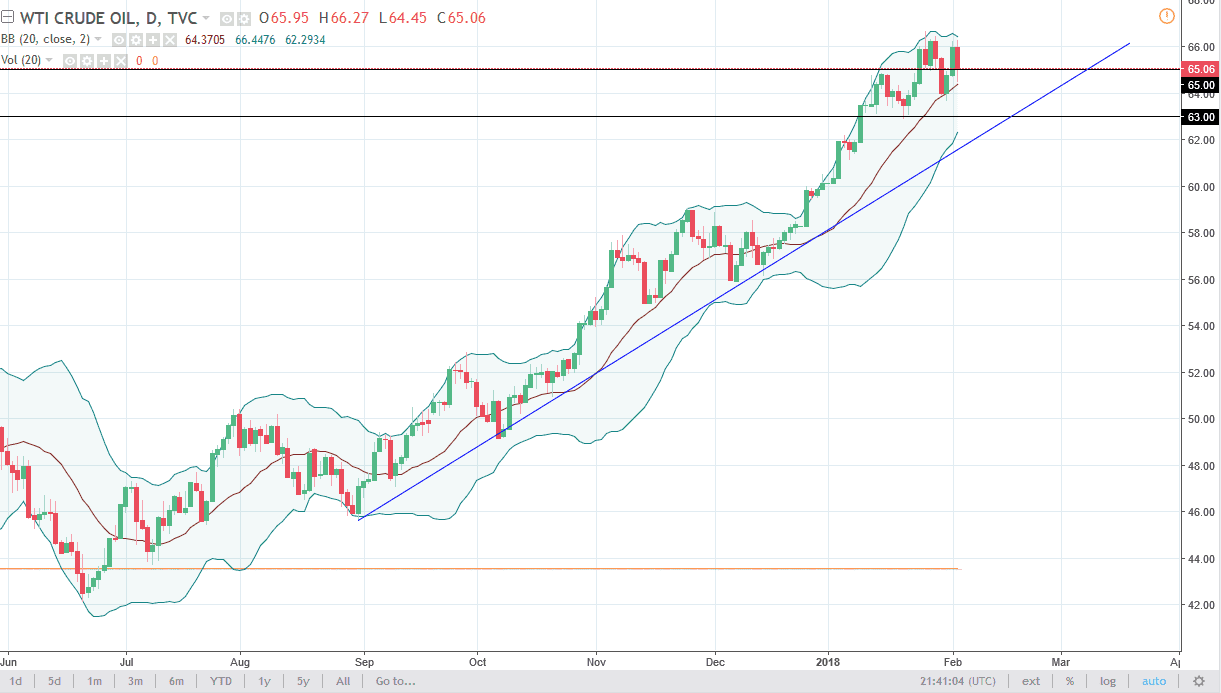

WTI Crude Oil

The WTI Crude Oil market fell a bit during the trading session on Friday, breaking below the $65 level at one point. However, later in the day buyers came back into the market place and started picking up the market. It looks likely that the overall uptrend should continue, but I recognize that we could fall as low as $63 without breaking anything. I like the idea of going long on dips, as it should offer plenty of value for what has been a very strong move. I believe that the $70 level above will be the target if we can continue to see the upward momentum, and certainly will be helped by a falling US dollar if it continues. If we break down below the uptrend line, then I think we could fall towards the $60 level at the very least.

Natural Gas

Natural gas traders continue to sell, as we are out of the most bullish part of the year. Demand will start to fall going forward, especially considering that the northern part of the United States will be falling out of the winter season soon. The $3 level underneath should offer plenty of support, but if we can break down below there, the market should fall rather significantly. If we rally from here, it’s likely that we should find a decent opportunity above the start selling as well on signs of exhaustion. The $3.30 level should be exhaustion, and I believe that the market reaching towards that area and showing signs of rolling over should be jumped on. We have sold off rather drastically over the last few sessions, so it’s probably a bit much to expect the fall to continue right away. However, I am sure that there are plenty people who bought natural gas and higher levels that would be glad to get out at breakeven.