The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 8th April 2018

In my previous piece last week, for the first time in a long while I made no trade calls, due to the severe weakening of the prevalent trends and general directionless market uncertainty. I think this was a good call as markets continued to either range or move counter-trend and the movements did not seem obvious.

Last week saw a still-volatile stock market where the S&P 500 ranged above a supportive 200-day simple moving average. The steady fall in stock valuations has been halted, but the chart still looks dangerous for bulls. The major event in the Forex market, the U.S. Non-Farm Payrolls data, came in weaker than expected, which was negative for the greenback at the end of the week. Risk sentiment is also broadly deteriorating due to the prospect of a trade war between the U.S. and China, as both announce tariffs on imports of the other’s goods.

The overall effect of these developments was to leave the U.S. Dollar broadly unchanged, while the Japanese Yen has fallen quite strongly. The market’s focus over the coming week should now move to the U.S. CPI data and FOMC Meeting Minutes, as well as the ECB Monetary Policy Meeting Accounts.

Fundamental Analysis & Market Sentiment

Fundamental analysis tends to support the U.S. Dollar; however, sentiment is contradicting this at present due to poorer than expected Non-Farm Payrolls data. Sentiment is likely to remain unchanged until Wednesday’s CPI data, unless there are any new developments concerning U.S. / Chinese trade tariffs or the Russia / NATO tension.

Technical Analysis

U.S. Dollar Index

This index printed a small candlestick, which closed up, but looks a little bearish if anything. This is not strongly bearish and coupled with the consolidative price action of the past 11 weeks, it suggests that the long-term bearish trend is weakening considerably and possibly coming to an end. The bearish trend is still in force and worth following, but it should be treated with increasing caution regarding its reliability. On the other hand, the fact that all the resistance levels which have formed during this downwards trend are still intact suggests continuing bearishness. Overall, it is an increasingly inconclusive picture.

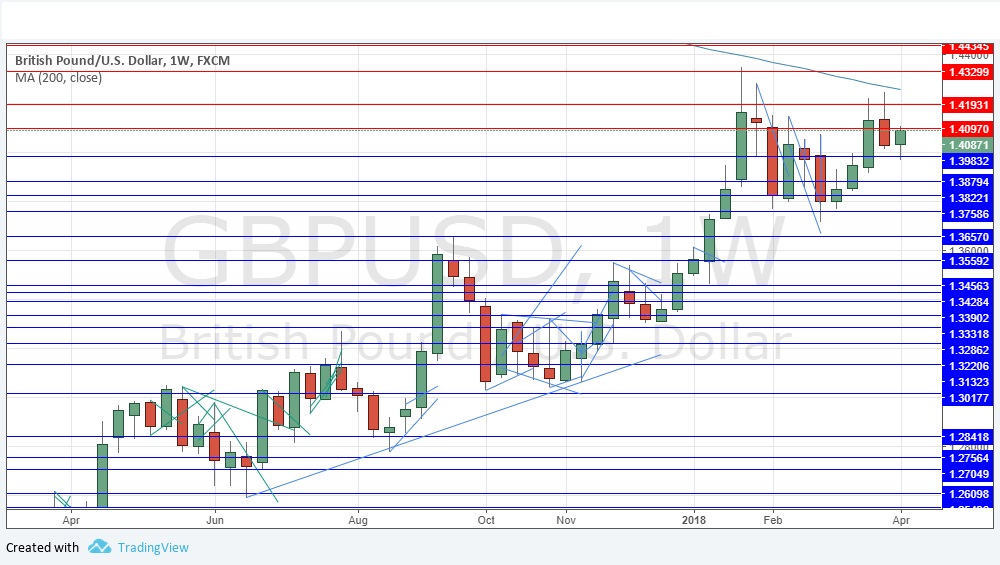

GBP/USD

This pair is in a long-term bullish trend. After consolidating over the past few weeks, it had begun to rise more strongly again. Last week’s candlestick was small, but undoubtedly bullish. Sentiment now seems to be more bullish on the Pound than on the Euro, which is another bullish sign. There is still a bullish trend here, but the price looks weak.

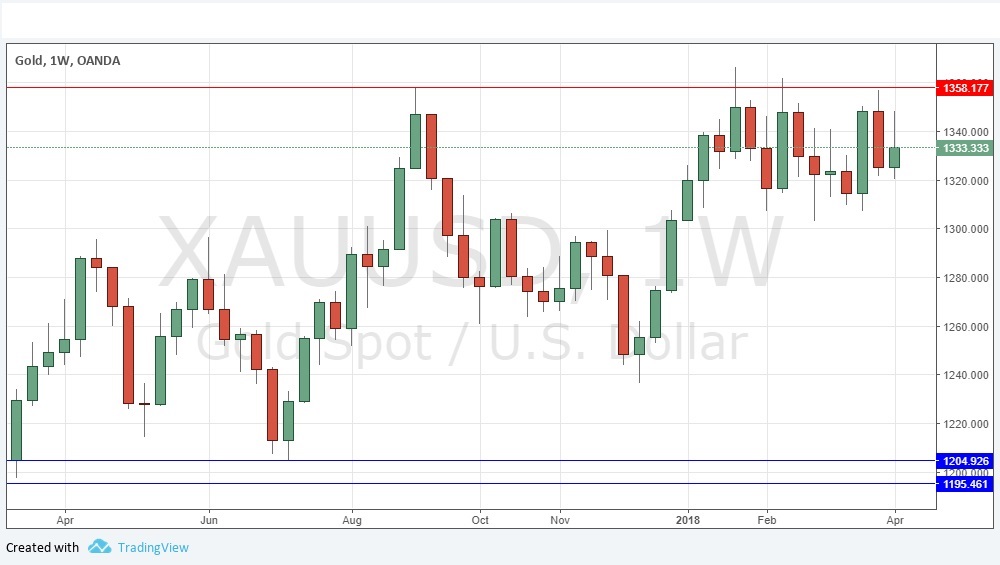

GOLD

There is a weak but definite long-term bullish trend in Gold. The key resistance level at $1,358 has continued to hold, however. Last week printed a mildly bullish candlestick. It looks quite dangerous to be long right now, but if some bullish momentum develops from here there would be a chance of a profitable long trade. A bullish breakout above $1,358 could be especially exciting, so that is something to watch out for here.

S&P 500 Index

I just wanted to take a quick look at the U.S. stock market’s major index, so we can see that the stock market is looking dangerous and increasingly bearish. The moving average shown in the daily chart below is the 200-day simple moving average. Last Friday’s close was just a fraction above it, and the weekly candlestick (not shown in the chart) was bearish. The price remains heavy and close to the moving average, which should be worrying for bulls. There are increasing signs that a bear market is on the way.

Conclusion

The only call I feel able to make this week is bullish on GBP/USD.