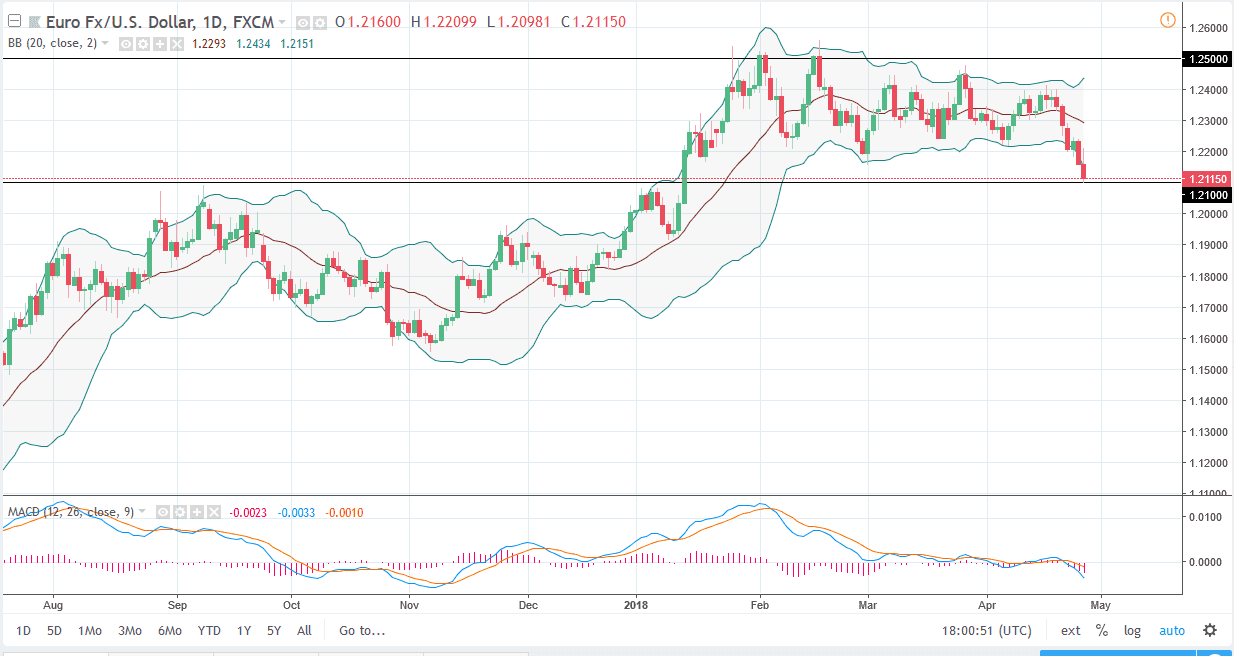

EUR/USD

The EUR/USD pair initially tried to rally during the trading session on Thursday, but comments from Mario Draghi suggesting that the ECB was going to keep interest rates lower for a more extended timeframe is weighing upon the Euro itself. I think that if we break down below the 1.21 level, then we could drop to the 1.19 level. This is an area that should be massively supportive though, because it was where we had seen significant resistance in the past. On the weekly chart, we had broken above a bullish flag, that should have measured for a move to the 1.32 level. However, I think the next couple of days will decide whether that happens. I would stay out of this market until we get the daily candle, because the next move should be rather significant. Take your time, I’ll keep you up-to-date as to what I’m doing once we get it.

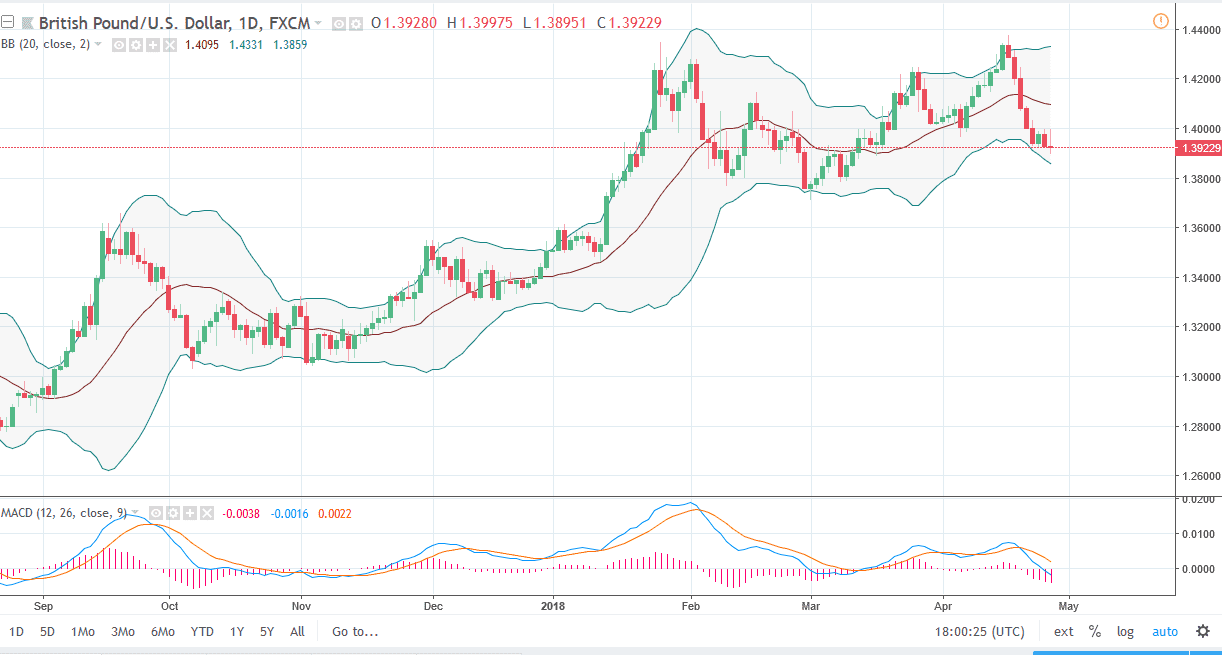

GBP/USD

The British pound initially tried to rally during the day but turned around to form a shooting star. It looks as if the US dollar is going to continue to try to show signs of strength. I think that interest rates rising in the United States will continue to put a bit of a bid into the US dollar. The 1.38 level would be the next target, which is an area that is rather supportive. Alternately, if we break above the 1.40 level, the market should continue to go much higher, perhaps reaching towards the 1.44 level. I think there is a significant amount of noise in this market just waiting to happen, but it does look as if we are dropping a bit. Alternately, if we do break above the top of the 1.40 level, it’s likely that breaking above that level could bring in a fresh round of buying as it would not only break the large, round, psychologically significant number, but it also negates a negative candle.