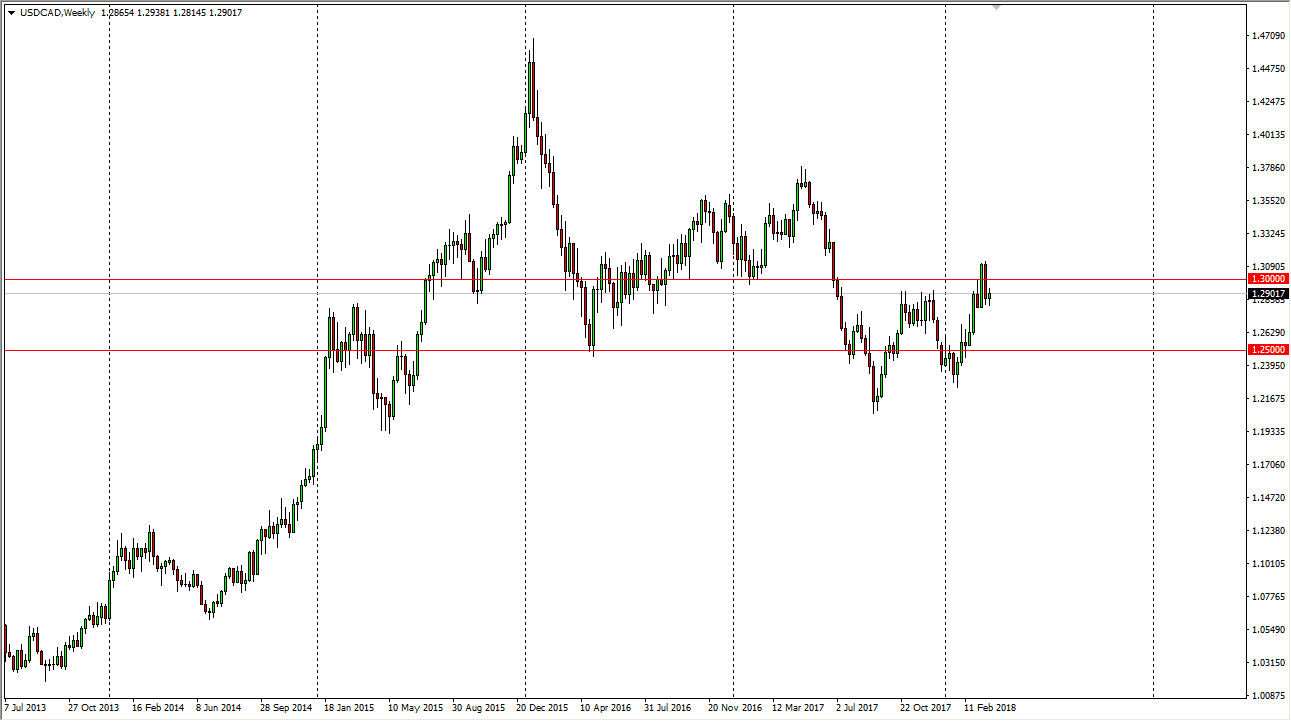

The US dollar has been very choppy against the Canadian dollar during trading over the month of March, initially breaking above the 1.30 level, but being turned around completely to form what could be looked at as a two-week shooting star. I think at this point, if we can break above the 1.31 level, that would be extraordinarily bullish. However, we would also need to see a falling oil market accompanying that moved to feel comfortable, and I think at this point it’s more likely that we will consolidate more than anything else. The 1.25 level underneath should be support, with the 1.31 level above being resistance. If we do break above that level, I think the next target will be a 1.33 handle, followed very quickly by the 1.35 level. Obviously, it will take a lot of work to get out there, because this pair is choppy in general. Beyond that, I think that the market continues to see a lot of noise.

If we do fall backwards, I think that the 1.25 level should be rather supportive. I also recognize that there are lot of missing pieces that a lot of traders are not paying attention to. I personally seen the housing bubble in the greater Toronto area, and could tell you that housing prices in the GTA have skyrocketed over the last couple of years. This cannot be sustained, and we are starting to see interest rates rise. Once that happens, we could have a housing prices in Canada. I think that must sit in the back of everybody’s mind, and of course any talk of trade wars will probably hurt the Canadian dollar as well, perhaps in a sympathy move to other commodity currencies. All things being equal though, I think that we grind a lot this month.