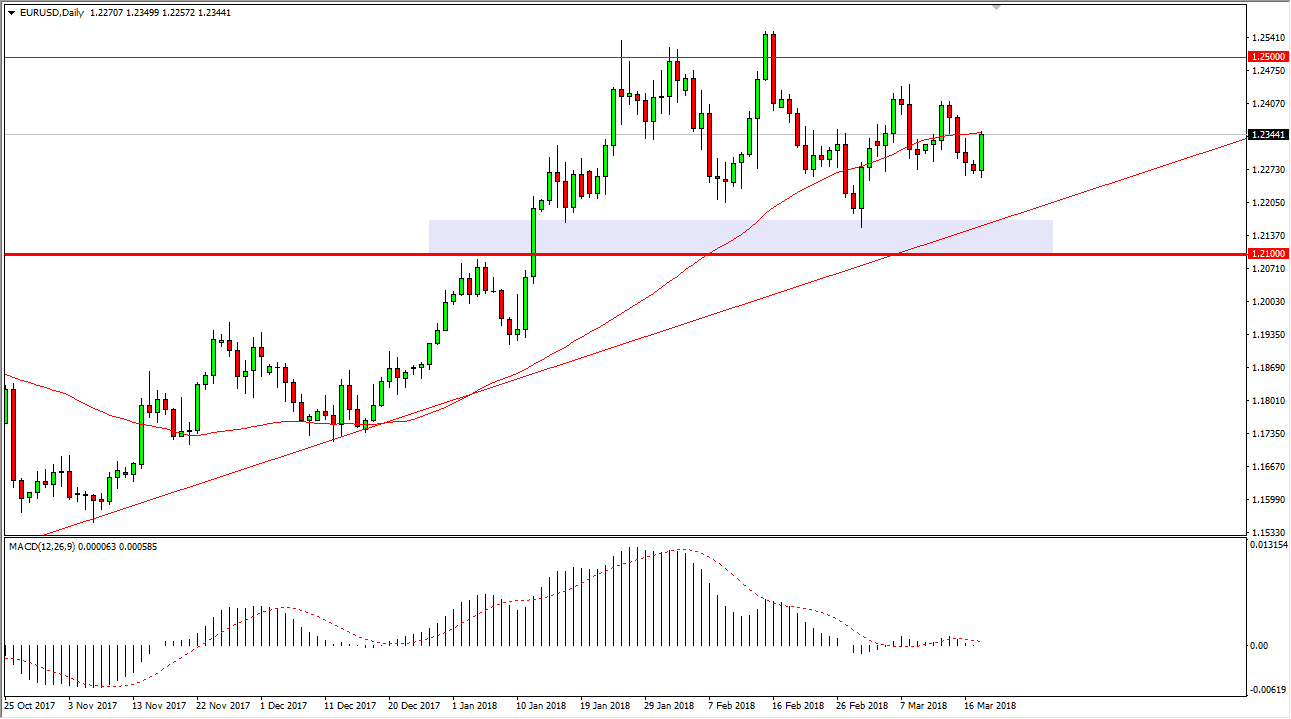

EUR/USD

The EUR/USD pair has rallied significantly during trading on Monday, as traders came back from the weekend. This is interesting, because I think a lot of traders are starting to question the statement coming out the Federal Reserve this week. If there are signs of a 4th interest rate hike this year, that could be very bullish for the US dollar. However, if we continue with just 3, that is something that people knew already, and it makes sense that traders would go ahead and continue with the status quo. Most certainly in an uptrend in general, and I do think that we will eventually break out to the upside all things being equal, with the 1.25 level being massive resistance. You can see that I clearly have an uptrend line on the chart, as well as a support rectangle near the 1.21 handle.

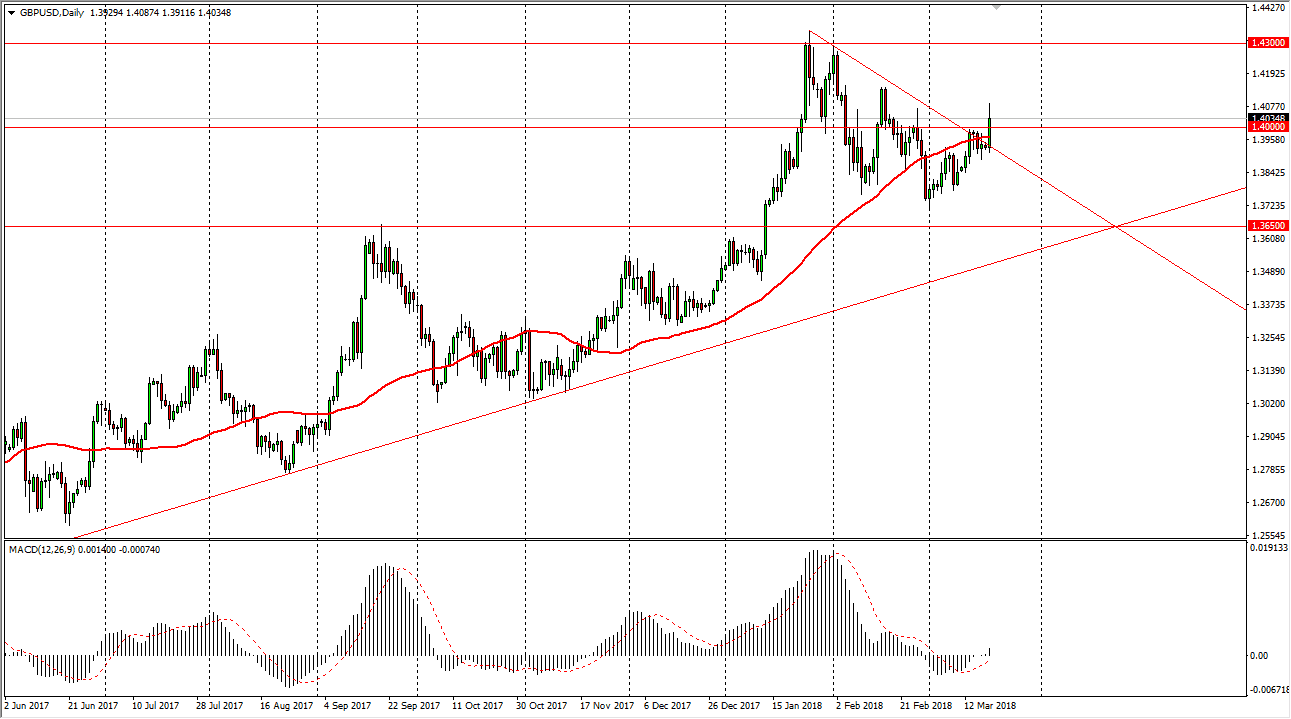

GBP/USD

The British pound broke out to the upside after it was announced that the UK and the EU came to some type of basic outline for the dissolution of Great Britain from the European Union itself. Because of this, the market now has a little bit more clarity as to what the landscape will be like longer-term, and that helps with certainty. At this point, we have broken above the 1.40 level which is also important, so I think it’s only a matter of time before the buyers come back on short-term dips. The 50-day EMA is underneath as well, so I think there’s plenty of reasons to be optimistic. That’s not to say that we will break out to the upside quickly, but I think we’re going to try to grind towards the 1.43 handle. We do have the Federal Reserve coming out with an interest rate statement this week, so don’t forget the other half of the equation.