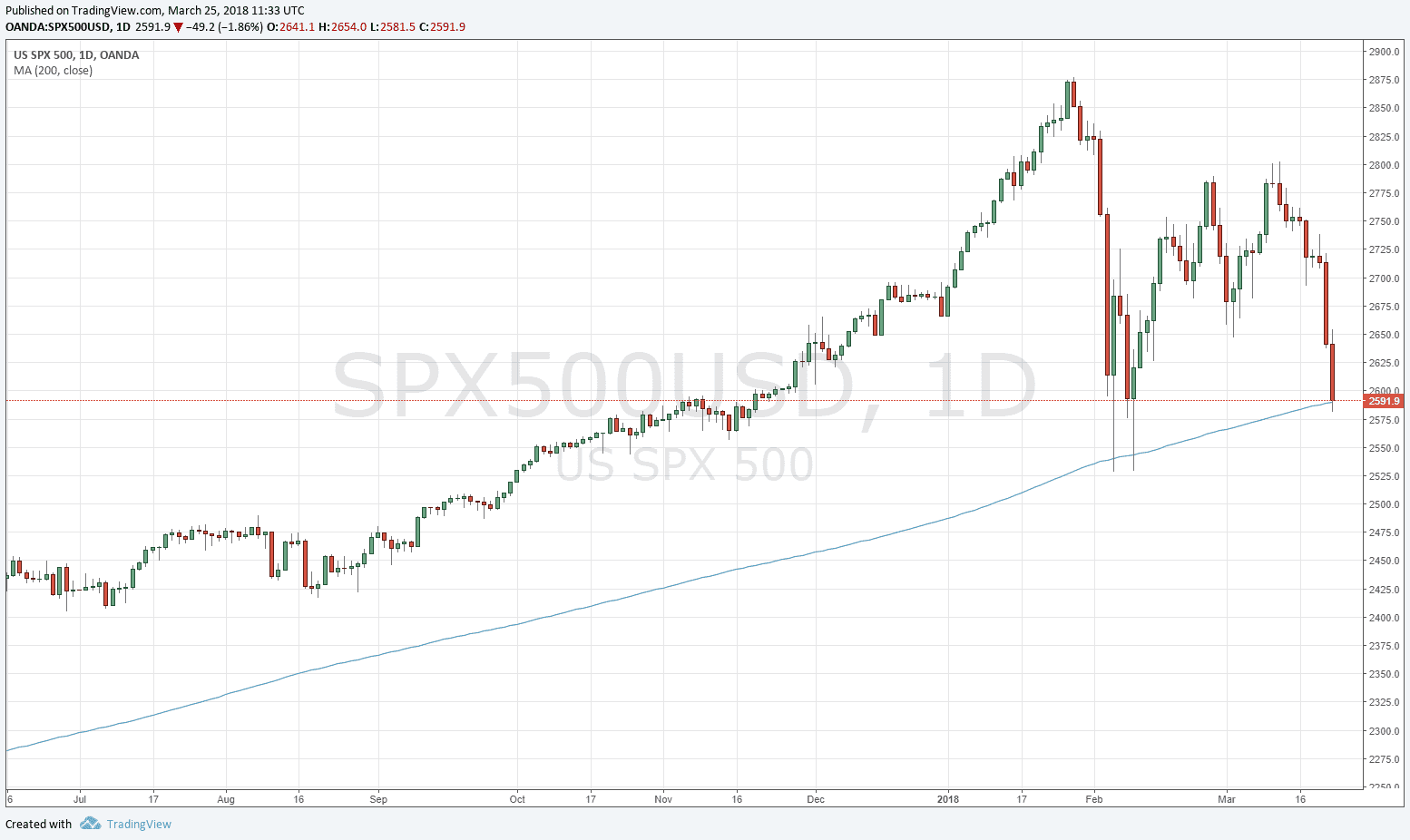

The U.S. stock market sold off quite strongly last week, ending the week near its low. It was the lowest closing price for about 4 months, and was only just above the S&P 500 Index’s 200-day simple moving average, a traditional measure of a market’s health:

It doesn’t look like a very healthy price chart, does it? Yet we shouldn’t be overly quick to call a bear market. After all, we haven’t had one close below the moving average, let alone the several consecutive ones we would ideally want to see. What about other measurements? The old benchmark is a drop of at least 20% from the high price, while the drop is barely only 10%. Another benchmark commonly applied is a cross of the 50-day moving average below the 200-day moving average (the “death cross”) to signify the start of a bear market. This is not remotely close to happening. My preferred measurement personally is simply whether the price is higher or lower than it was 6 months ago, and on this metric, the price must drop further before qualifying as bearish.

Yet there is still something about this chart that makes me deeply uneasy and ready to consider liquidating all my stocks. Two things, in fact: the steep rise in volatility since the sell off, and the price action of the candlesticks within the chart itself. Both look bearish, as such a sharp increase in volatility after a strongly bullish “exhaustion” move is often bearish. Also, we can see a double top made after the price recovered from its initial strong fall. The price has moved down strongly from the second top within the double top formation.

Arguments can be made to persist with a bullish outlook. The price still hasn’t broken the recent lows, as can be seen from the chart above. The price might test them again and rise sharply, printing a double bottom which becomes a buying opportunity. This might happen. Historical data shows the U.S. stock market is more resilient on the long side than the short side: long is the market’s natural tendency.

The next week or two are likely to be critical to the future direction of the stock market. If you have stocks or are considering investing, it would probably be wise to watch the next developments carefully, especially what happens as the first quarter comes to an end at the end of this week. Much will probably depend upon how the U.S. / China tariff “war” plays out.