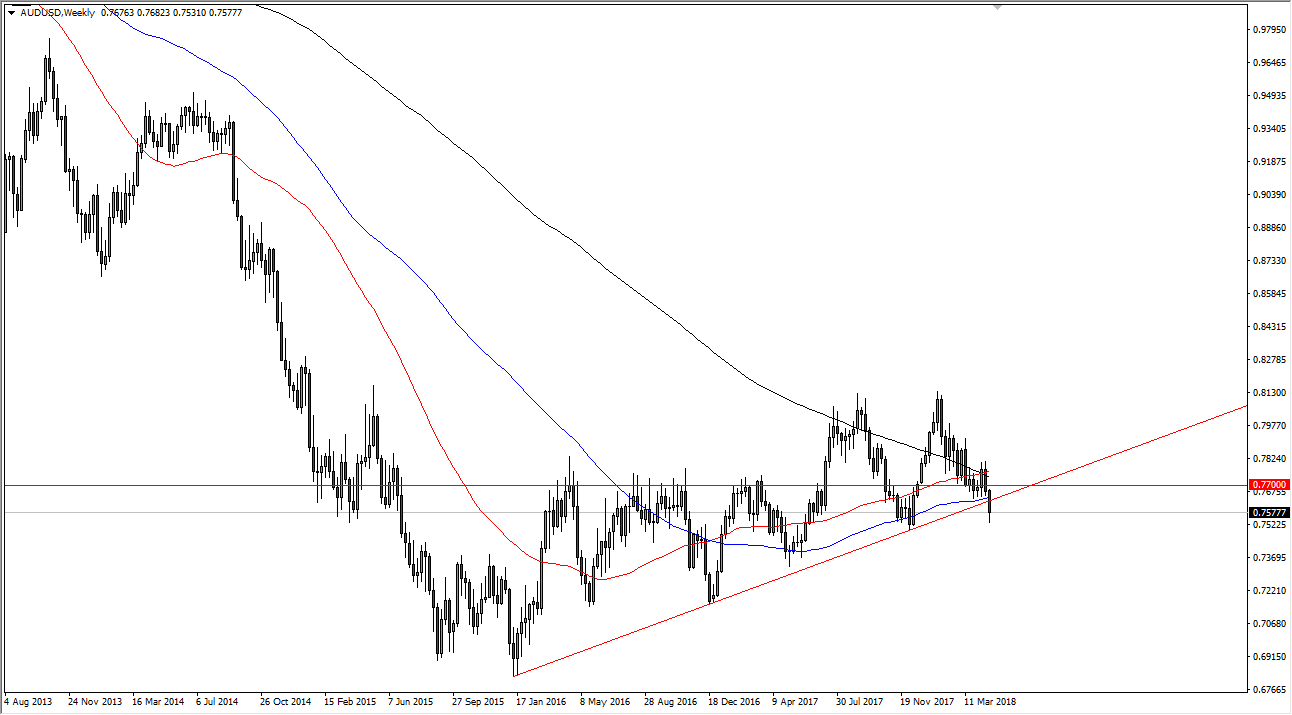

The Australian dollar has broken down during the last couple of weeks of April, slicing through major uptrend line that goes back to late 2015. This is a very negative sign, and even though we did bounce a bit towards the end of the month, I think we will probably see resistance near the uptrend line once we approach it again. If we stay below the uptrend line, I suspect that we will then eventually go to the 0.75 handle, and then break down below there to go to the 0.7250 level. Pay attention to the yields in the United States, because if they do rise that will send this market much lower. There is a lot of noise just below though, so I think that even if we break down it will probably be more of a grind than anything else.

The alternate scenario of course is that we break above the 0.77 handle, and that should send this market much higher, perhaps towards the 0.80 level. That would also prove the market breaking through the uptrend line as a “false breakdown”, which of course is something that shows just how bullish the market is. Currently, I think that we have a lot of volatility just waiting to happen, and of course gold will have its usual influence. The question now is do we break above the 0.77 handle and start buying, or do we break down below the 0.75 level and see this market unwind? I anticipate that the month of May will determine where we go for the next several months, if not the next couple of years.