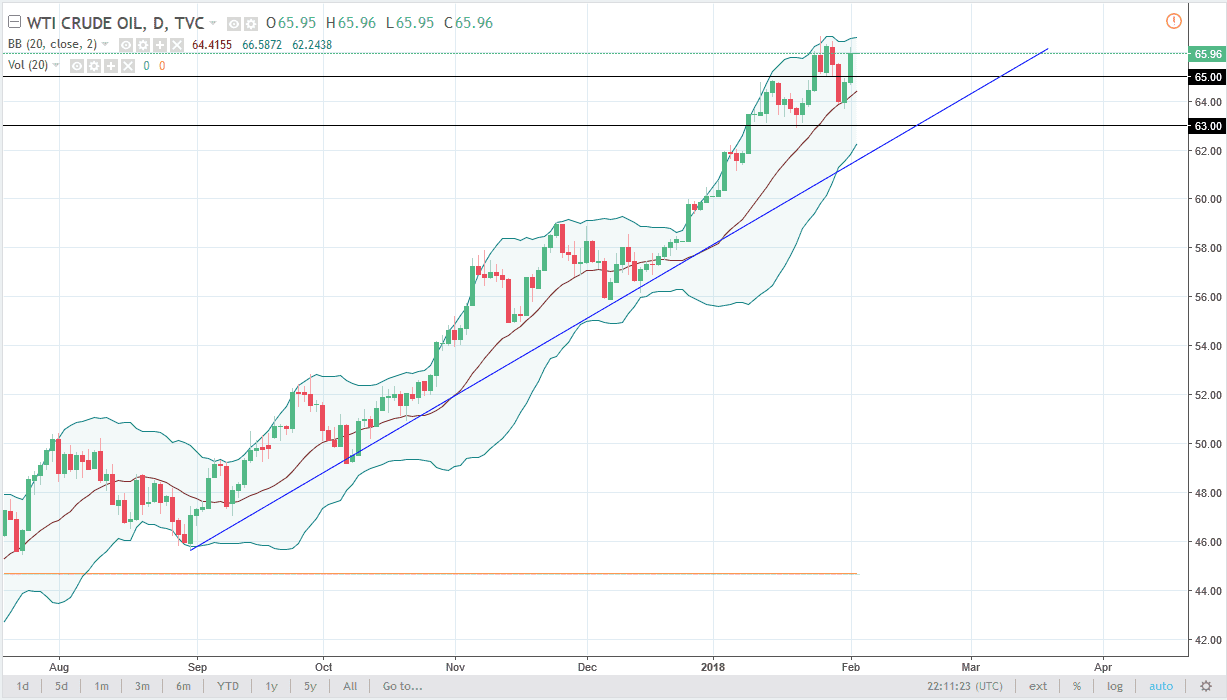

WTI Crude Oil

The WTI Crude Oil market had a positive session on Thursday, as we broke above the $65 level again. It looks likely that we’re going to reach above $66 as well, especially if the jobs number comes out positive in shows a significant amount of demand potentially building up for crude oil. I think that there is plenty of support underneath, especially at the $63 level, so it’s not until we break well below that area that I would be a seller. Longer-term, I think that the market is trying to reach towards the $70 level, which of course is a large, round, psychologically significant number. If the US dollar falls, that will also help the crude oil markets going forward. In general, I believe that this market continues to be volatile, but I would be very cautious about selling.

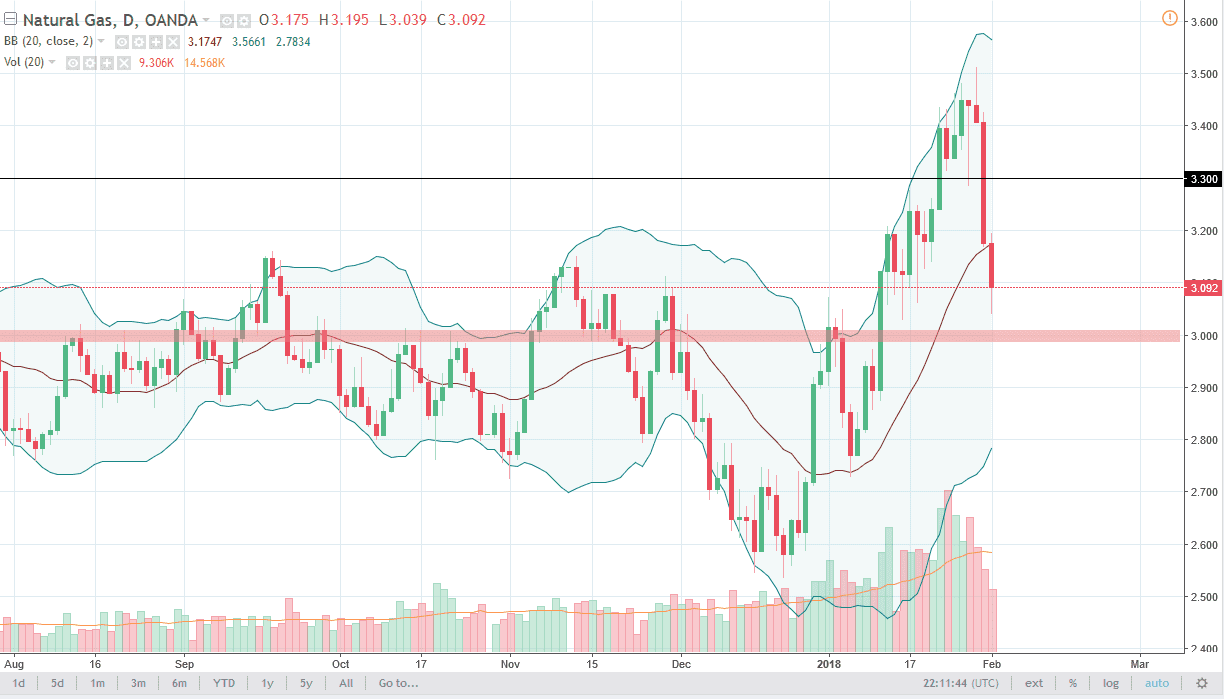

Natural Gas

Natural gas markets have broken down during the trading session on Thursday, as we continue to see a lot of trouble. The $3 level is significant support underneath, and I think if we break down below there the market breaks down rather rapidly. We have sold off drastically in just the last couple of days though, so I would anticipate some type of short-term bounce, but that should be an opportunity to get short yet again. The seasonality is working against natural gas, as we are starting to reach towards the warmer temperatures in the United States. The winter is almost over, so the futures markets will start to look towards Spring, which of course means a lot less demand. Any rally during the next couple of sessions should be looked at with suspicion, and I would be a seller of the first signs of exhaustion.