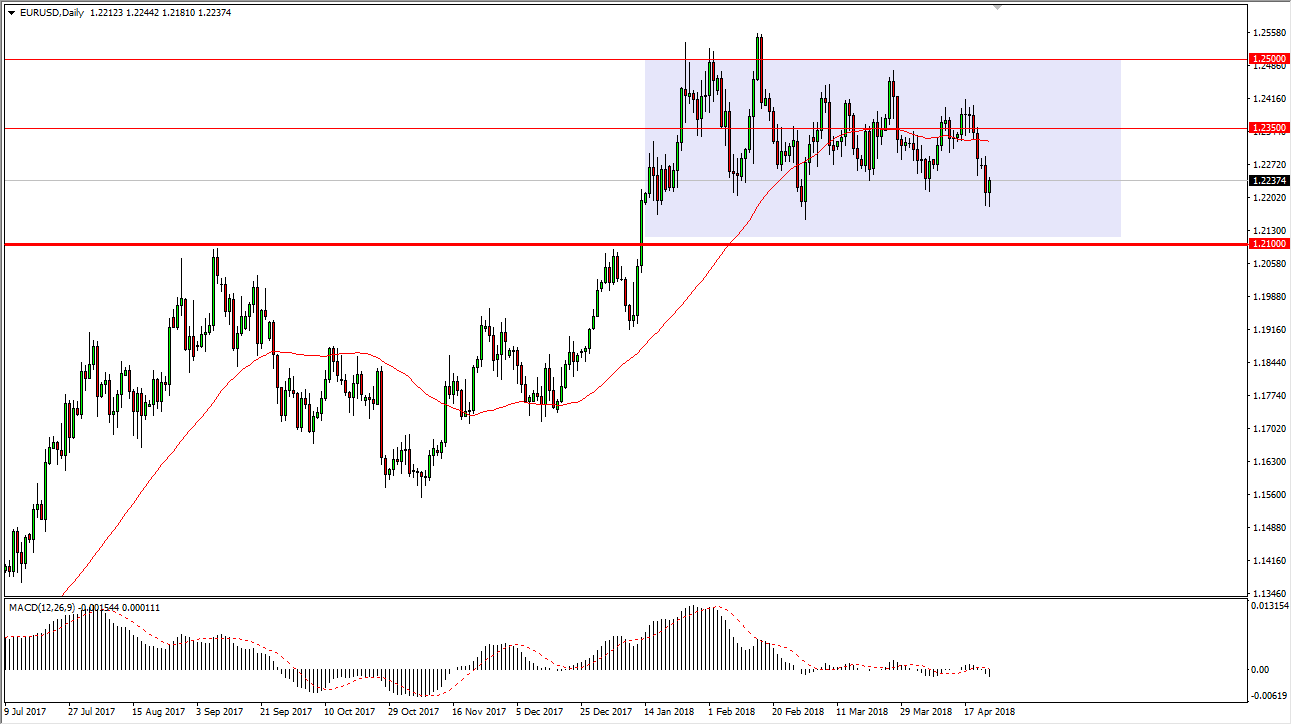

EUR/USD

The EUR/USD pair initially pulled back during the trading session on Tuesday, continuing the bearish pressure. However, when you look at this chart from a longer-term perspective you can see that we are in an uptrend and have been consolidating over the last couple of months after that move. The 1.21 level underneath continues to be a hard “floor” for the market, and I think that turning around the way we did during the Tuesday session suggests that we could go towards the 1.2350 level, perhaps even the 1.24 level. Beyond that, the 1.25 level is massive resistance, and if we can break above there we should continue the longer-term uptrend. The alternate scenario of course is that we break down below the 1.21 handle, but I don’t think that happens anytime soon as the level had been so resistive in the past and it was a scene of a major breakout.

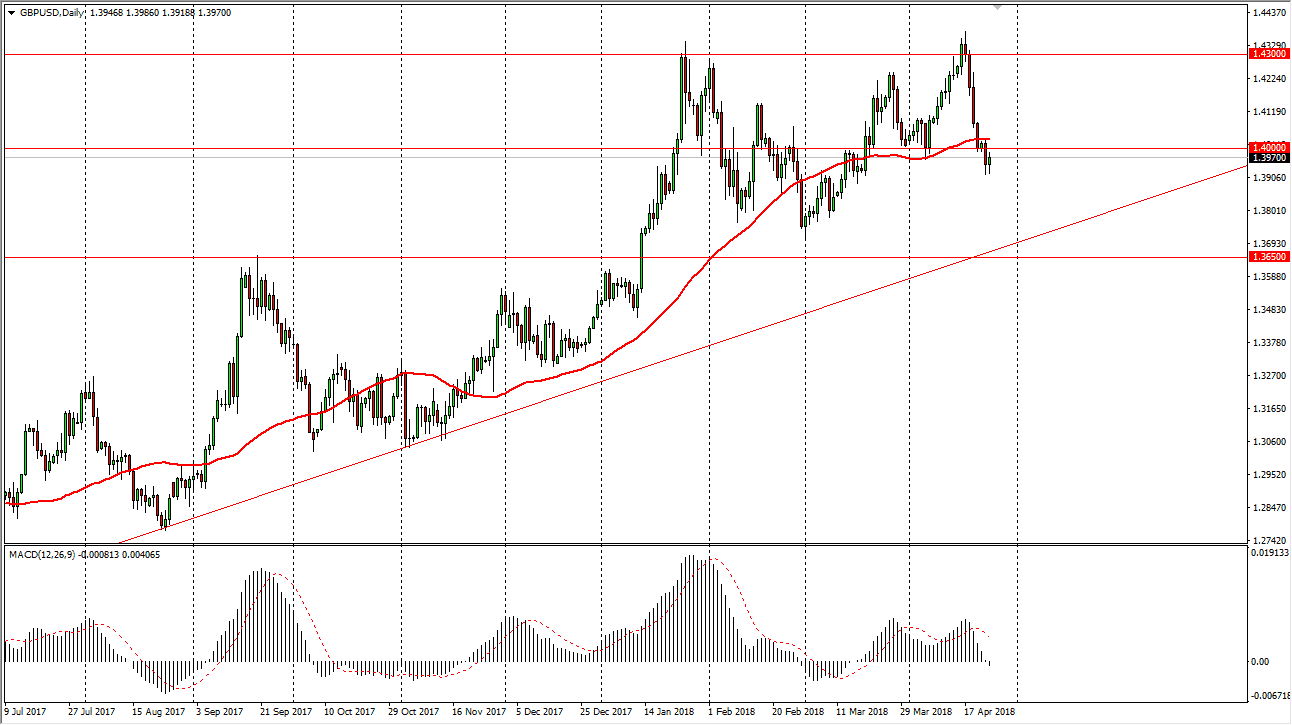

GBP/USD

The British pound initially pulled back during the trading session as well but turned around to form a bit of a hammer. If we can break above the 1.40 level above, and perhaps even the 50-day EMA, I think that we could go higher and reach towards the 1.43 level above. The uptrend line underneath should continue to keep this market higher, so even if we pull back from here I think that the move lower would probably be short term in nature. In fact, I have no interest in shorting this market, least not until we would break down through the 1.3650 level, which would be a collapse of the uptrend. I believe that we are simply seeing the market trying to pick up enough momentum to finally break above the 1.43 level and reach towards the 1.45 level after that.