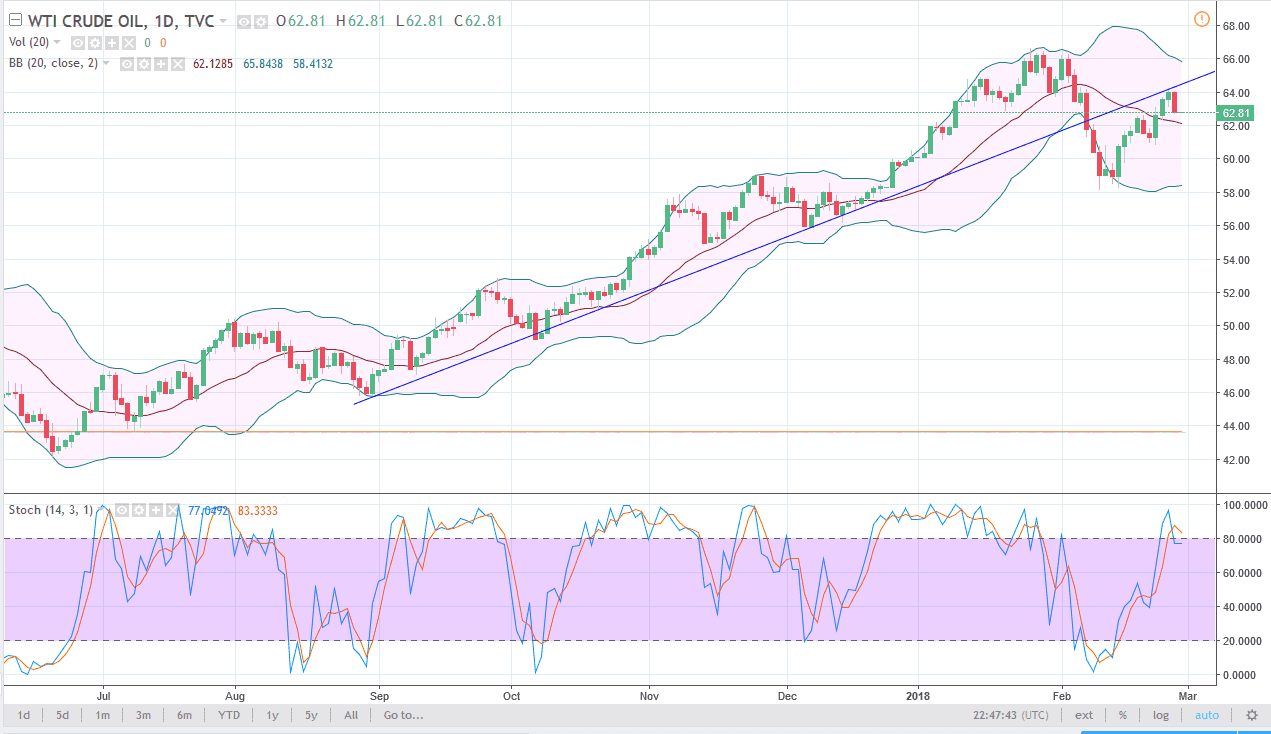

WTI Crude Oil

The WTI Crude Oil market has broken down significantly during the day on Tuesday, breaking below the bottom of the hammer that had formed on Monday. We were trying to break above the uptrend line that should now offer resistance, and by the end of the day it has shown that we have seen that exact scenario. By breaking below the bottom of the hammer, that forms a “hanging man” for Monday, and I believe that we are going to fall from here based upon not only that, but the fact that we have closed at the very bottom of the range for the day. Because of this, I anticipate that oil markets will go to $61, and then eventually $60. I believe that the $58 level gets targeted next. With US producers ready to become the largest producers of crude oil in the world by 2019, it’s very likely that oil continues to suffer.

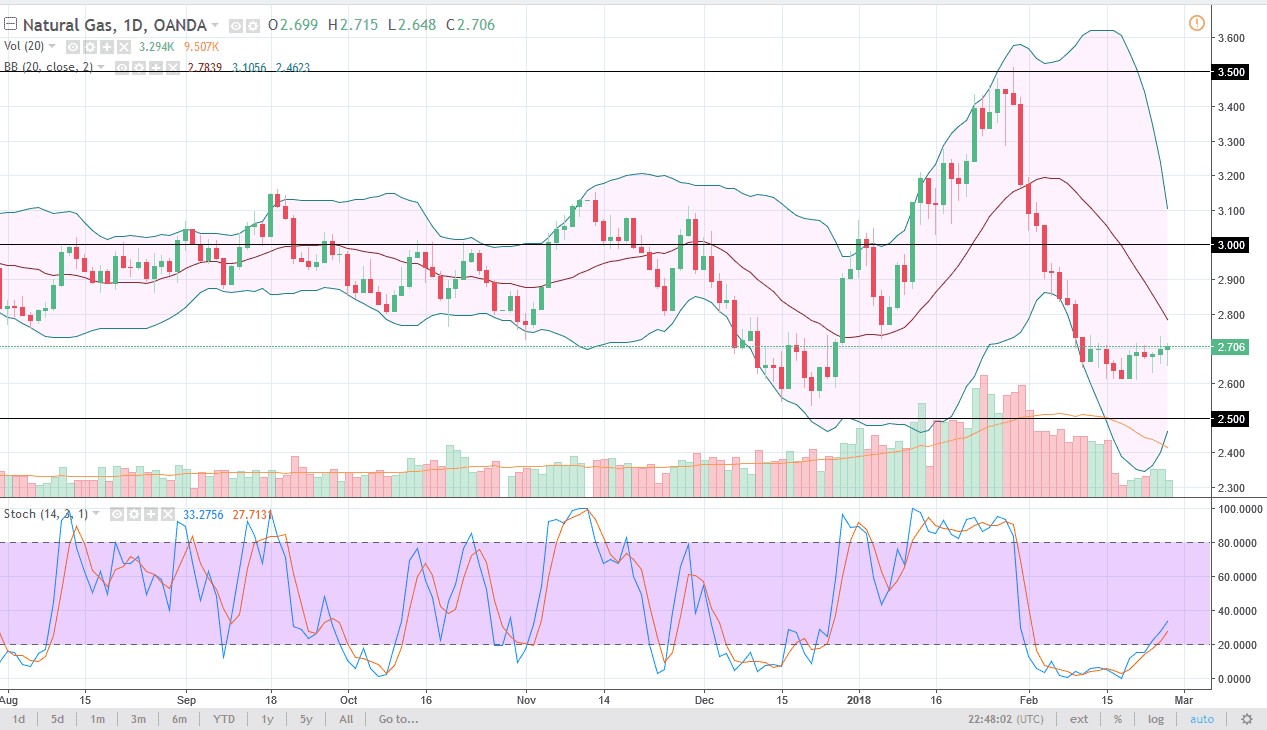

Natural Gas

Natural gas markets initially fell during the trading session on Tuesday but turned around to form a bit of a hammer. The hammer sits right at the $2.78 level, and I think it shows that we are probably going to bounce rather soon. I think that $3.00 level above will be massively resistive, especially considering that the bullish pressure that we did see during the Tuesday session is based almost entirely on warmer temperatures coming in the short term, but spring is coming in America rather soon, and that will drive down demand. I don’t have any interest in buying this market, I believe it is only a matter of time before the sellers return on any bounce, and I’m willing to wait for exhaustive daily candle to start shorting again.