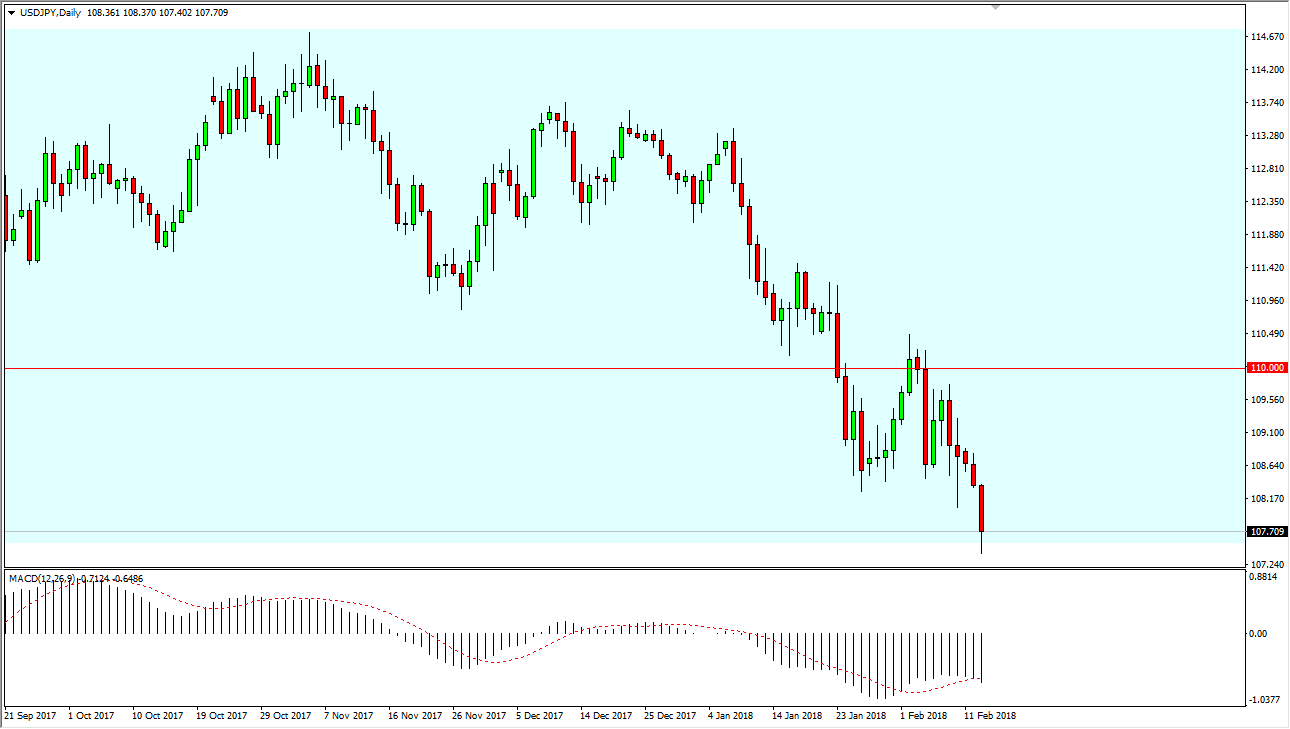

USD/JPY

The US dollar broke down initially during the trading session on Tuesday, testing the 107.50 level. We did bounce from there a bit though, so there is a least a chance that we rally. If we break down below the lows of the Tuesday session, I think that opens the door to a move down to the 105 handle. If stock markets rally, that should turn this market around, as this pair tends to follow the overall attitude of stock traders and risk appetite around the world. Ultimately, I do think that the buyers come back, so if we break down from here, I believe there would be even more buying pressure at the 105 handle. If we do rally from here, I anticipate a move to the 110 level of the next several sessions.

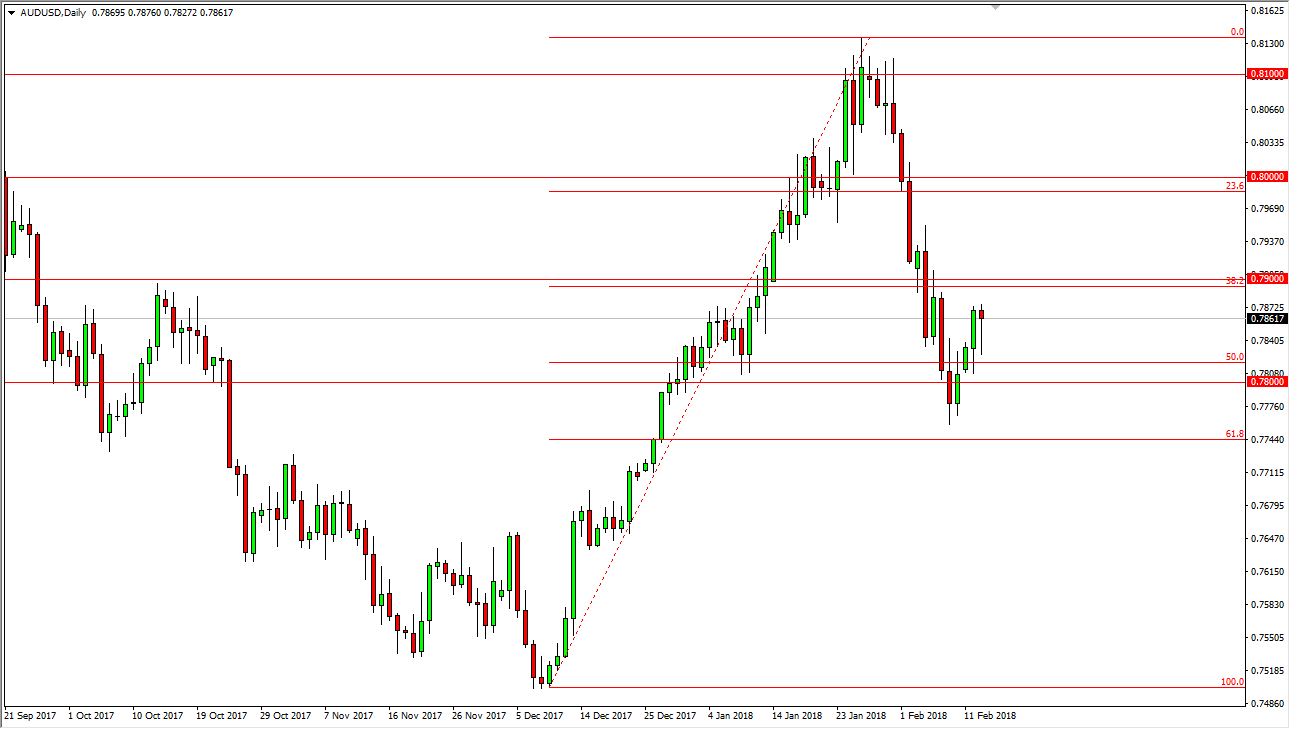

AUD/USD

The Australian dollar fell initially during the day on Tuesday, testing what was the 50% Fibonacci retracement level. We ended up rallying significantly, forming a hammer on the daily chart, suggesting that we are going to continue to go higher. The 0.79 level will be targeted, and a break above there should open the door to the 0.80 level. Ultimately, that’s an area that goes back decades and its importance, and I think that the resistance extends to the 0.81 level above there. In general, I believe that the market is bullish, and I believe that the US dollar is falling overall. Ultimately, I think that the market should continue to rise as not only do Gold markets look healthy, but the Australian dollar itself looks healthy. We have bounce from the 61.8% Fibonacci retracement level recently, after rallying far too quickly. At this point, I’m a buyer of dips, and I believe that a break above the top of the daily range for the Tuesday candle will also bring in fresh buyers.