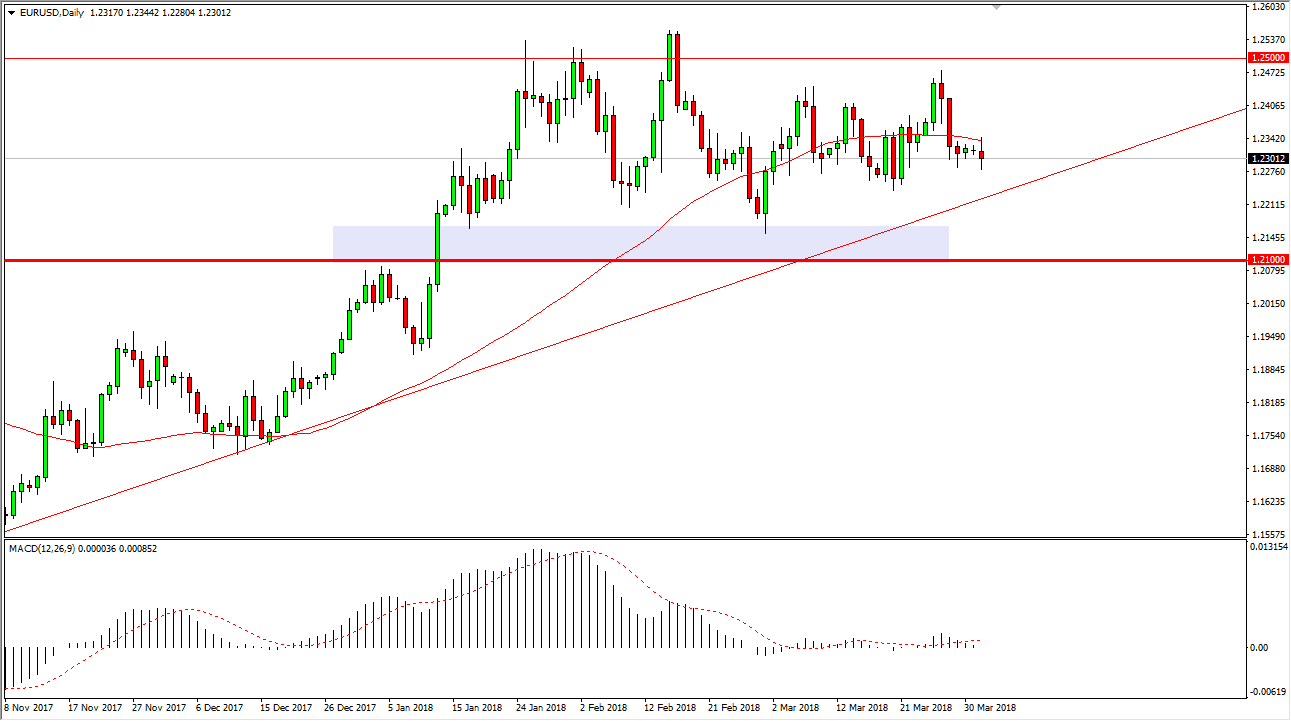

EUR/USD

The EUR/USD pair tried to rally initially during the trading session on Monday, but rolled over at the 1.2350 level, and the 50 EMA. The market continues to have support underneath though, especially near the uptrend line. If we were to break down below the uptrend line, the next major support level is closer to the 1.21 handle. When I look at this chart, I recognize that we are at a significant point of inflection, and with the jobs number coming out on Friday it’s not a huge surprise to think that it might take some time to get that momentum picking back up. Once we get those jobs numbers released though, I think that we need to follow whatever impulsive move that we get next. The 1.25 level above will be resistance and breaking above that level would be a sign that we are going to continue to go much higher. If we break down, things could get a bit messy.

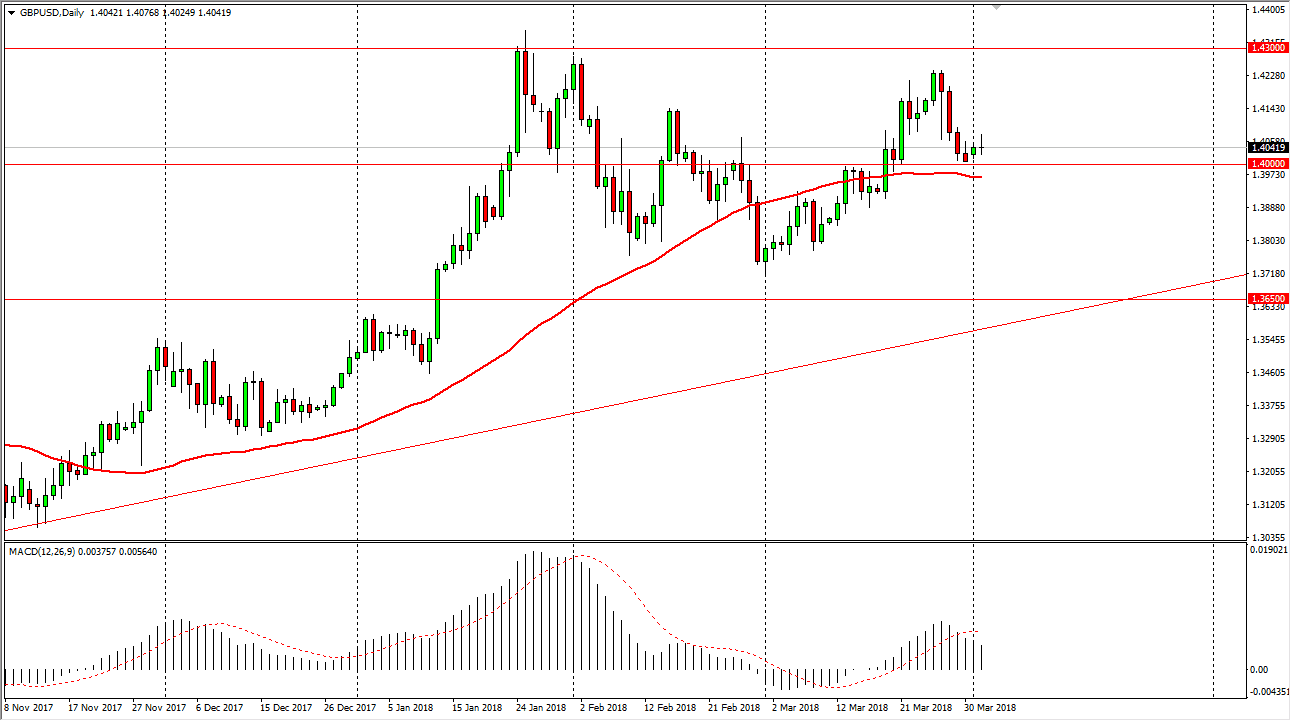

GBP/USD

The British pound went back and forth during the trading session Monday, as we continue to have a lot of volatility. In the end, we didn’t really go that far as the gains given back shows signs of weakness. The 1.40 level underneath should be supportive, just as the 50-day exponential moving average should be. If we break down below the 50-day exponential moving average, I think that the market probably goes down to the 1.38 handle. The alternate scenario is that we break above the top of the shooting star candle for Monday, which should send this market to the 1.42 handle, possibly the 1.43 level. I anticipate that the next couple of days should be rather choppy though, so keep that in mind. As soon as we get the jobs number coming out on Friday, it should give us an idea as to which direction to go.