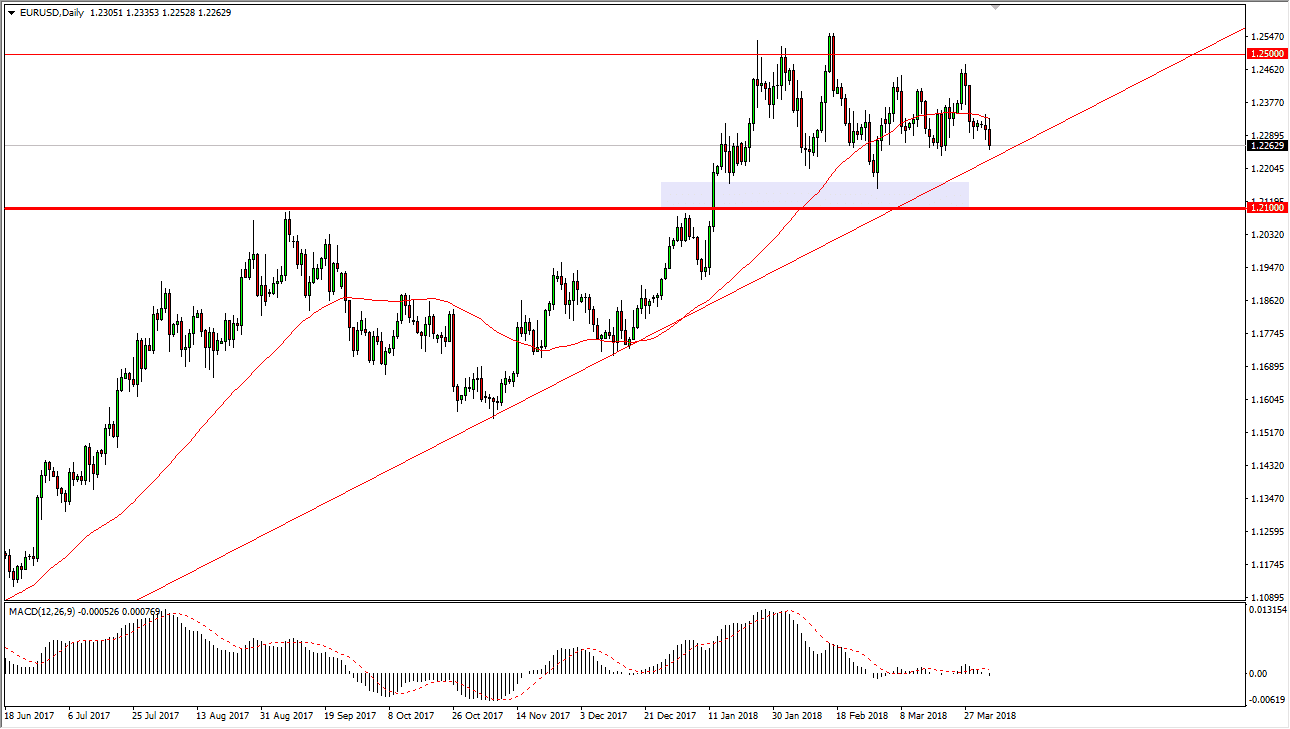

EUR/USD

The EUR/USD pair initially tried to rally during the trading session on Tuesday but found the 50-day EMA resistive not to roll over and break down. We closed towards the bottom of the range, reaching towards the 1.2250 level. There’s an uptrend line just below, and of course the 1.21 support level. I think that it will be difficult to make a huge move between now and then, as the Nonfarm Payroll announcement comes out on Friday, and that of course will be a major move around the market. The 1.25 level above is resistance, and I think it will take something special to break above there. I believe that in the meantime, we are simply going sideways in anticipation of what could be a significant move. We are towards the bottom of the overall consolidation that we have seen over the last several weeks, so I suspect we are probably going to see buyers jump in and trying to pick things up for the short term.

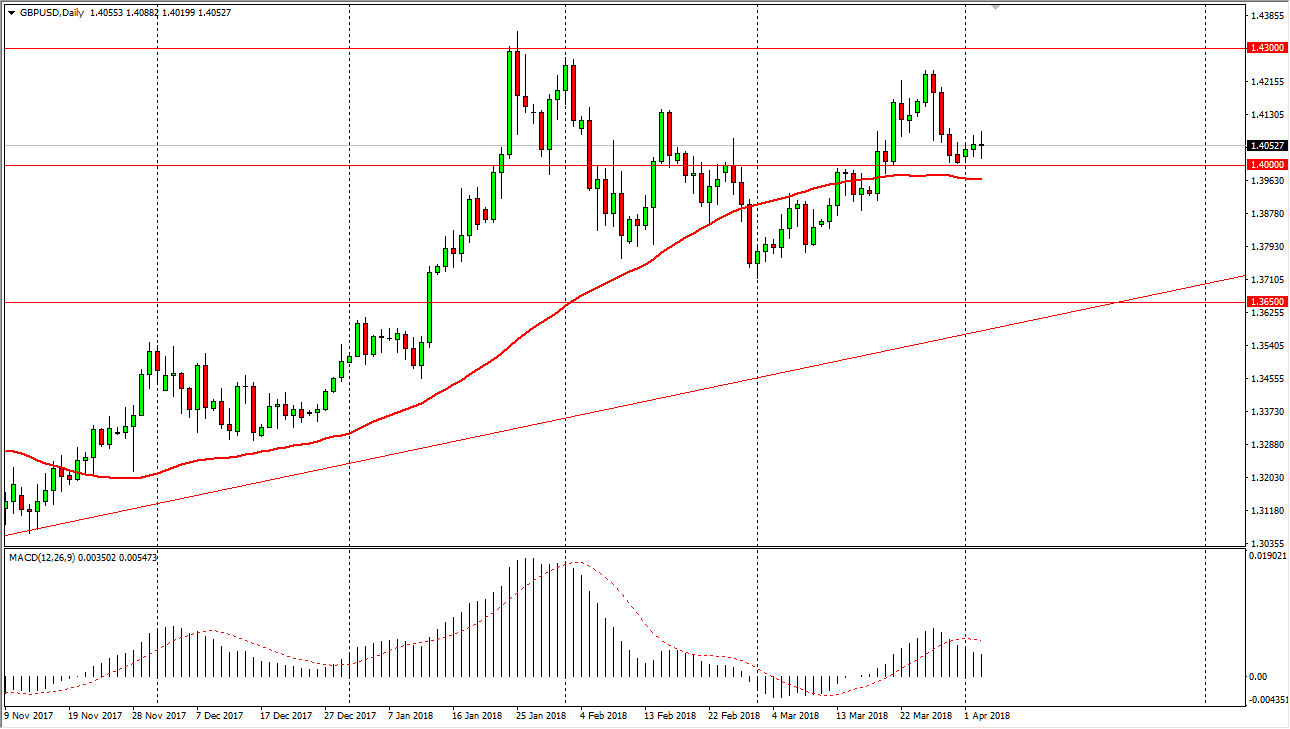

GBP/USD

The British pound went back and forth during the trading session on Tuesday as we continue to see a lot of volatility. I believe that the 1.40 level will be significant support, just as the 50-day EMA just underneath will be. However, it will probably take a significant amount of momentum to make a breakdown below that level, but it’s not impossible. I think that the market breaking below the 50-day EMA probably will have traders looking for the 1.39 handle, perhaps even the 1.38 level. Alternately, if we break above the top of the range for the Tuesday session, we probably go looking towards the 1.42 handle after that. It’s not until we get the jobs number on Friday that I anticipate this market being able to make a significant move.