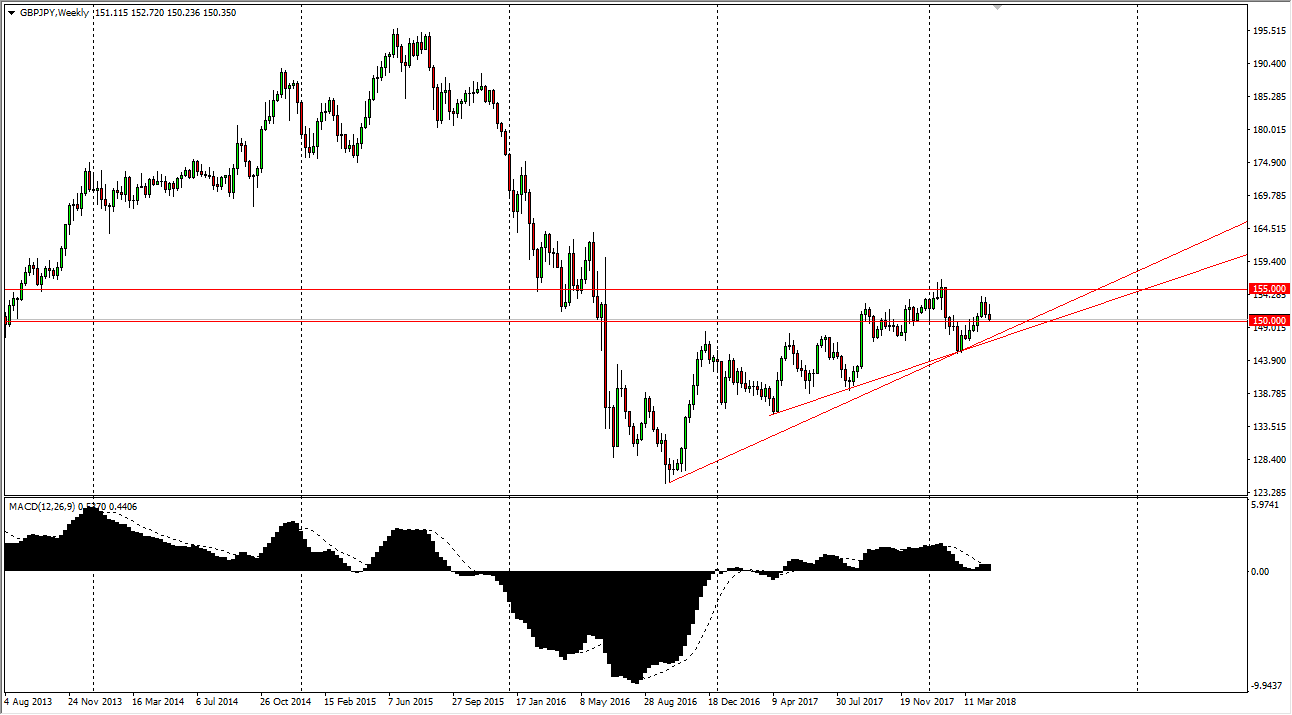

The British pound has been rallying over the last couple of months, but over the last couple of weeks has started to see a bit of selling pressure. I believe that the market looks likely to go back towards the uptrend line underneath, so the initial part of the month of May could be a bit negative. I think that the 150 level is of course important, so it might cause a bit of a selloff, perhaps down to the 147.50 level, which coincides nicely with the uptrend line. The alternate scenario is of course that we break above the weekly candle that formed for the last week of April, which would be a very strong sign and could send this market looking towards 155. A break above there sends the market looking the 160.

Keep in mind that this pair is highly sensitive to risk appetite around the world, so pay attention to stock markets. If they rally quite nicely, that should push this market to the upside. The market should continue to be very noisy in general, but I think that if you are cautious and build up a position slowly, you may be able to take advantage of what will be a major move. We do breakout to the upside and go much higher, perhaps built on relief, or we break down rather drastically based upon some type of “risk off” scenario. Those uptrend lines on the chart should continue to guide this market, so pay close attention to this market place, and if we get a weekly close underneath one of those lines, we will more than likely breakdown rather significantly, perhaps to the 140 handle. The volatility in this pair will continue to be a major issue, but if you are cautious you can build up a position. I believe that this month will be crucial as to where we go next.