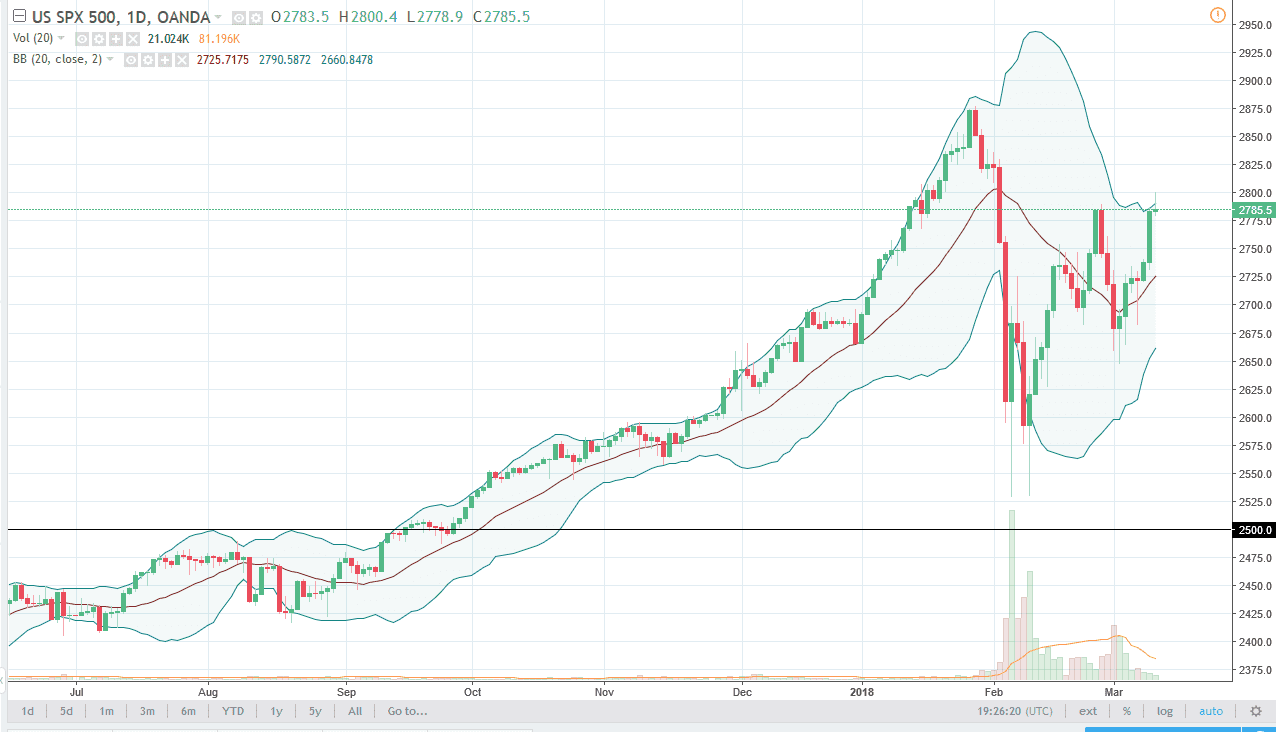

S&P 500

The S&P 500 rallied a bit during the trading session on Monday but gave back most of the gains to form a bit of a shooting star looking candle. Because of this, I think we could find the market drifting a bit lower during the day today, but ultimately, I still believe in the uptrend. Otherwise, if we can break above the top of the daily candle for the Monday session, it’s likely that we will continue to go much higher, perhaps reaching towards 2900, and then eventually the 3000 level, which is my longer-term target. I believe that dips continue to offer value the people will take advantage of, then offer volatility yet again. I believe that selling may help short-term, but longer-term you going to need to be bullish of the market that simply will not roll over for any real length of time.

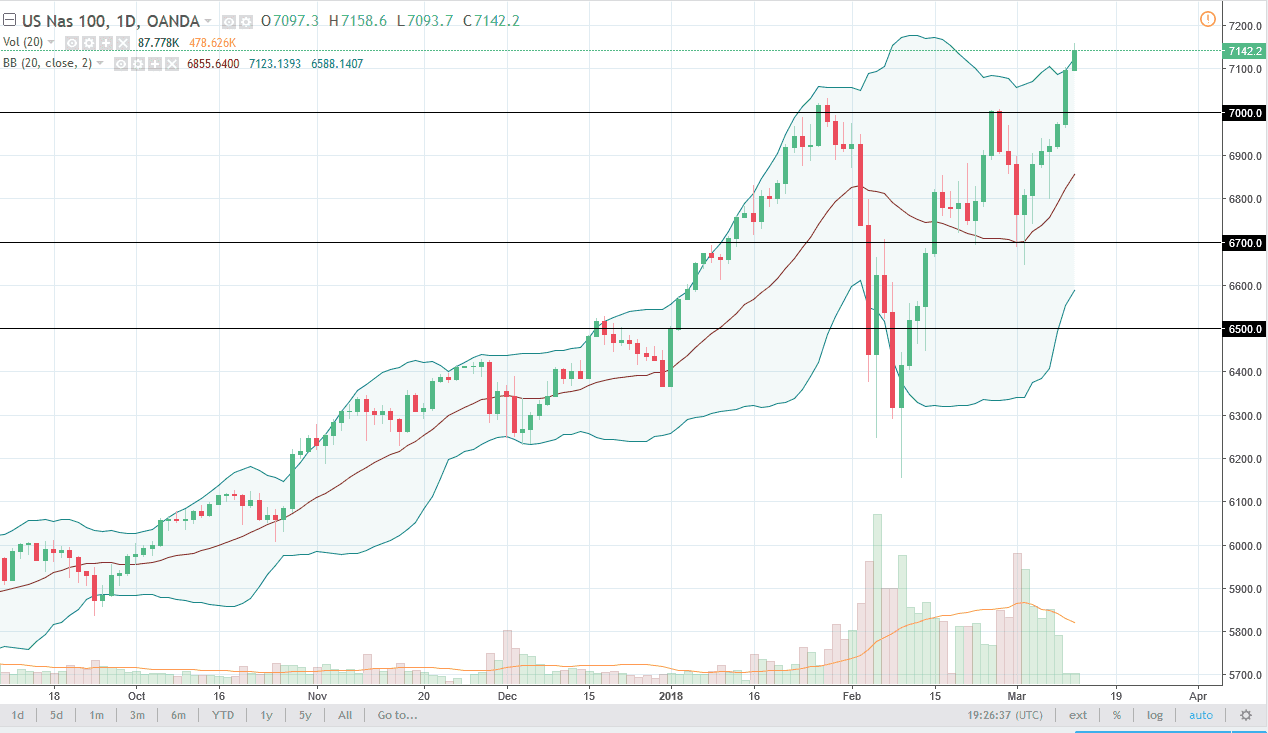

NASDAQ 100

The NASDAQ 100 was a bit different though, because it broke out to a fresh, new high, and shows signs of real strength. It appears that technology stocks are going to continue to lead the way, and I believe will be a major driver of where US indices go over the next several weeks. The NASDAQ 100 has lead the other indices higher earlier in both this year and 2017, and I think we are about to see more of the same. I believe 7000 should now offer support, so if we can stay above there, I don’t see the reason the market would breakdown. In fact, it's likely that the 7100 level will also offer significant support now as well. Longer-term, I believe that the NASDAQ 100 goes looking towards 7500, but obviously it’s going to take a while.