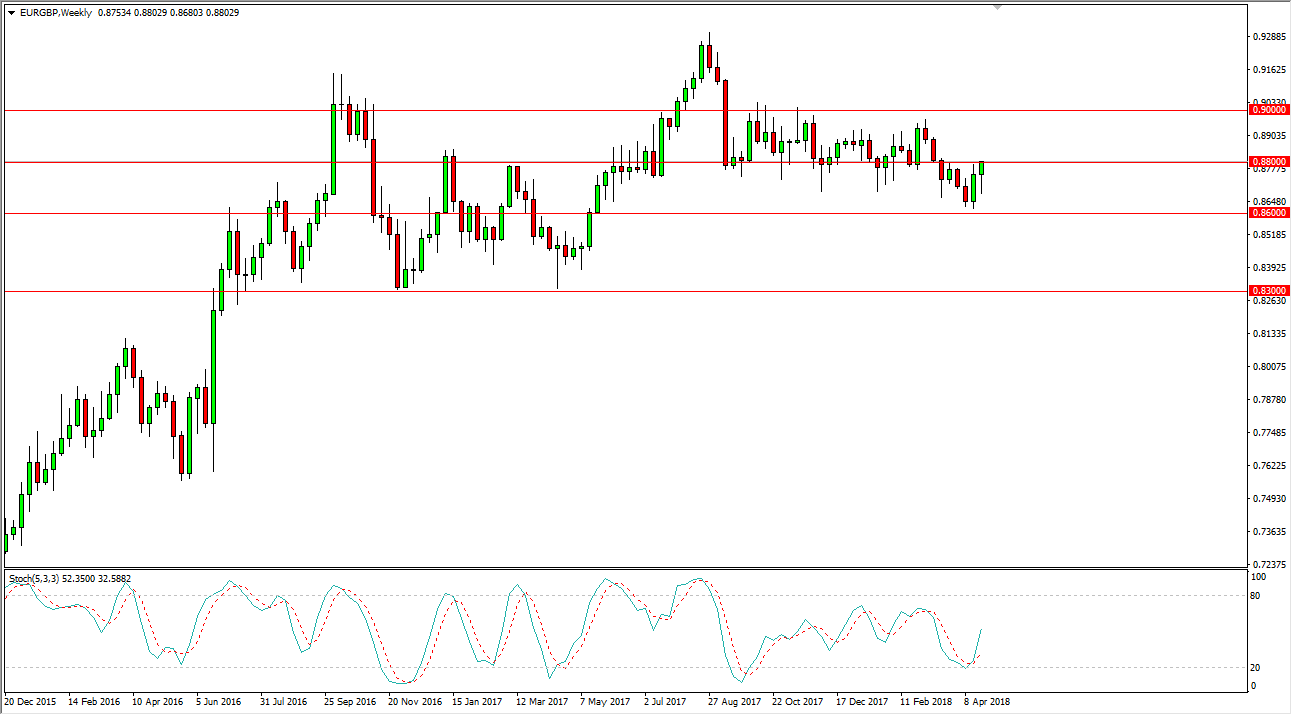

The EUR/GBP pair has fallen initially during the month of April, but then turned around to show signs of support at the 0.86 level, bouncing over the last couple of weeks. The market is targeting the 0.88 handle, and by breaking above there it’s likely that the market could go to the 0.89 handle, possibly even the 0.90 level during the month. The weekly candle that formed for the last week of the month is a hammer, which of course is a very bullish sign. Beyond that, the monthly candle is a hammer, which is also a very bullish sign.

Regardless, this is a market that has been very choppy overall, and I think that the consolidation should continue to be a major issue. I don’t think that we break out of the range that we have been in before the negotiations are over between the United Kingdom and the European Union. However, I do have a couple of levels that I would pay attention to on some type of move. For example, if we break above from here, the 0.90 level should be massive resistance. If we did break above there, then the market should go to the 0.92 level.

The alternate scenario of course is that we break down below the 0.6 level, but I think we would find plenty of support near the 0.83 level underneath which has been supportive in the past. This is a market that should continue to be driven by headlines, so making a longer-term call is quite difficult. All I can do at this point is pay attention to the 4 levels that I think matter, the 0.90 level, the 0.88 handle, the 0.86 level, and of course the 0.83 level. Those are the signposts as to where we go over the next month.