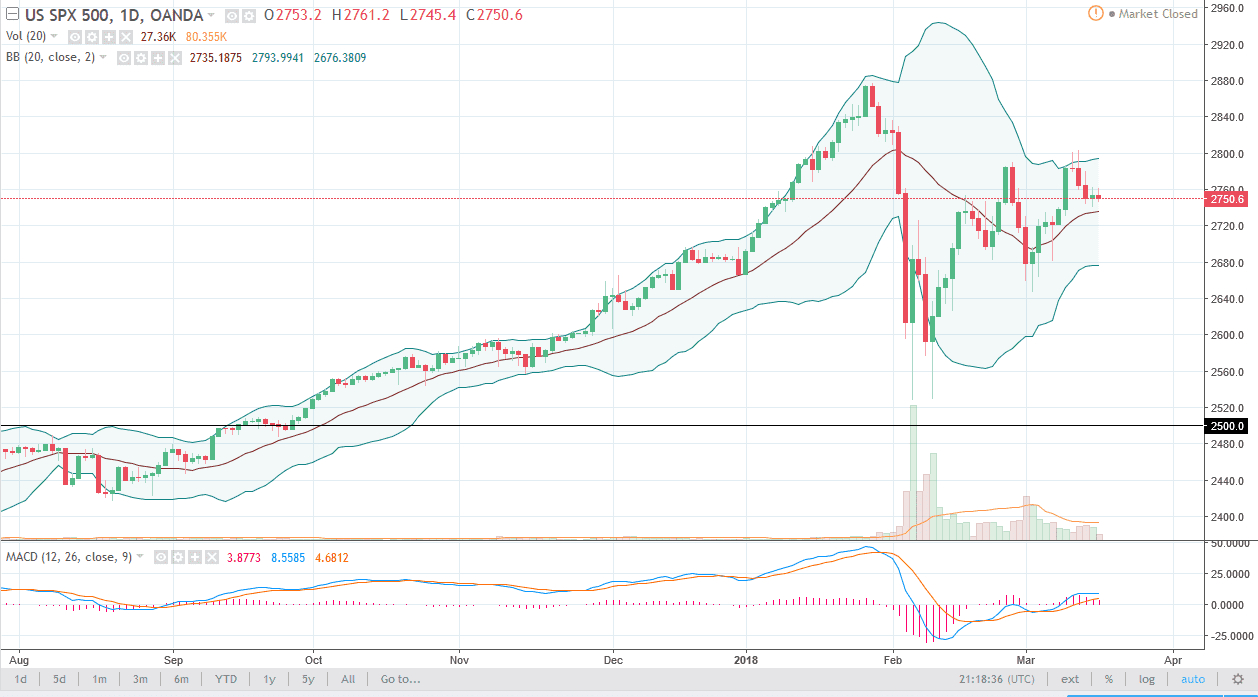

S&P 500

The S&P 500 initially tried to rally during the trading session on Friday but turned around to form a shooting star. The shooting star of course suggesting a bit of weakness, but I see plenty of support just below. I think that we may drift a little bit lower before attracting attention, somewhere near the 2725 handle. Alternately, a break above the 2760 level would send this market looking towards the 2800 level. A break above there could free this market to go much higher, perhaps reaching towards the highs again. Alternately, if we break down a bit I think that there is plenty of support near the 2675 level to turn things back around. I expect volatility, as there are a lot of geopolitical concerns right now, and of course fears of the potential of starting a trade war.

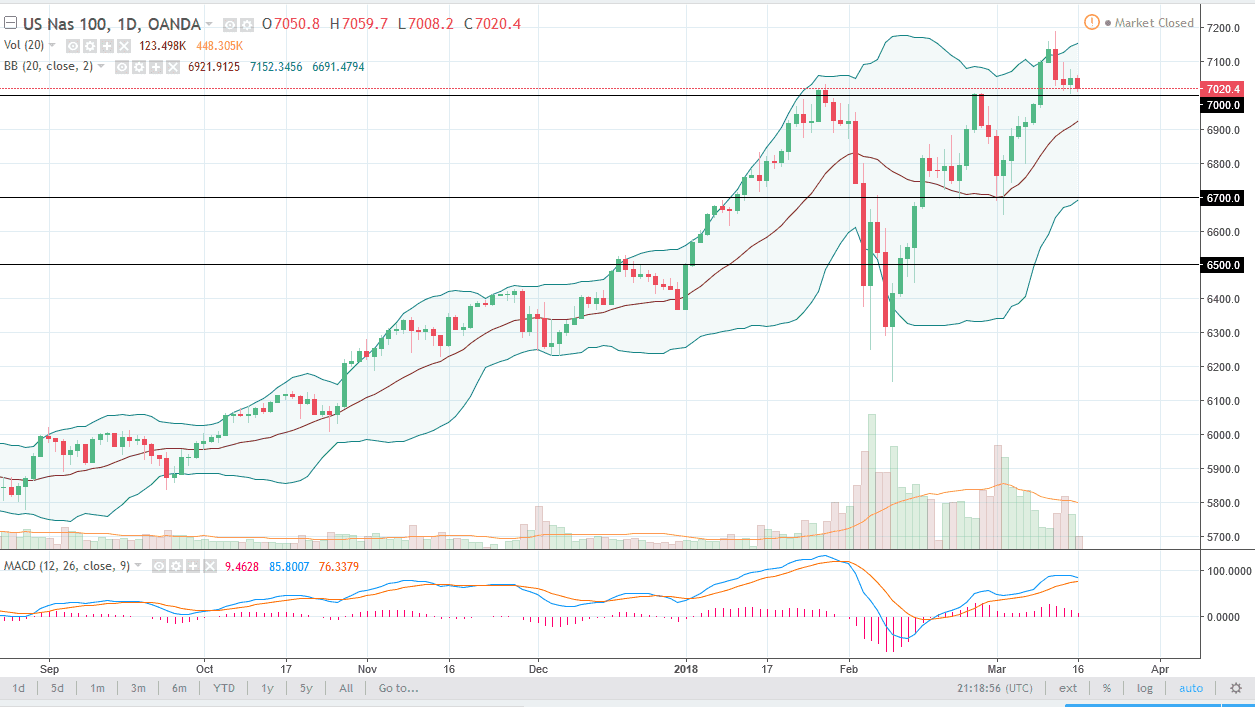

NASDAQ 100

The NASDAQ 100 fell during the trading session on Friday but remains above the crucial 7000 level. I think this area should bring in buyers, and it’s probably going to offer a bounce. However, if we do break down from here I would anticipate that we could probably find support at both the 6950 and the 6900-level underneath. Ultimately, the market should continue to go higher, barring some type of major trade war. I think there are a lot of geopolitical concerns right now but given enough time I think that will flush itself out, and we should continue to go to the upside. I look at the 6700 level as the “floor” in the market currently, so if we were to break down below there I would suddenly become very concerned about the NASDAQ 100. All things being equal, the NASDAQ 100 is one of the stronger indices that I follow.