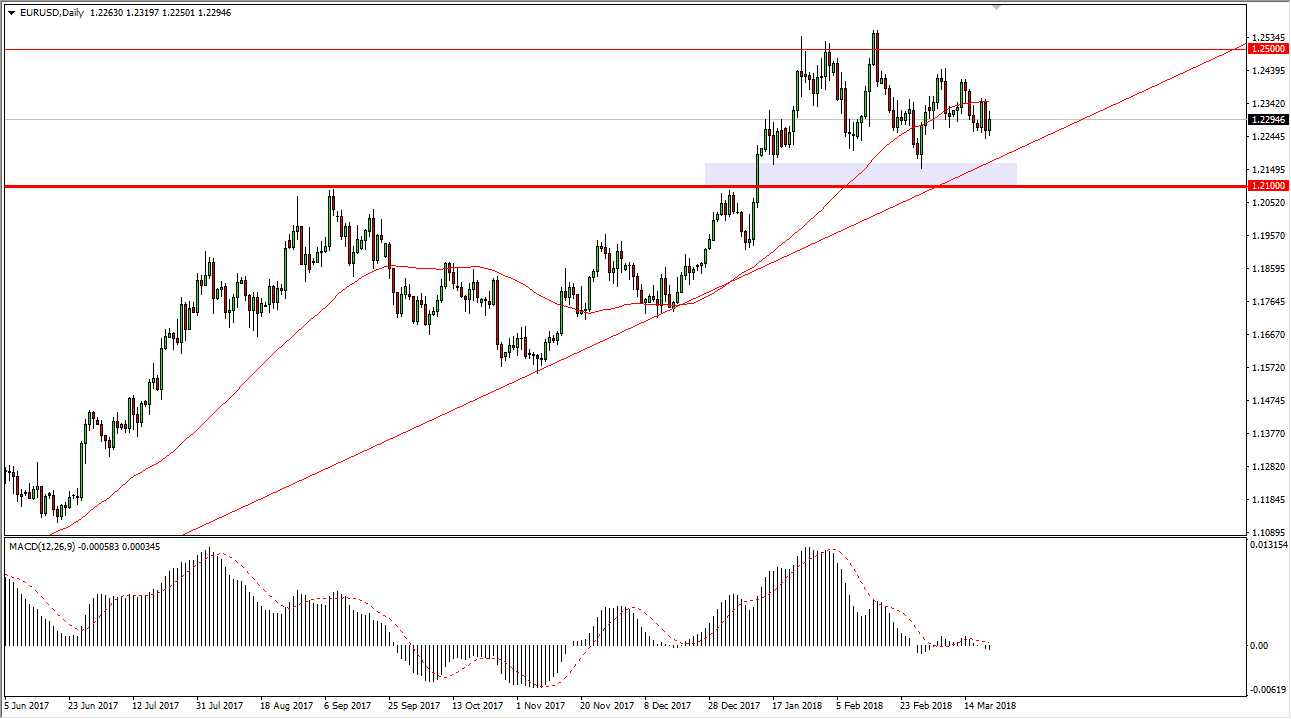

EUR/USD

The EUR/USD pair was noisy as one would expect during a Federal Reserve meeting session, but ultimately showed a slightly positive move. It looks as if we continue to consolidate overall, and I think most certainly with an upward bias. As the markets hover around these areas, I feel that the uptrend line will keep things in check, and that buyers will continue to be aggressive on dips. It’s not until we break down through the uptrend line or the 1.21 level that I would be a seller. I think short-term pullbacks are buying opportunities, and we are currently trying to build up momentum to finally break above the psychologically and structurally important 1.25 level above. Longer-term, I still look to the 1.32 level as a target, based upon a bullish flag being broken.

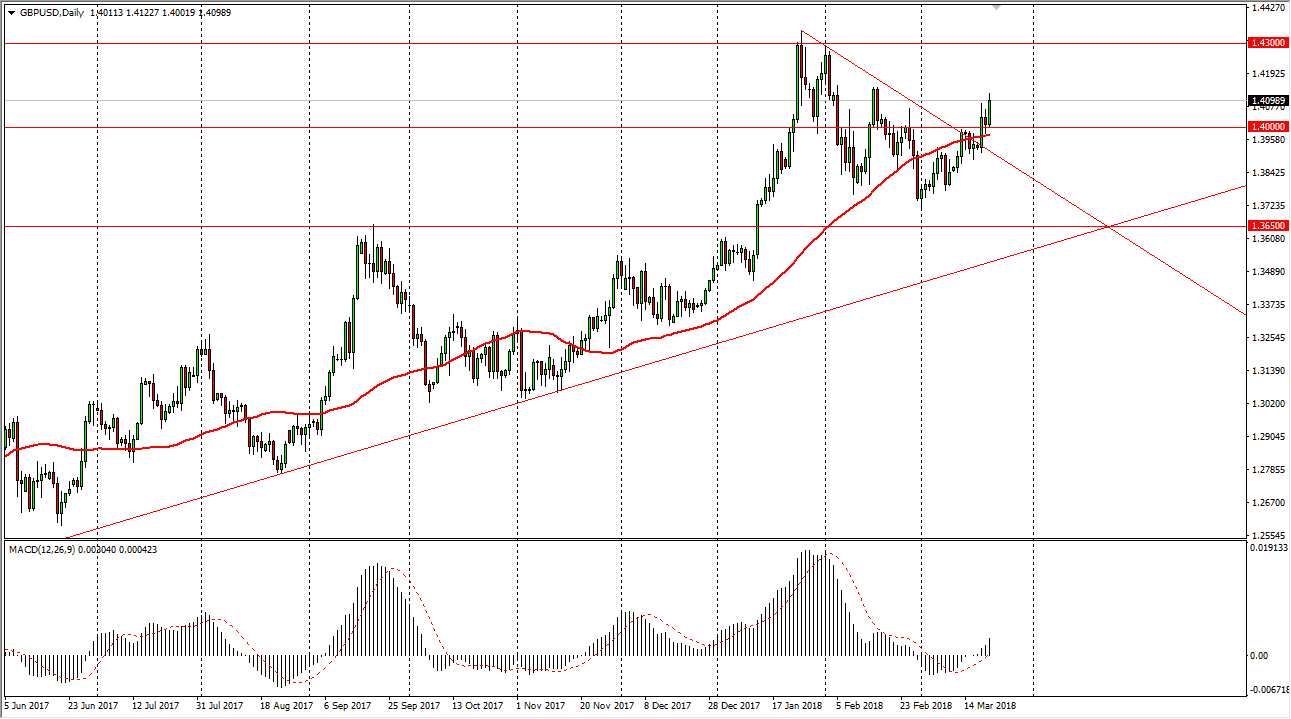

GBP/USD

The British pound exploded to the upside during the day, reaching towards the 1.41 level. The market now looks likely to go much higher, and I believe that it is only a matter of time before we reach the 1.43 handle. Short-term pullback should be buying opportunities, and I think that the 1.40 level should now offer a bit of a “floor” in the market. I believe that the 1.43 level above will be massive resistance, but if we can break above there I think the next target will then be the 1.45 handle. I am still very bullish of this market, and the 50-day EMA looks to attract a lot of attention still, so therefore there are a lot of things lining up to press markets to the upside. Currently, I have no interest in shorting this market as it looks so strong to me.