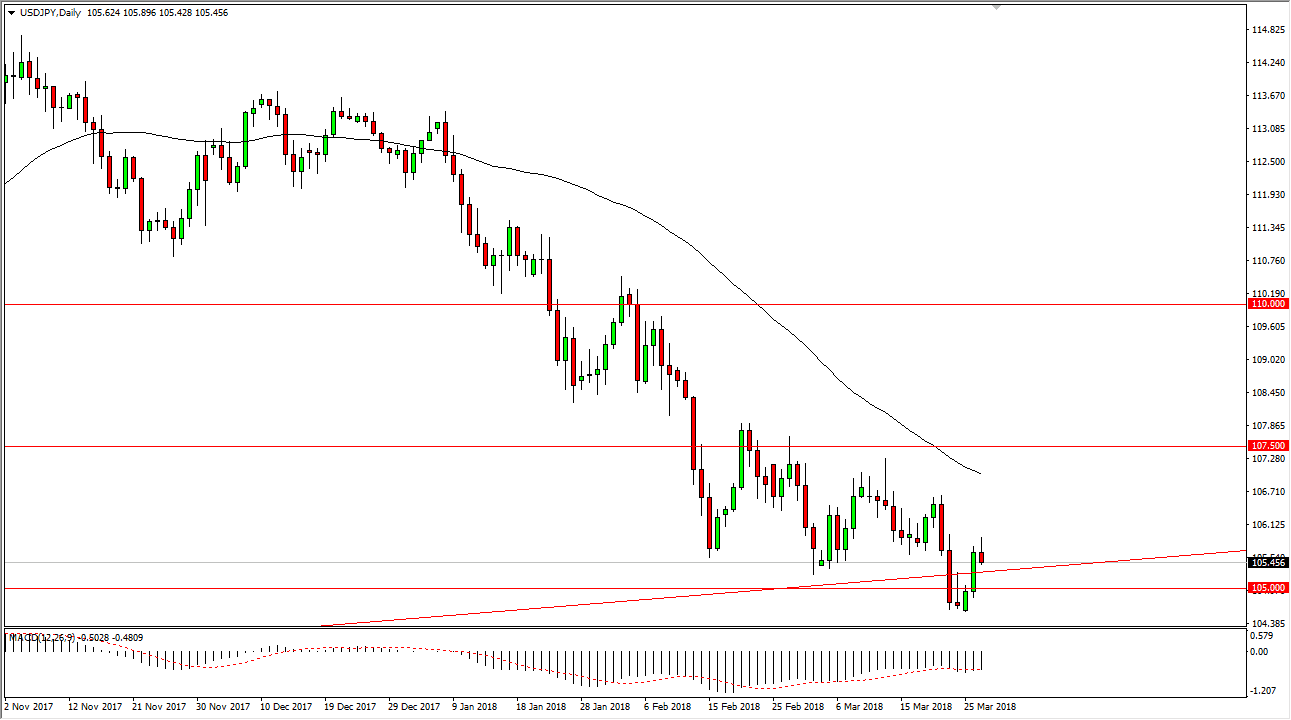

USD/JPY

The US dollar has initially tried to rally during the trading session on Tuesday but rolled over drastically late in the day. It seems to be more of a “risk off” situation, and I think that the market could go looking towards the 105 level again. However, if we were to break above the top of the range for the session on Tuesday, that would be a strong sign that the buyers are coming back and taking over again. Expect volatility, but I think that this market is going to continue to move right along with the stock markets in general. If we were to break above the top of the shooting star for the day, we could go as high as 107.50, but that will take a lot of work. I suspect that we continue to see a bit of softness in this market.

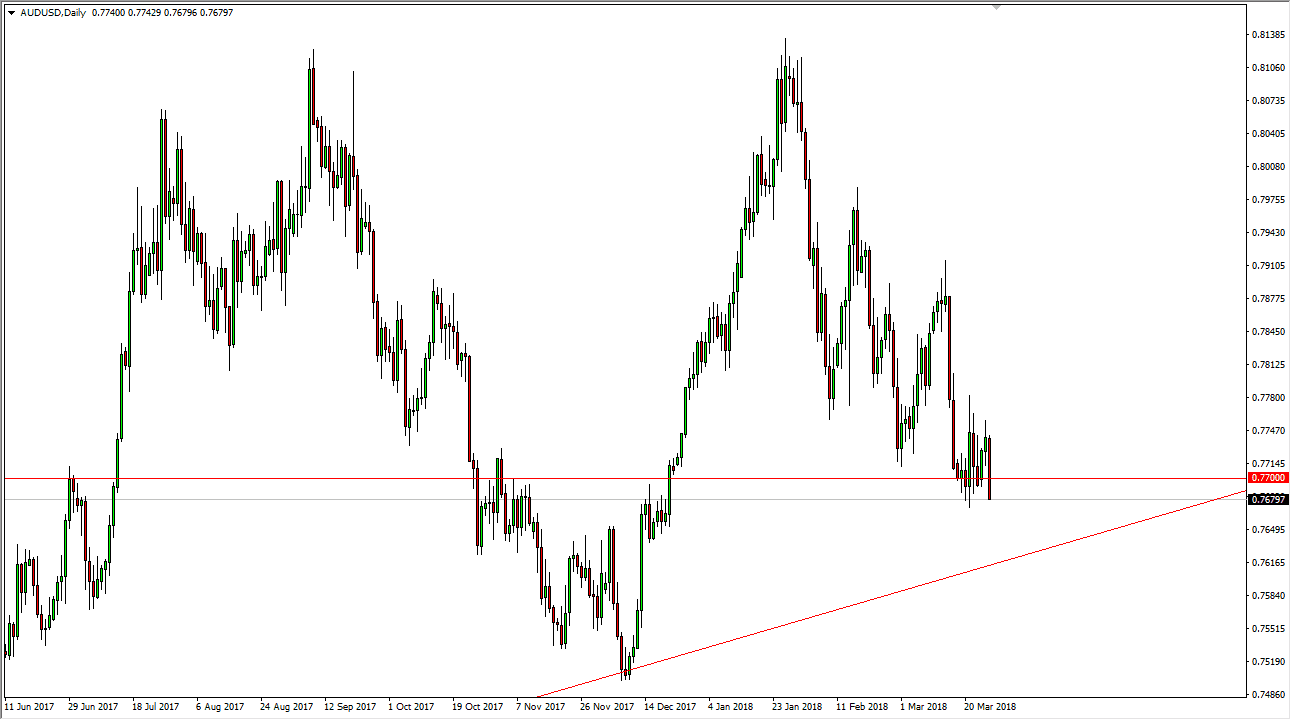

AUD/USD

The Australian dollar rolled over significantly during the end of the day on Tuesday, as risk appetite fell off late during the New York session. It now looks as if the Australian dollar is going to go hunting for the uptrend line underneath, an area that should be supportive. If we break down below there, the market should then go to the 0.75 handle. I believe that the markets continue to be very sensitive to headlines and of course will be skittish at the first signs of trouble. If we break above the top of the recent consolidation, then we could go higher, but right now I think it’s going to be very difficult to buy this market, so I would need to see some type of daily supportive candle or an impulsive candle to the upside to start putting money to work. Shorting is possible, but I think that the uptrend line is going to be a major barrier for the sellers to get through as it goes back months.