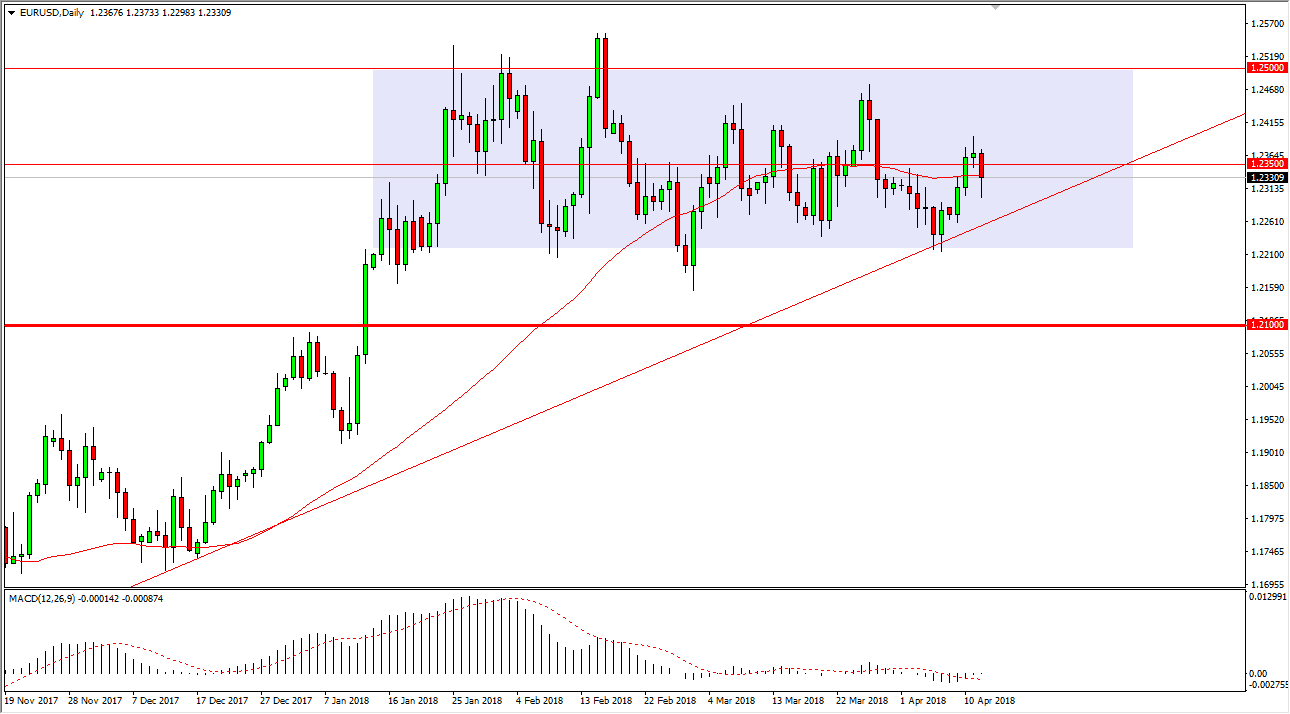

EUR/USD

The EUR/USD pair fell during most of the session on Thursday, reaching down towards the 1.23 level. We rallied though and ended up forming a candle that suggests we could have plenty of buying pressure underneath. Ultimately, I also look at the deli uptrend line as another sign that the buyers will probably return. I recognize that the 1.25 level above continues to be massive resistance, so if we were to break above that level, then we could go much higher. I think that we will eventually find buyers that are needed for the uptrend to continue. If we were to break down below the uptrend line, we could drift down to the 1.22 handle, and then eventually the 1.21 level. I think that the market will be volatile, but I believe that every time we pull back it should represent some value that you can take advantage of.

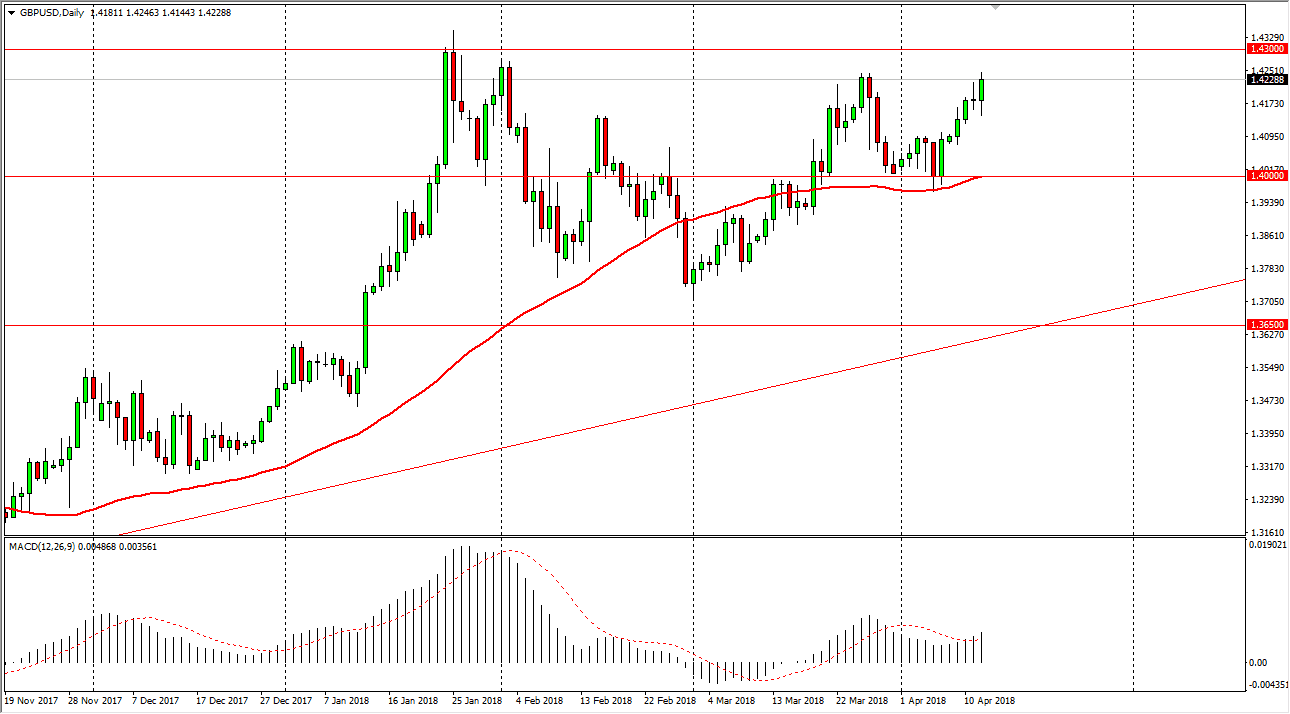

GBP/USD

The British pound initially fell on Thursday but found buyers underneath to turn things around and break above the top of the shooting star from Wednesday. That’s a very positive sign, but I also recognize that there is a lot of noise between here and 1.43, so I think that it’s probably best to wait for this market to close above the 1.43 level on a daily chart to start buying. If we pull back from here, I think there’s plenty of support underneath, especially near the 1.40 level, which has been important more than once. The 50-day EMA is just underneath as well, so I think that every time we pull back there will be buyers sooner rather than later. If we can break above the 1.43 level, then the market should go to the 1.45 handle which is my longer-term target. I recognize that this market will continue to be very volatile, but certainly seems to have a lot of buyers interested.