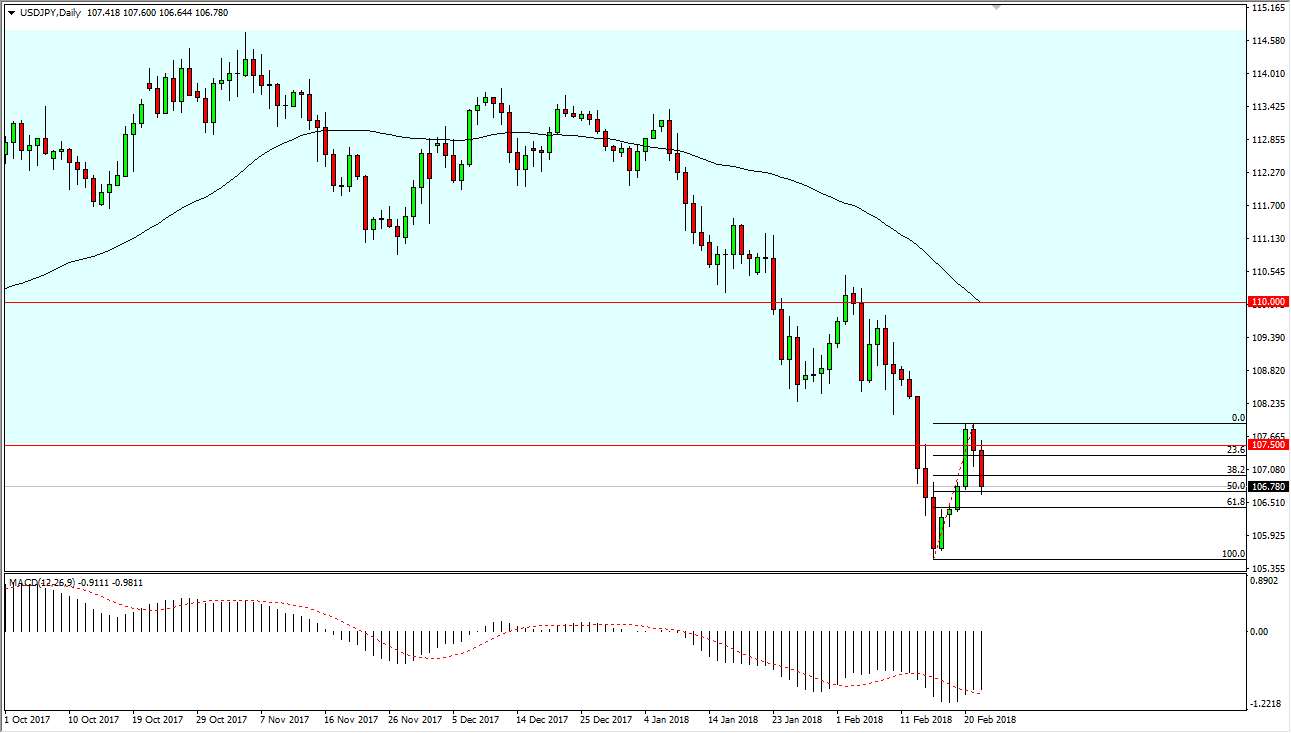

USD/JPY

The US dollar initially tried to rally on Thursday but found the area above the 107.50 level to be a bit too rich for the market. I think that if the market break down below the bottom of the candle stick on the Wednesday session is a rather negative sign, but I would also point out that we are starting to see support at the 50% Fibonacci retracement level on short-term charts. In other words, I’m a bit wishy-washy when it comes to this pair right now. I think the easiest trade to take would be if we can break above the highs at the 108 handle, which would show a “higher high” in the market, a classic buy signal. A breakdown below the 106.50 level, we would break down below the 61.8% Fibonacci retracement level, and more than likely reach down to the bottom of the move near the 105.50 level.

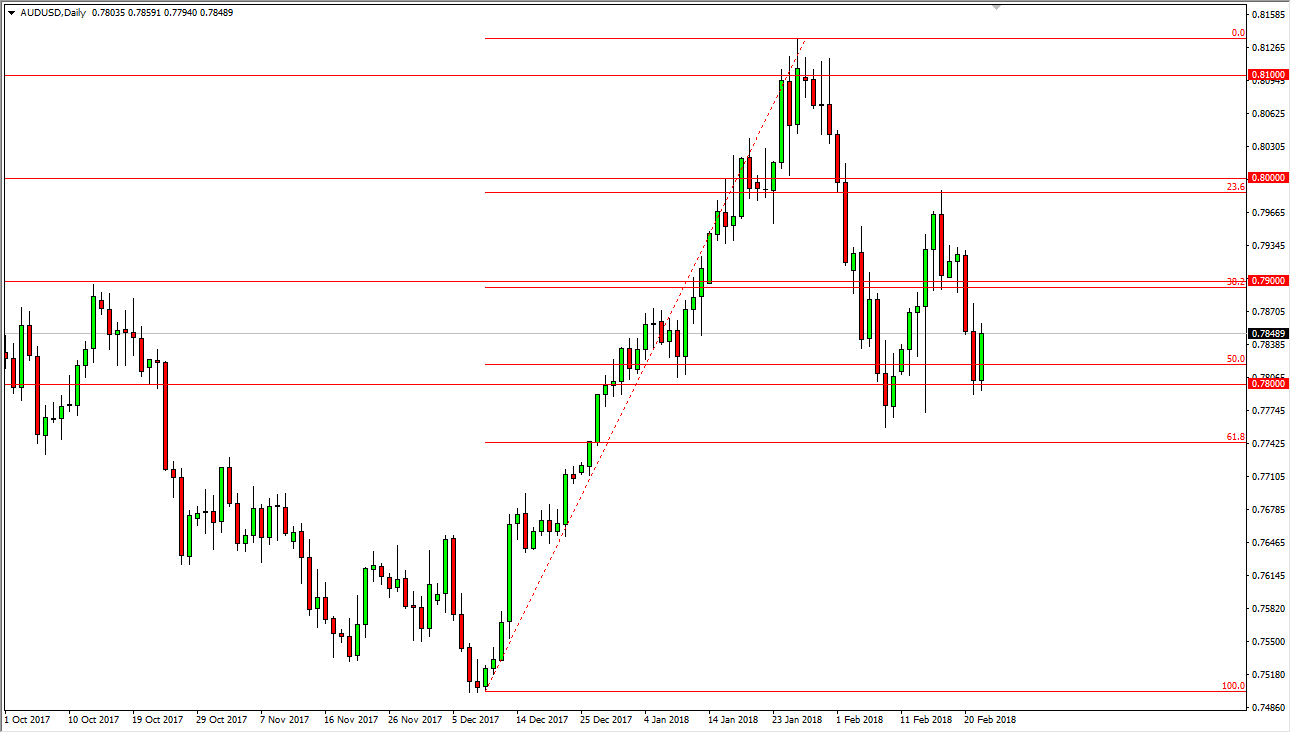

AUD/USD

The Australian dollar rallied during the day as the US dollar took a bit of a hit. This makes sense as the gold markets turned around to rally as well, but when I look at the shirt I recognize that you can also make an argument for a bit of a psychological bounce from the 0.78 level. Because of that, I believe that the market is looking to rally towards the 0.79 level, and then eventually the 0.80 level. On the whole, I do think that the market will continue to find buyers underneath, so I like buying pullbacks as they give us an opportunity to pick up a bit of value. I think that the market will continue to be very noisy, but ultimately there is an underlying argument to be made for US dollar weakness.