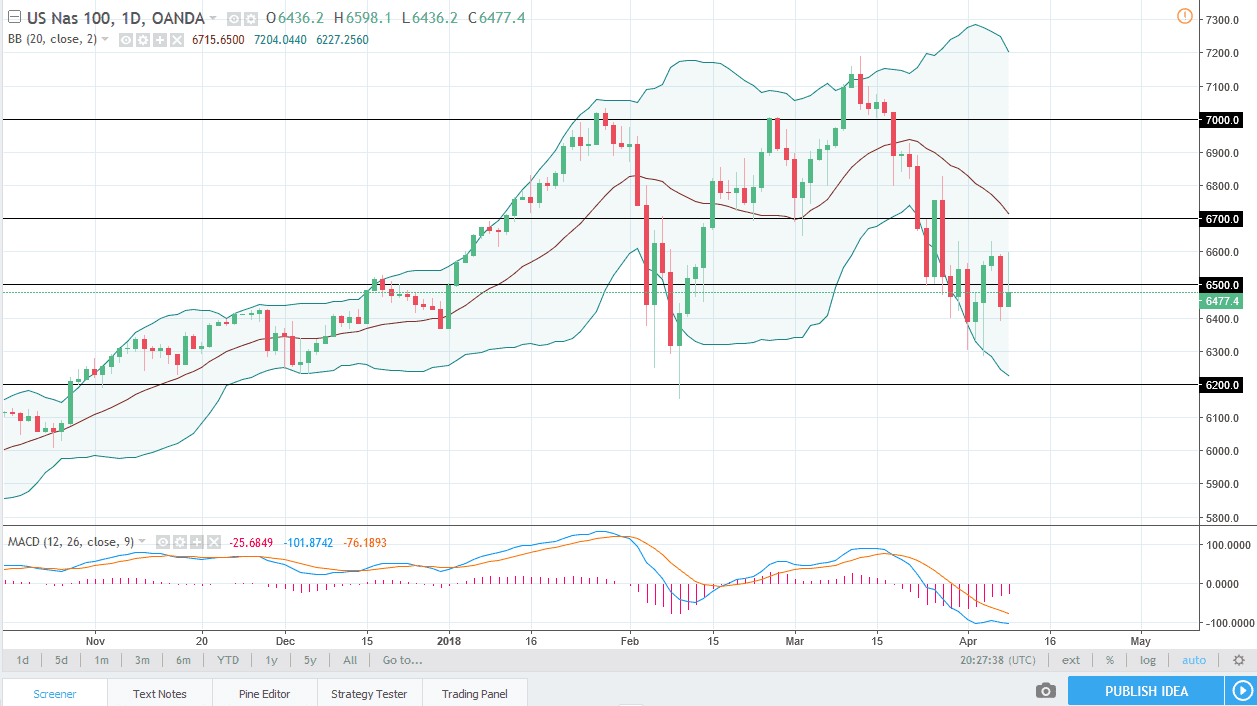

NASDAQ 100

The NASDAQ 100 had a very similar action, reaching towards the 6600 level before rolling over and forming a negative looking candle. However, I think there’s a significant amount of support underneath that the 6400 level, that extends down to the 6200 level. I don’t like the idea of shorting this market, least not yet. It looks likely that this overall choppiness will continue to be a major issue, but if we were to break down below the 6200 level, that could unwind this market rather rapidly. The alternate scenario is that we could break above the 6600 level, sending the market towards the 6800 level after that. Expect volatility, but you should also keep in mind that most of what’s moving the market now is going to be headlines, which are very unpredictable. With this being the case, keep your position size small.