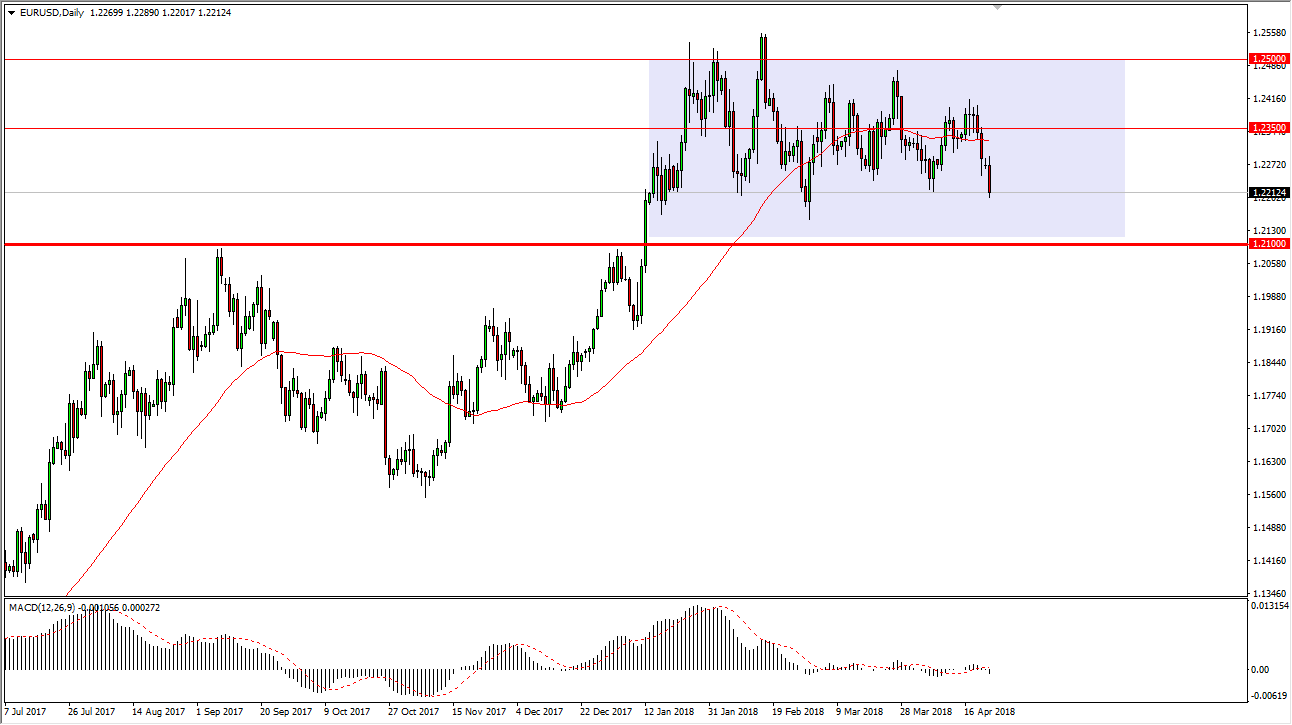

EUR/USD

The EUR/USD pair initially tried to rally during the trading session on Monday but rolled over and showed extreme weakness, crashing into the 1.22 level. There is a lot of support between here and the 1.21 level, an area that was previous resistance. I think that if we were to break down below that level, then we could be in serious trouble. Otherwise, I think that there will be value hunters coming into this market rather soon, continuing the overall consolidation that we have been in for several months. If that happens, the market will more than likely go looking towards the 1.24 level above, possibly the 1.25 handle after that. A break above the 1.25 level is very bullish and should send this market much higher. In the meantime, look for some type of bounce or supportive candle to take advantage of on the short-term chart.

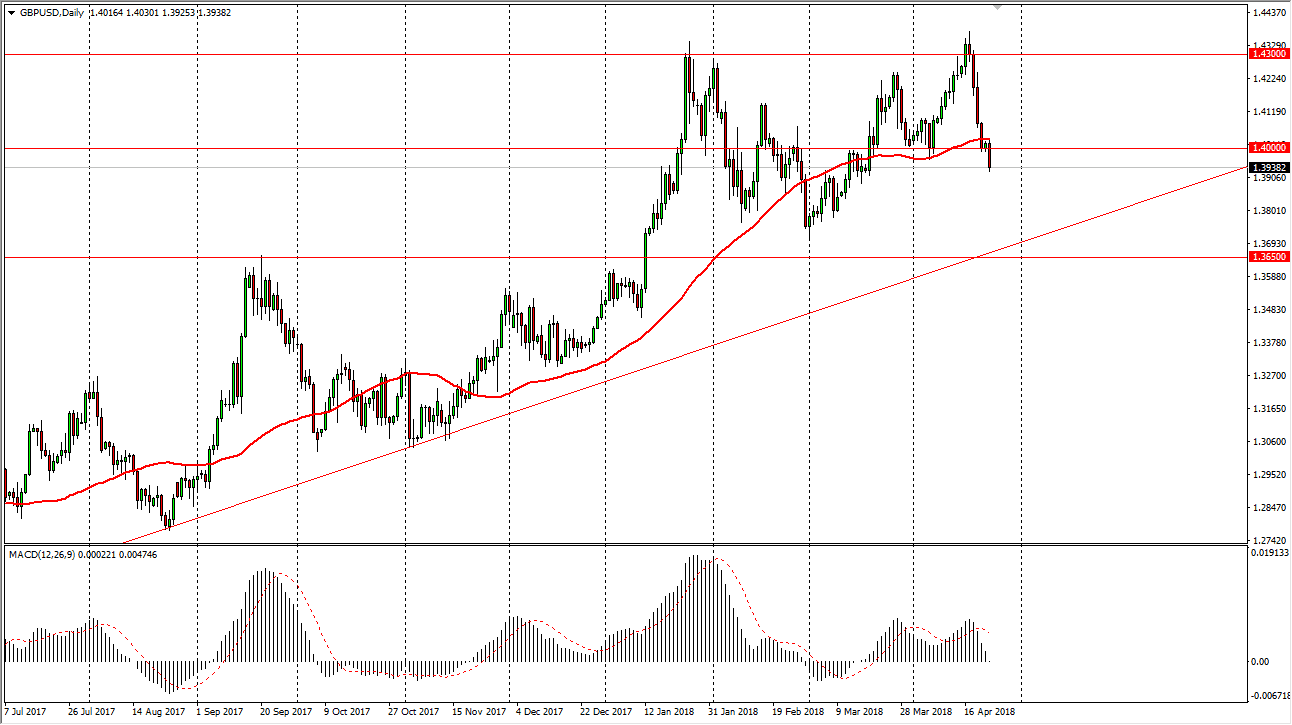

GBP/USD

The British pound fell during the Monday session, slicing through the 1.40 level, reaching down towards the 1.39 level after that. We are well below the 50 EMA, and I think that the market is probably going to continue to drift lower from here. However, there is a strong amount of support near the uptrend line, and of course the 1.3650 level after that. I think it’s only a matter of time before the buyers get involved, but clearly, we are starting to see some weakness in the British pound as the US dollar has been strengthening against most things. The Bank of England is probably going to take a while to raise interest rates, and that of course has spooked the markets as well. It’s not until we break down below the uptrend line that I would be overly concerned about the overall uptrend that we have been in 4 months. If we did breakdown below the 1.3650 level, look out below.