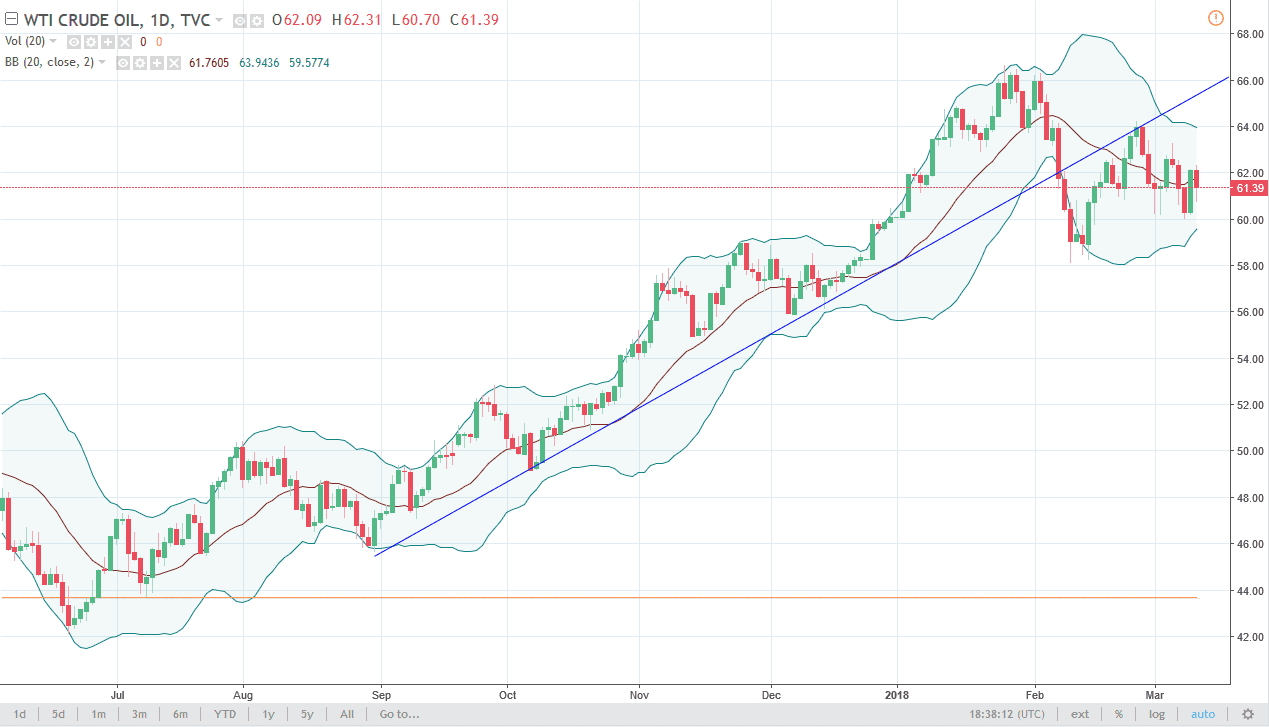

WTI Crude Oil

The WTI Crude Oil market has been noisy during Monday trading, falling significantly but finding buyers later in the day. I think at this point, it looks as if the $61.50 level will continue to attract traders and is essentially the “fair value” level that we are trading at. If we can break out above the $64 level, I might be more inclined to buy, but in the meantime, I think it’s likely that we will bounce around between $63 on the top, and $60 on the bottom. I suspect that we continue to see a lot of noise in the market, but ultimately, I believe that breaking below the trendline is a sign that we will probably go lower eventually. Once we break down below $58 the bottom in this market could fall out rather quickly.

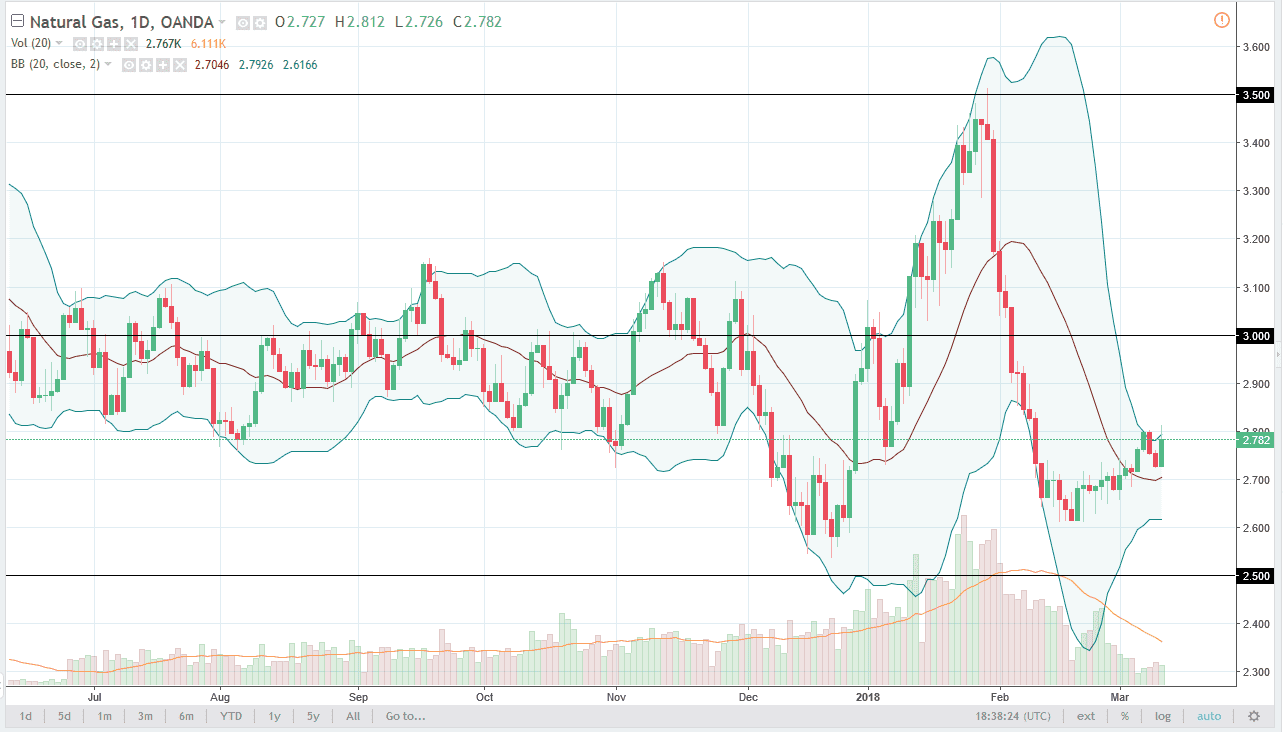

Natural Gas

As things stand right now, natural gas markets have been a bit of an enigma. While we do have a bit of demand currently, it is only a matter of time before most demand in the northeastern part of the United States dries up, and that the cold weather goes away. That typically causes bearish pressure this time of year, or shortly after. Because of this, I believe that we will eventually find sellers in this market, but right now it looks likely that we will continue to be very noisy. I don’t have the daily candle I want to see the star shorting, but I certainly don’t have anything on this chart that compels me to buy either. I am still waiting for the market to go looking towards the $3.00 level, and perhaps show signs of exhaustion that I can start selling. Short-term traders may be willing to buy this market, but it is going to be very noisy on the way up.