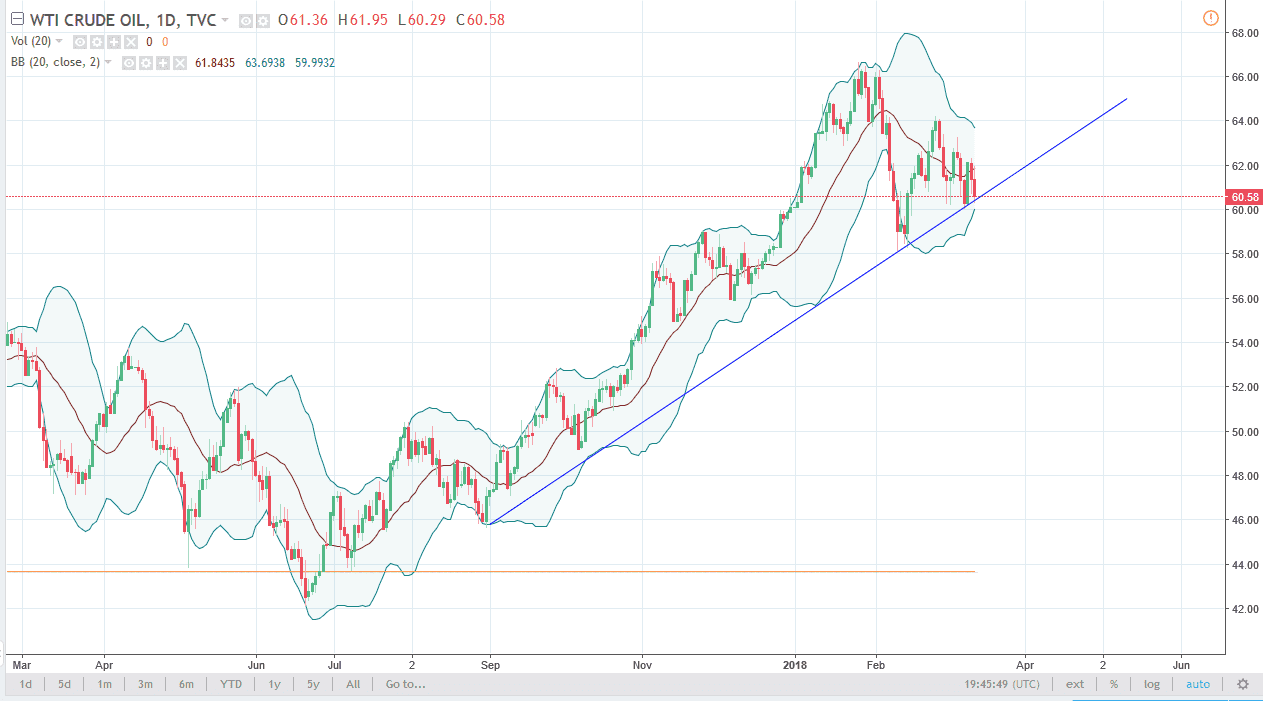

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during Tuesday but rolled over to slam into the uptrend line that I have marked on the chart. I think that the market could be an interesting level right now, because the uptrend line being broken to the downside could be a major signal that we are going lower. The $60 level coincides nicely with it, so if we break down below there, we probably go down to the $58 level initially, which being broken to the downside would be extraordinarily negative and send this market even lower. If we bounce from here, we need to clear the $62 level for me to be convinced that the upside is going to continue to attract buyers. At this point, it does look like we are struggling so I think the next couple of sessions will be very important.

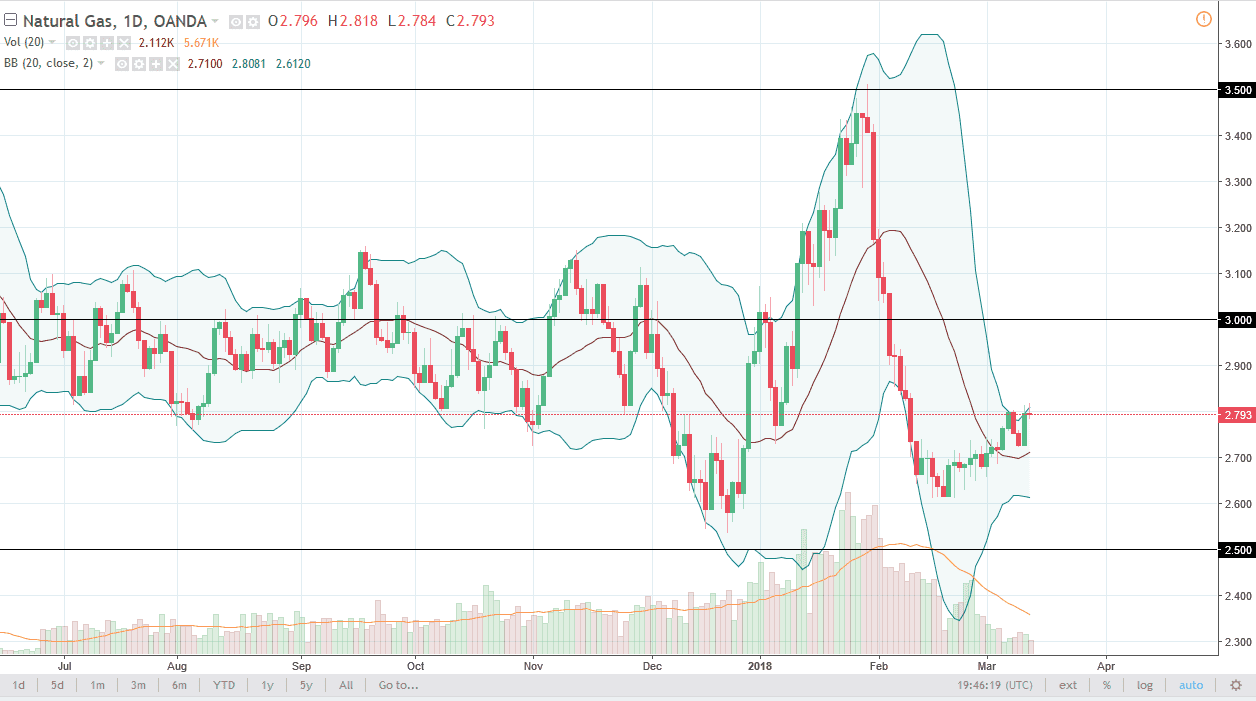

Natural Gas

Natural gas markets did very little during the day by the time was all said and done, as we initially rally, but then rolled over to form a shooting star. The shooting star is a negative sign, and it appears that the $2.80 level is probably going to offer enough resistance to cause this market to roll over. If you been watching me here at Daily Forex, you know that I would prefer to short this market at the $3.00 level, but if we break down below the bottom of the daily candle for Tuesday, it’s likely that we could drop a bit for a short-term selling opportunity. I think that the $2.73 level will offer support though. Otherwise, if we break above the top of the candle for the session on Tuesday, that could send this market looking towards the $2.90 level next.