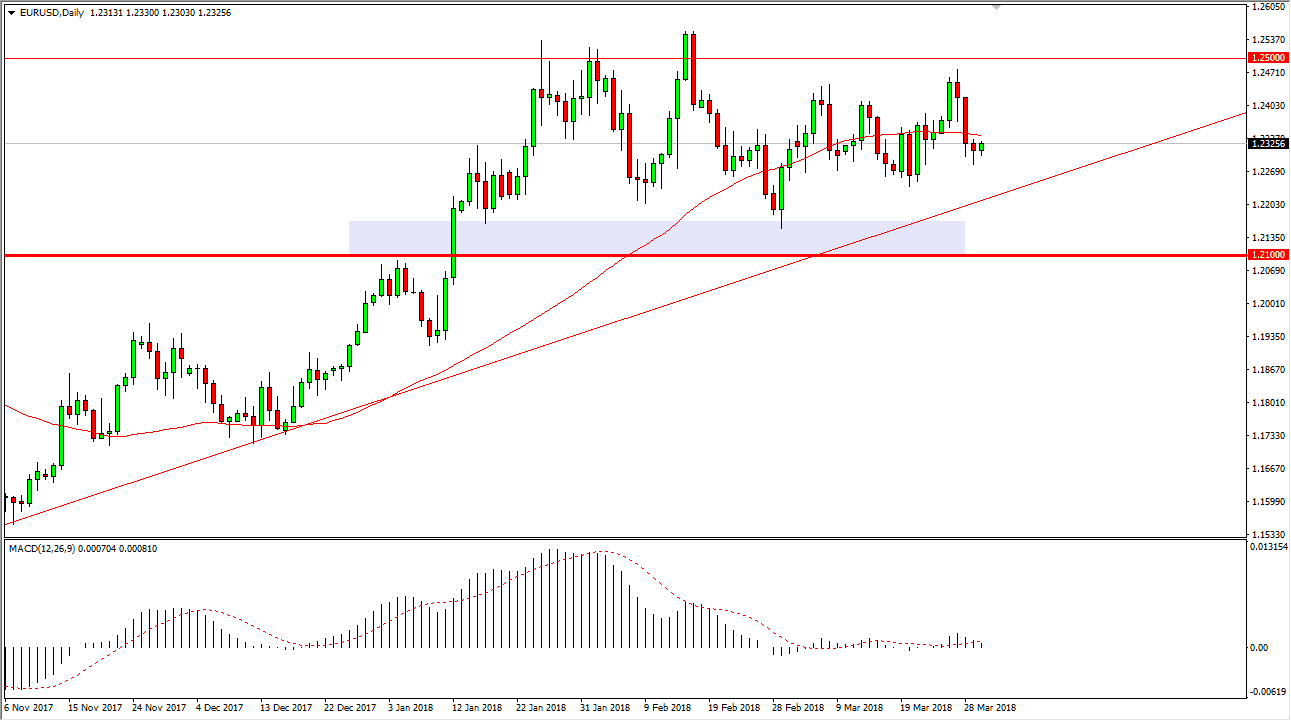

EUR/USD

The EUR/USD pair has been a bit noisy during Friday trading, but there would’ve been a major lack of liquidity due to the Good Friday holiday, so I think that the market should continue to hang about this area in the short term. I think that the hammer on the Thursday session is probably more important than anything else, so if we can break above the top of that, we should be ready to rally towards the 1.2450 level again. I think that the 1.25 level above could be massively resistive, and I think that will be a hard level to overcome. However, if we did I think that the market could go to the 1.2750 level. Ultimately, if we break down below the uptrend line, the market should then go down to the 1.21 handle, which is massive support. I believe that we continue to grind sideways overall, but as we are at the bottom of the range, and I think that it’s likely that we will continue.

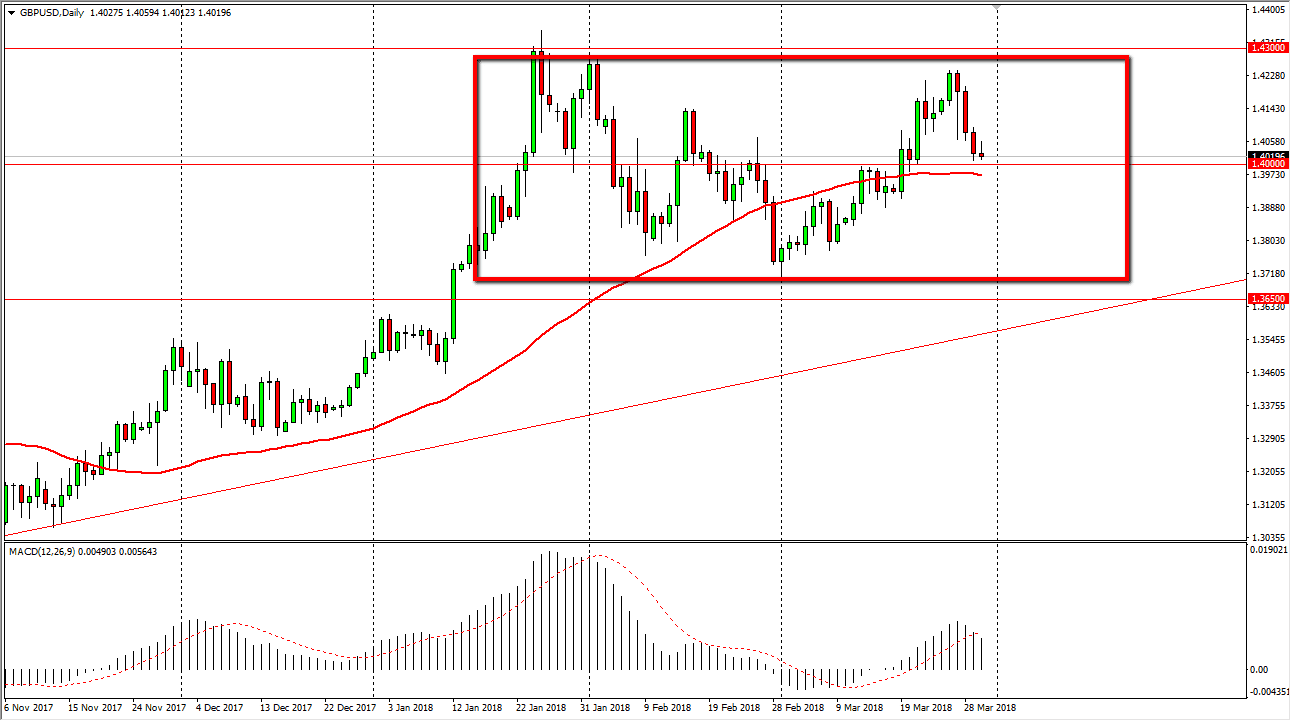

GBP/USD

The British pound has tried to rally a bit during the trading session on Friday, but the most important thing that I see on this chart is that we are testing the 1.40 level. The 1.40 level underneath should be supportive, but if we break down below there I think it’s obvious that we will probably go down to the 1.38 handle. I believe that the next move will be based upon either a break above the top of the candle for Friday, leading to bullish pressure, or a breakdown below the 1.40 level which of course leads to selling. Expect a lot of choppiness and noisy trading, but with the 50 EMA underneath, that will only add to the confusion from a technical standpoint.