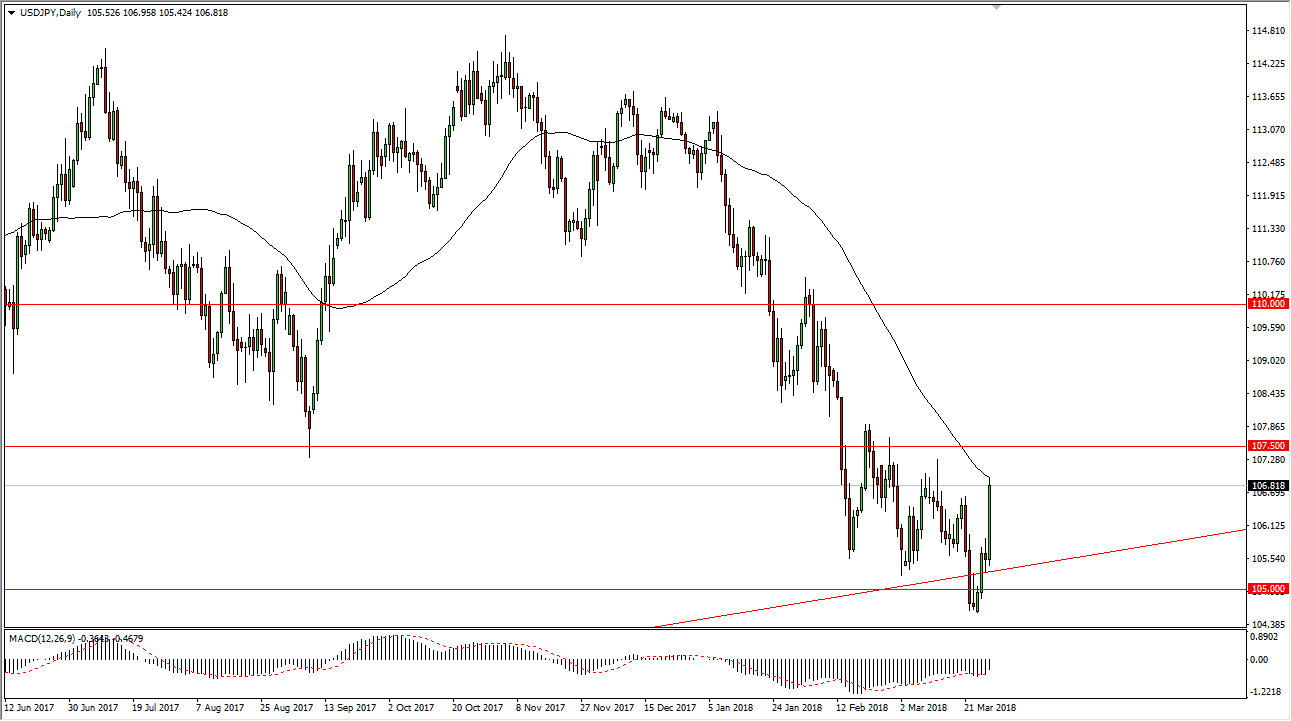

USD/JPY

The US dollar has rallied significantly during trading on Wednesday, reaching towards the 50-day exponential moving average, at the 107 area. I think that the bullish move of course is a good sign for this pair, but I would not be surprised at all to see a bit of a pullback, as this pair tends to be very noisy when it tries the bottom out. So, for that, my trade plan includes waiting for some type a pullback that I can take advantage of and start buying. I believe that the previous uptrend line should continue to be very supportive, especially near the 105 level. If we can eventually break above the 107.50 level, that should free the market towards the 108.50 level, followed by the 110 level. I think that it’s not until we break below to make a lower low that it’s safe to start selling.

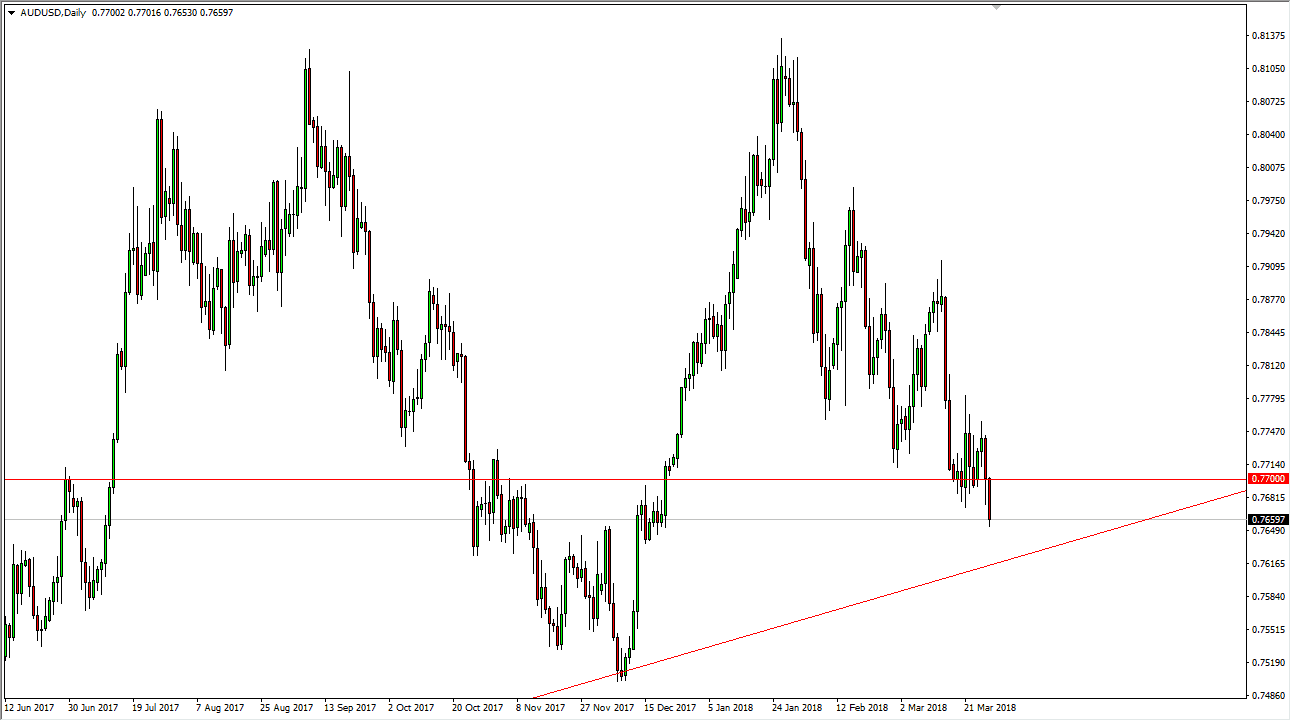

AUD/USD

The Australian dollar has broken down during the trading session on Wednesday, making a “lower low.” I think that were going to now try to get down to the previous uptrend line, which of course is the bottom of the daily uptrend channel that we have been in for some time. I think that buying this market can be done until we get above the 0.78 handle, which would show the market chewing through a significant resistance barrier. This pair of course is very risk sensitive, so you should keep that in mind as the markets will be very choppy, especially considering that we have so many people going on about potential trade wars. I believe that the market will continue to be jittery at the past, so you should be cautious about putting too much money into this pair, least not until we get a strong daily signal.