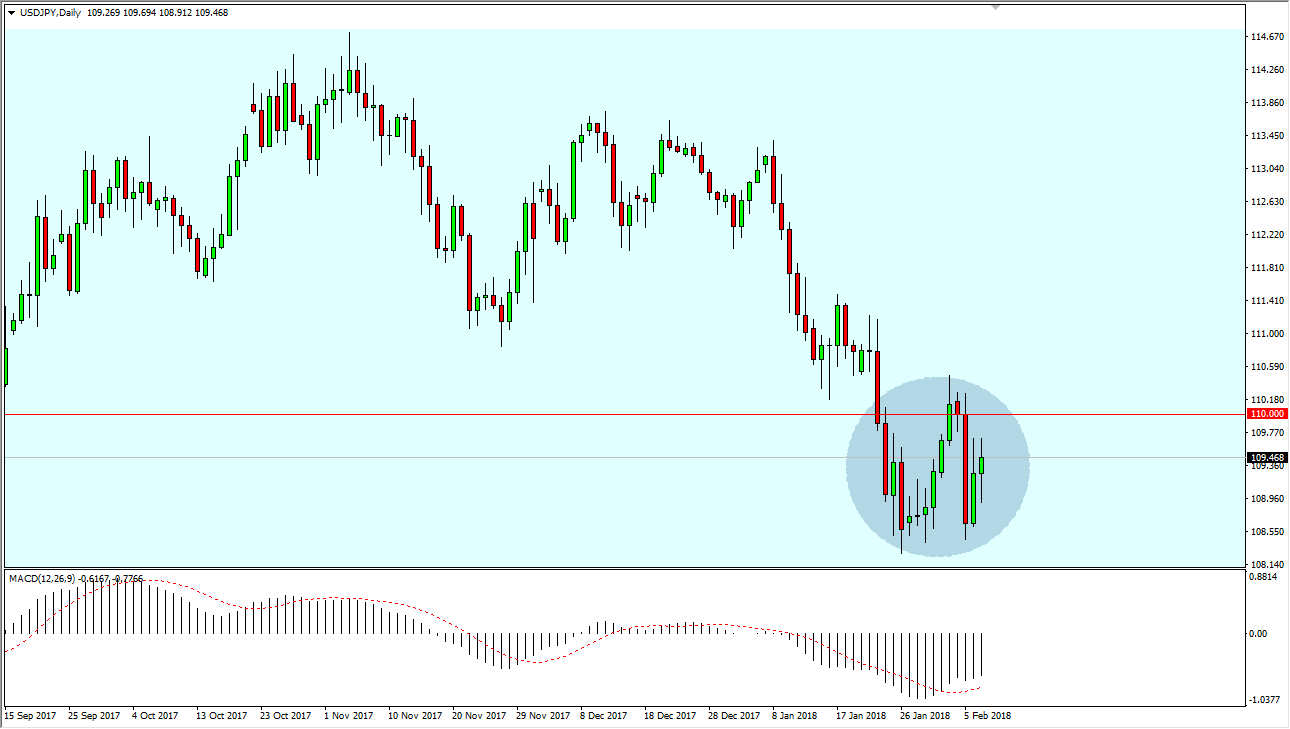

USD/JPY

The US dollar went back and forth during the trading session on Tuesday, showing signs of volatility yet again. Stock markets have been very noisy, and that typically is the best measure of risk appetite, something that drives this market. I think that the 110 level above being broken would be a very bullish sign, and probably bring in fresh money. The 108.50 level is support underneath, and I think that support runs down to the 107.50 level. In the meantime, it’s more than likely going to be a situation where we go back and forth and simply grind in this range. If you are range bound trader, perhaps uses of the like the stochastic oscillator to confirm that we are either overbought or oversold might be the way to go, selling near the 110 handle, and of course buying near the 108.50 level.

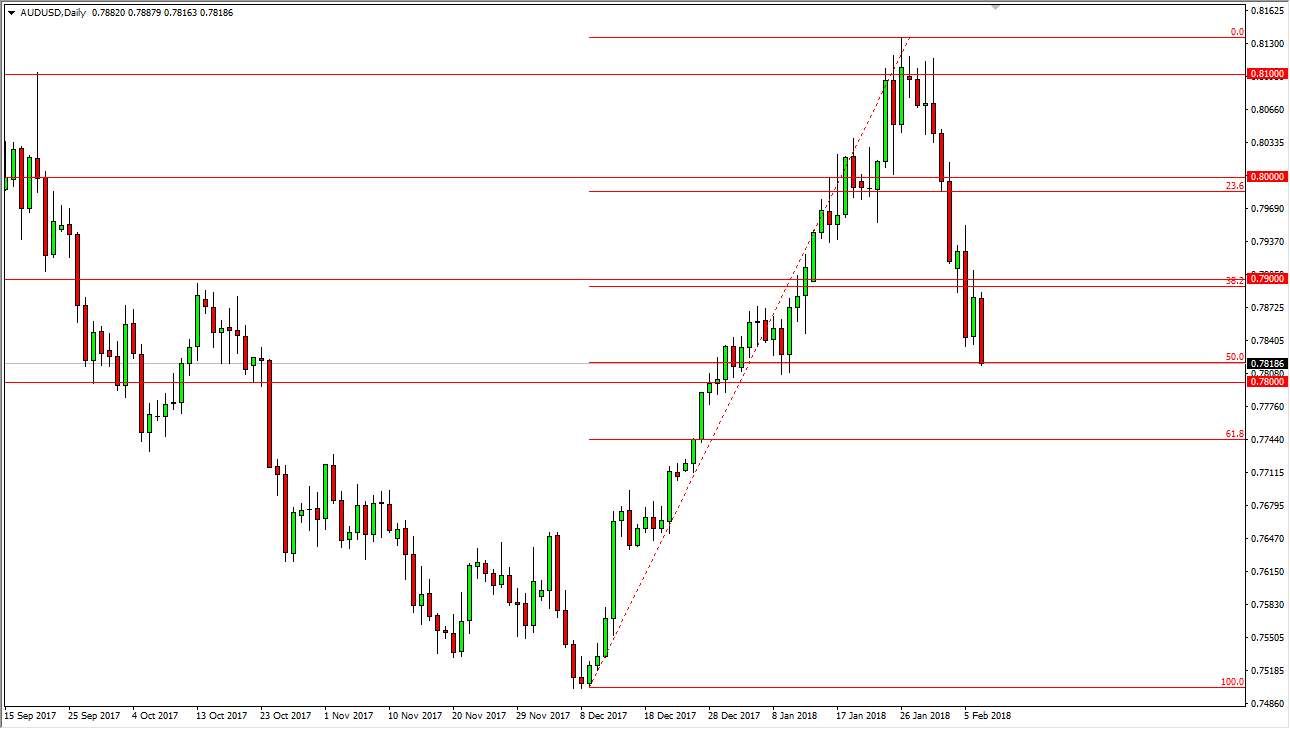

AUD/USD

The Australian dollar fell hard during the day as the United States dollar continues to strengthen, and this was very negative for gold. That has a bit of a knock-on effect for the Aussie dollar, so I’m not surprised that we struggled, and now we find ourselves near the 50% Fibonacci retracement level, an area that should attract some attention. It’s just above the 0.78 level, which of course has offered support previously. We have gotten a little ahead of ourselves recently, so I like the idea of this pullback, and I think if we can get strengthen the gold market, or at least the US dollar calming down, it’s likely that the Aussie will benefit from that. If we do break down from here, I suspect that the market will probably go looking towards the 0.7750 level underneath, which is the 61.8% Fibonacci retracement level. I prefer buying, but we need the help of gold markets to put money into play.