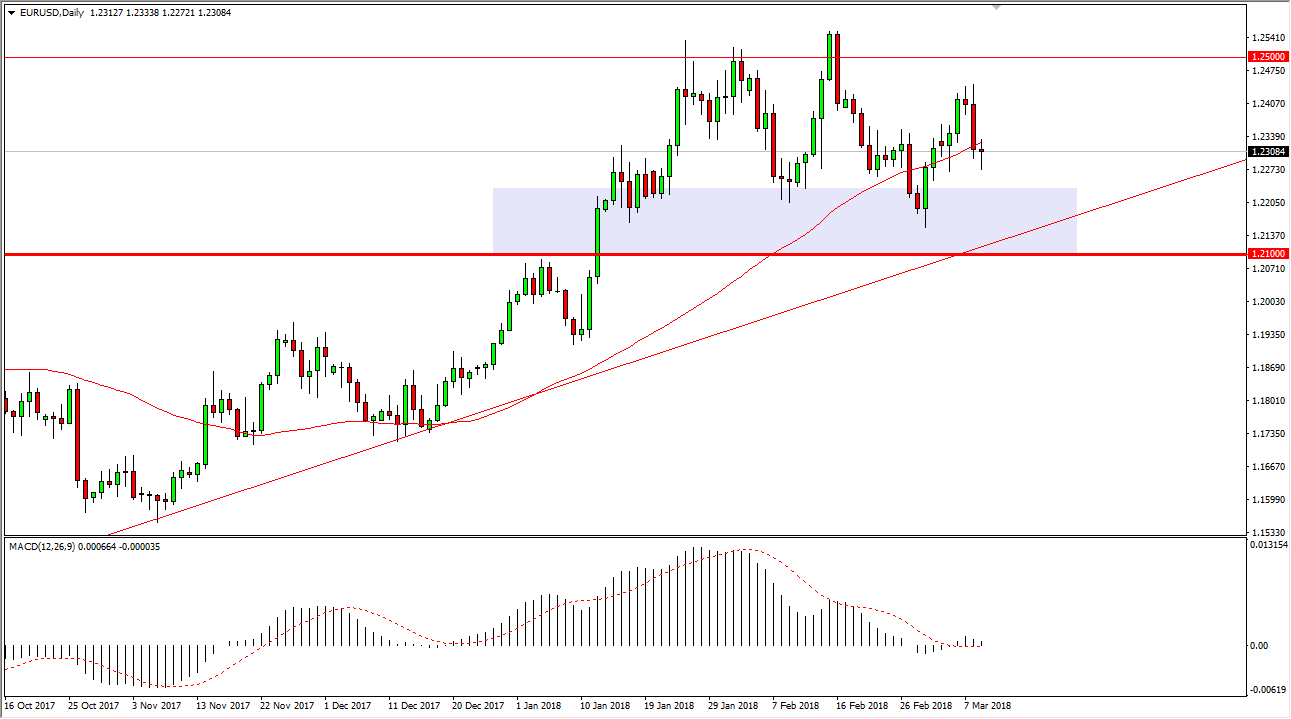

EUR/USD

The EUR/USD pair went back and forth during trading on Friday, which isn’t much of a surprise considering that markets typically are volatile during Nonfarm Payroll Fridays but end up going nowhere by the time it’s all said and done. This candle does suggest a bit of a hammer though, so I think if we can break above the top of the range for the session on Friday, then the market can continue to go higher. I do find it interesting that we have done this right at the 1.23 level, an area that I think should be support. Ultimately, I think we break to the upside we go to the 1.25 level again, an area that is significant resistance. The market going further to the upside plays out nicely when looking at the longer-term charts as well, as there was a bullish flag on the weekly chart broken to the upside.

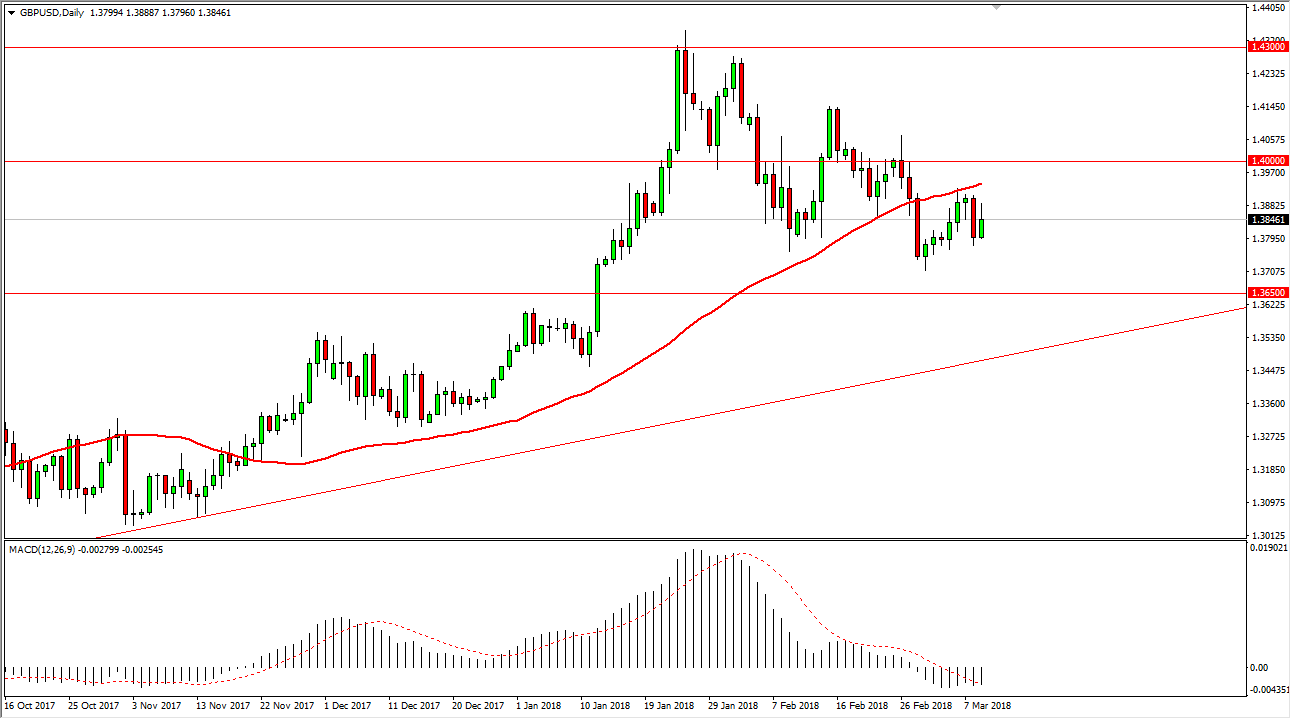

GBP/USD

The British pound rallied during the day as well but continues to struggle at the 50 EMA. If we can break above that, and more importantly the 1.40 level, the market can continue to go much higher, perhaps looking towards the 1.43 level. I think there’s plenty of support underneath, so don’t have any interest in shorting this market, and I believe that pullbacks should be buying opportunities for those looking to pick up a little bit of value. The uptrend line just below there should also keep this market afloat as well, and I think the given enough time we should see buyers come back in. I think that the market breaking above the 1.43 level should send this market to the 1.45 level again. Expect volatile conditions, but longer-term I think the buyers continue.