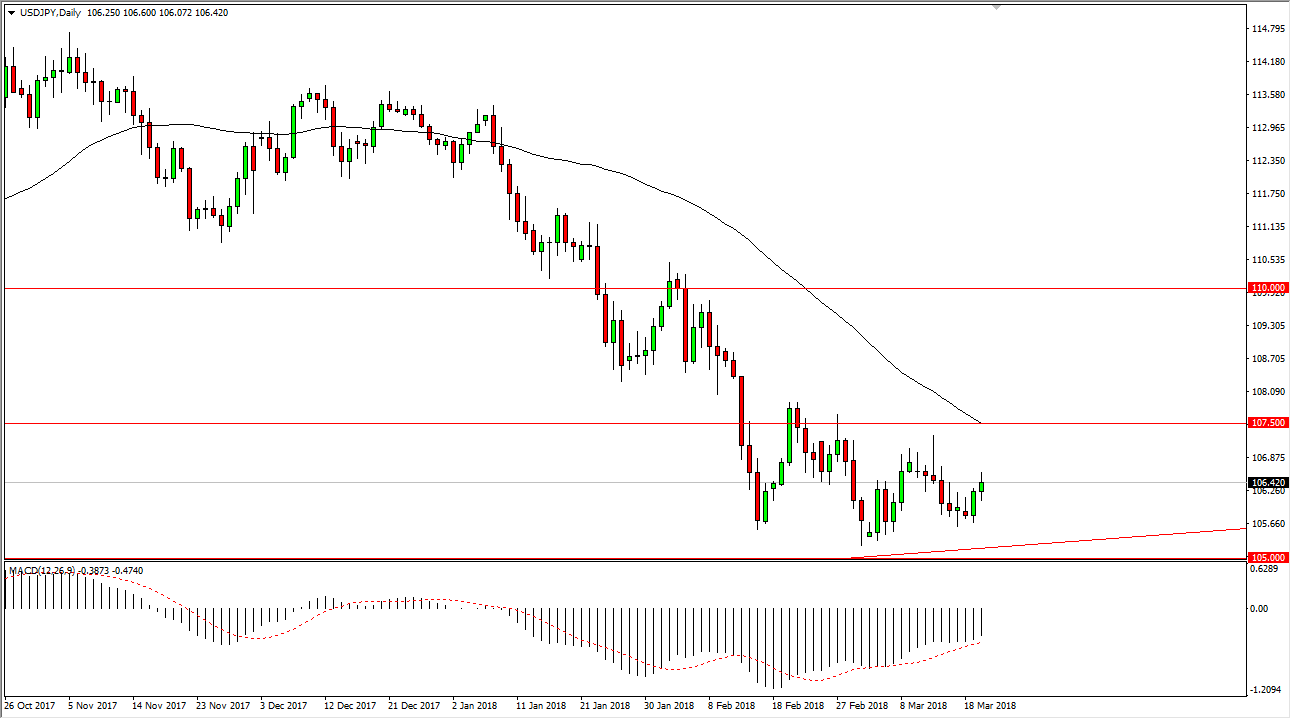

USD/JPY

The US dollar was slightly positive against the Japanese yen during trading on Tuesday, as we continue to see a lot of noise. The market looks likely to continue to see a lot of volatility until we get the press conference coming out of the Federal Reserve. Once we do, then I think there will be more clarity. In the meantime, we are watching to see whether we Federal Reserve looks likely to raise interest rates 3 times this year, or perhaps even 4. The larger amount of interest rate hikes is your one of course moves the US dollar to the upside, perhaps reaching towards the 107.50 level after that. I think there is a band of resistance that extends to the 108 handle, and if we can break above that, the market should then go looking towards the 110 level. Pullbacks are also possible, but I think the 105.50 level is going to be the beginning of massive support that extends down to the 105 level.

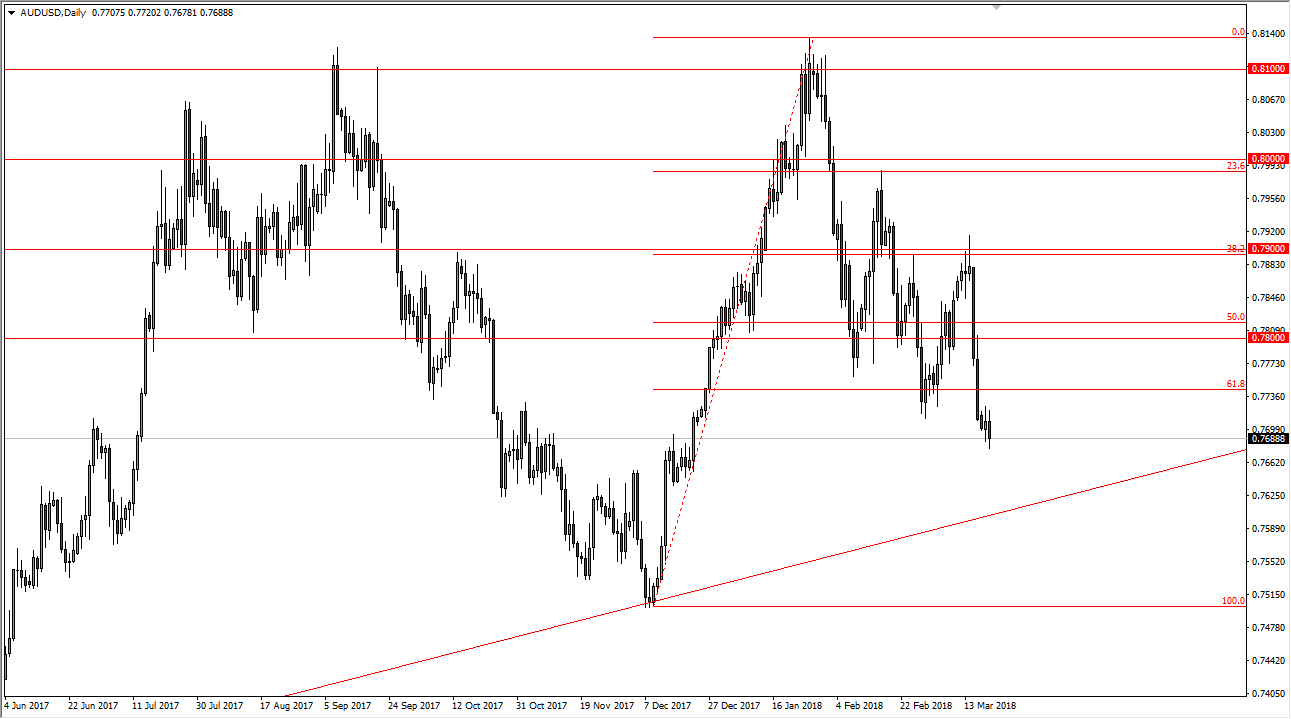

AUD/USD

The Australian dollar initially tried to rally during the day on Tuesday but rolled over again as we are now below the 0.77 handle. There is an uptrend line underneath that causes support in the uptrend in general on the daily chart, so I think it’s only a matter of time before the buyers get involved if we reached towards it. However, if we were to break down below the 0.76 level, the market could then go looking towards the 0.75 level next. I think that given enough time, the buyers will jump back into this market looking at a breakdown as potential value. However, if we get those 4 interest rate hikes this year, that might be enough to break down even below the 0.75 handle.