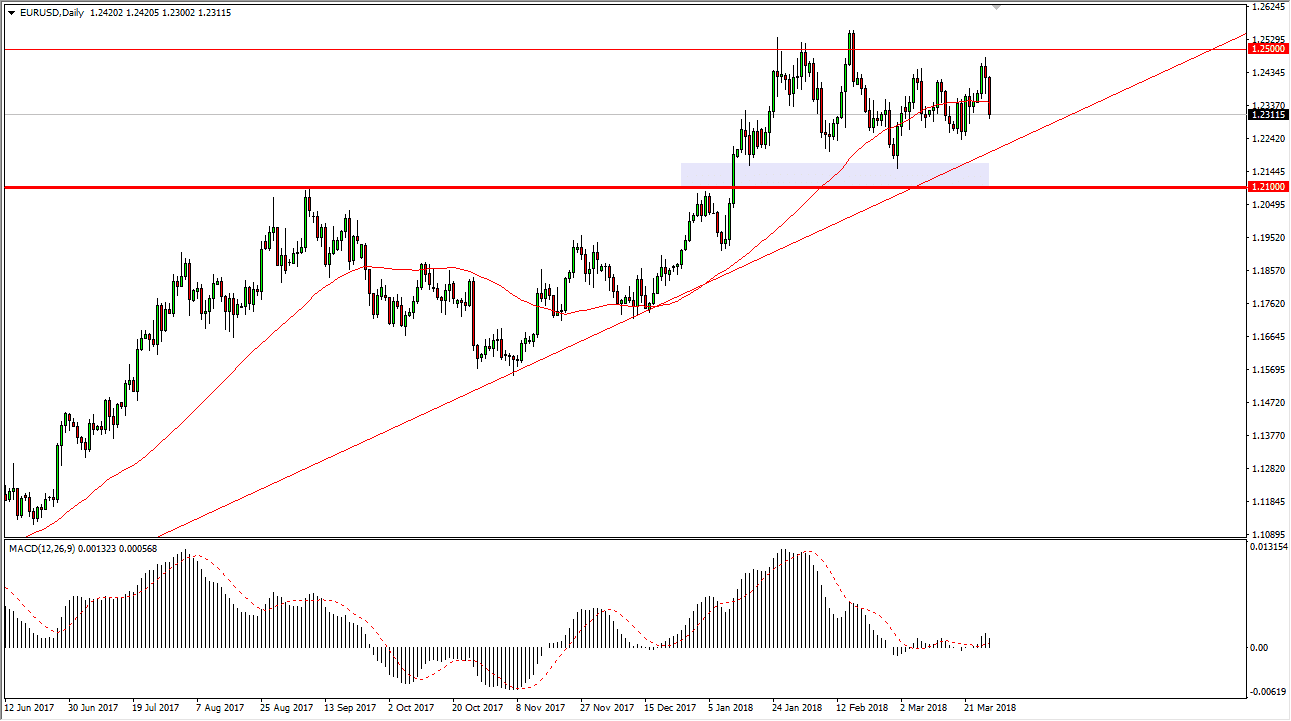

EUR/USD

The EUR/USD pair broke down during trading on Wednesday, breaking below the 50-day EMA again. However, the market seems to have plenty of support underneath, especially at the 1.21 handle. Beyond that, there is a nice uptrend intact, and I think that the market will eventually respect that. However, we may have to drift around in general before finding enough bullish pressure to go higher. Ultimately, I think that we will go looking towards the 1.25 handle, and even with the bearish pressure that we had seen during the trading session on Wednesday, the market still is an uptrend. I think as we continue to bounce around, we are trying to build up the momentum to finally make the break out to the upside. On the weekly chart, we had broken above the top of the bullish flag, and that measured for a move to the 1.32 handle. I believe that is still the target.

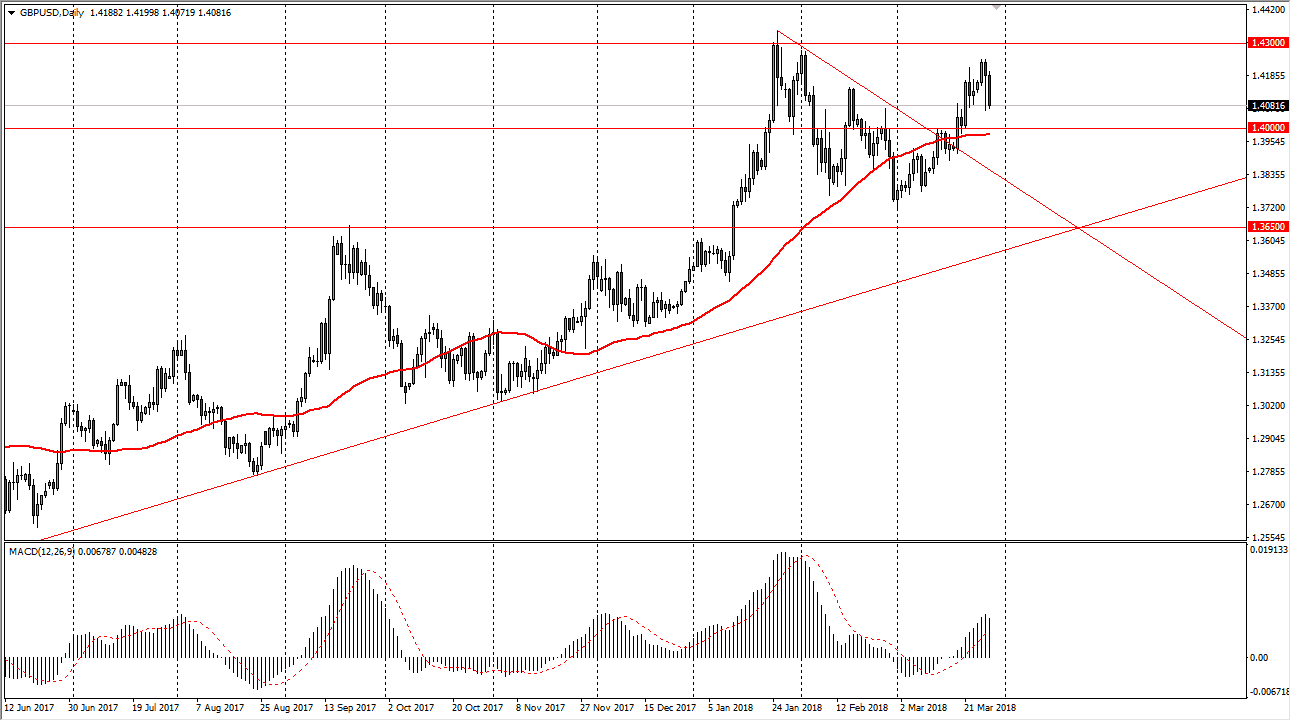

GBP/USD

The British pound broke out during the day as well, as the US dollar enjoyed strength. However, I think that there is more than enough support at the 1.40 level to keep the market afloat, as well as the 50-day EMA just below. Because of this, I think it’s only a matter of time before the buyers get involved, so some type of supportive candle might be needed to take advantage of what has been a strong move higher. I believe that eventually we will reach towards the 1.43 handle, and a break above that could send the market to the 1.45 handle. The market should continue to be noisy, but at the end of the day it looks very bullish in general.