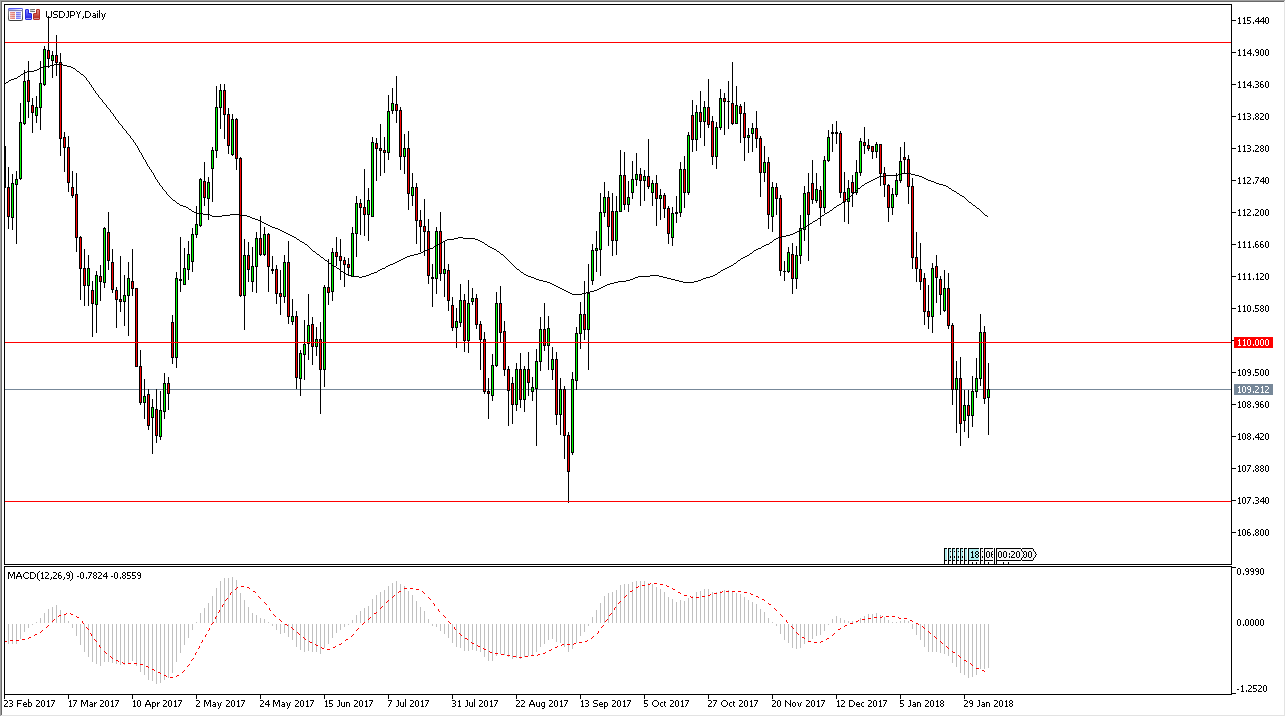

USD/JPY

The US dollar has been very volatile during the trading session on Tuesday, testing the 108.50 level for support, and then bouncing. There is a lot of support just below based upon longer-term charts, so I would not be surprised at all to see this market rally, especially if the stock markets can claw back some of the recent losses. It looks likely that we are ready to, so at this point I would not be surprised at all to see this market reach towards the 110 level, followed by the 111 level, and so on. If the S&P 500 can continue to rally, this pair will do the same. Alternately, if we break down from here the 107.50 level will be the bottom of the “floor” that we are currently testing. The marketplace is going to be very noisy, so keep that in mind and keep your position size small.

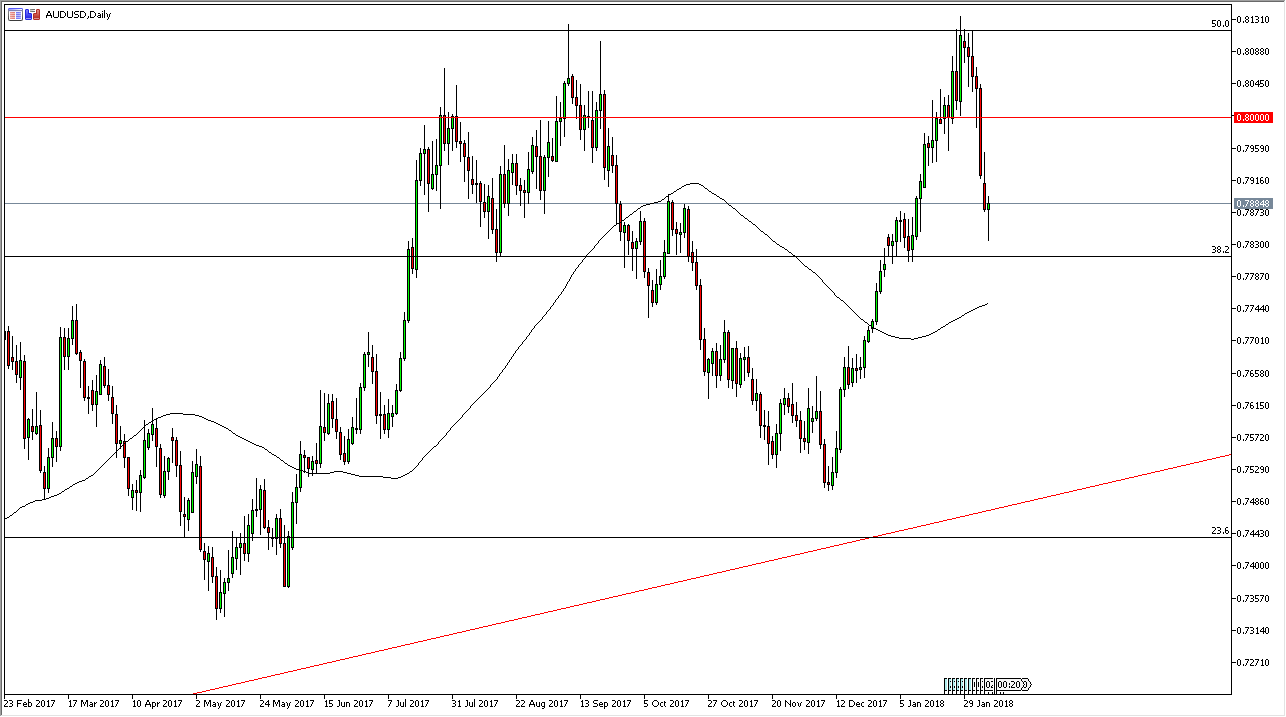

AUD/USD

The Australian dollar fell rather hard during the day as well, reaching down towards the 0.7830 level. We bounced enough to form a bit of a hammer, so I think we are getting ready to see buyers come back into this market place, and perhaps trying to reach towards the 0.80 level. That’s an area that has been important for a very long time, so it will probably take a bit of stronger momentum to finally break out above there and continue to go higher. If we can break above the 0.81 handle, the market should continue to go even further, perhaps reaching towards the 0.85 level. If we do fall from here, the market could drop down to the 0.77 handle, but it is the least likely of scenarios that I have right now, and I believe that value hunters are coming back.