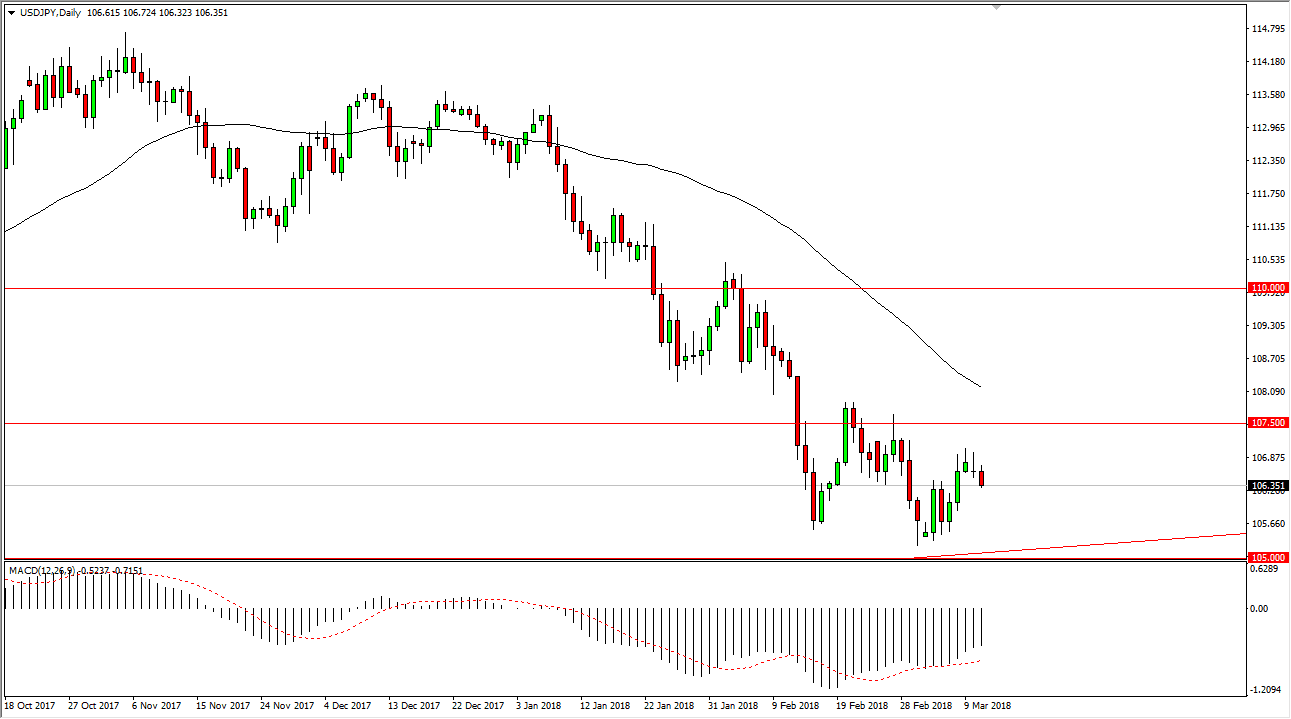

USD/JPY

The US dollar rolled over a bit on Monday against the Japanese yen, as it looks like we have started a bit of a “risk off” move again. However, I see a significant amount of support just below, so I don’t think that the markets going to break down to drastically. The 105-level underneath is massive support, coinciding not only with a large, round, psychologically significant number, but also the uptrend line that slices through it. Because of this, I think it’s only a matter of time before the buyers come in and pick up a bit of value, something that I think that the market will be offering. Once we do breakout and above, the 107.50 level will be the target, and a clearance of that level could send this market much higher, perhaps as high as 110. If we were to break down below the 105 handle, I would then anticipate that the pair will go looking towards the 102.50 level.

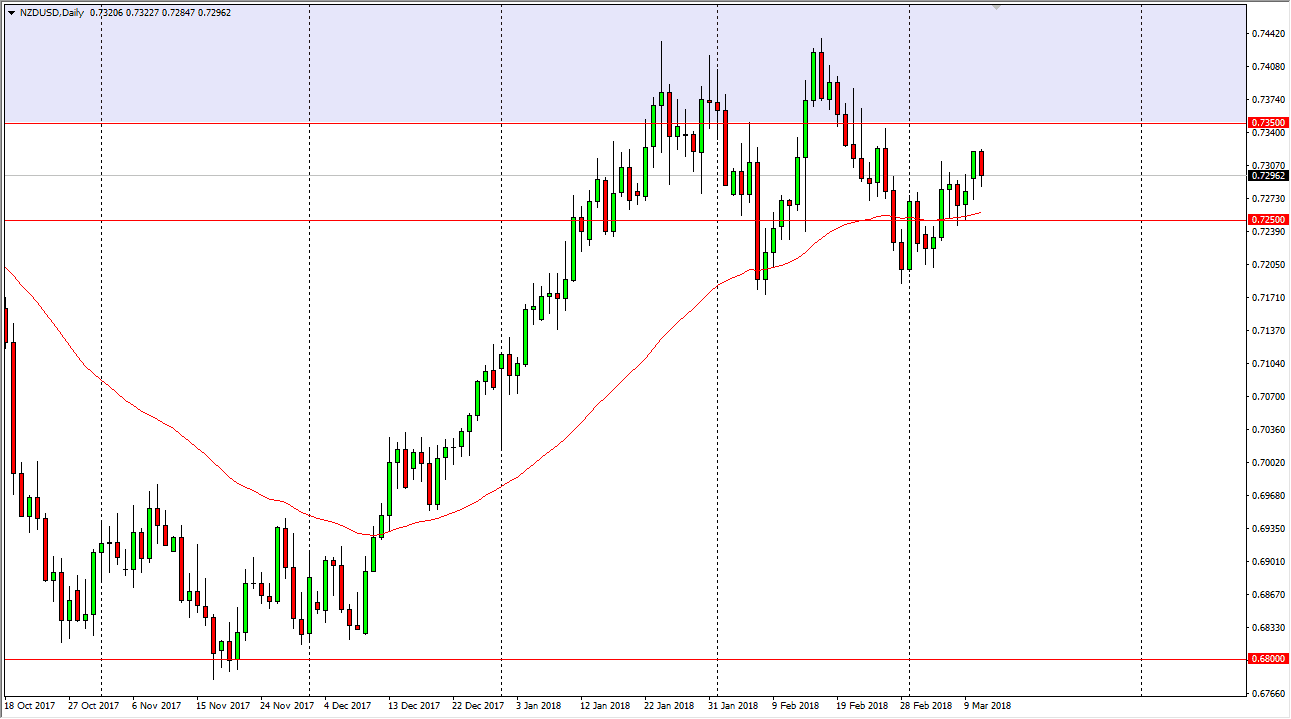

NZD/USD

The New Zealand dollar fell during trading on Monday, dropping down towards the 0.73 level. Just below, we did find some buying pressure though, and it looks like we may stabilize a bit as the Americans are going home. If that does hold true, I think it will continue to show the 0.7250 level underneath being supportive, and that the target will still be the 0.7350 level. Above there, I anticipate a lot of resistance extending to the 0.75 handle above, which is a major round figure. A break at that level of course a frees the market to go much higher, but on the other hand if we were to break down below the 0.72 level, that could send this market much lower, perhaps down to the 0.70 level.