GBP/USD

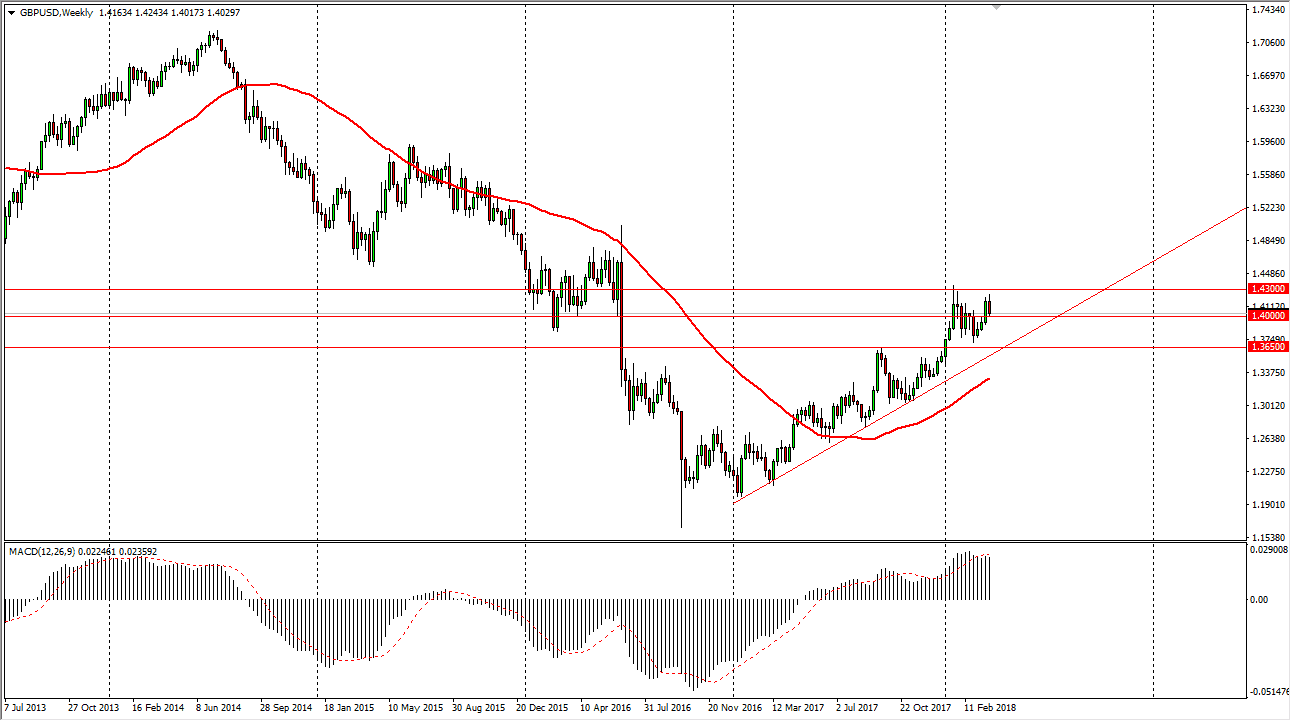

The British pound has been bullish during most of the month of March but did pull back a little bit towards the end. As I write this, we are currently testing the 1.40 level, an area that obviously will have a certain amount of psychological importance to it. However, when you look at the weekly chart, it does not take much imagination to see the potential daily channel that we have been climbing. I recognize that there is a lot of noise between current levels and the 1.45 level, so I think that we will continue to see a lot of back and forth action, but with an upward bend to the slope.

I think that the uptrend line continues to be an area that will cause a lot of support, so I do not believe that we will be selling anytime soon. I believe that a break above the 1.43 level opens the door to the 1.45 handle, and then possibly the 1.48 level. The Bank of England is of course expected to raise interest rates sometime over the summer, so that continues to help the British pound as well. Furthermore, if we can get some type of clarity or resolution between the negotiating parties of the United Kingdom and the European Union, that will only add more fuel to the fire of the uptrend.

Even if we do have a negative month, it’s not until we break down below the 1.3650 level, or at the very least the uptrend line that I’m willing to sell. I recognize it will be the is move higher, but as we continue to build confidence, the market continues to march higher in a slow and steady manner. I believe that we in the month higher, not lower.