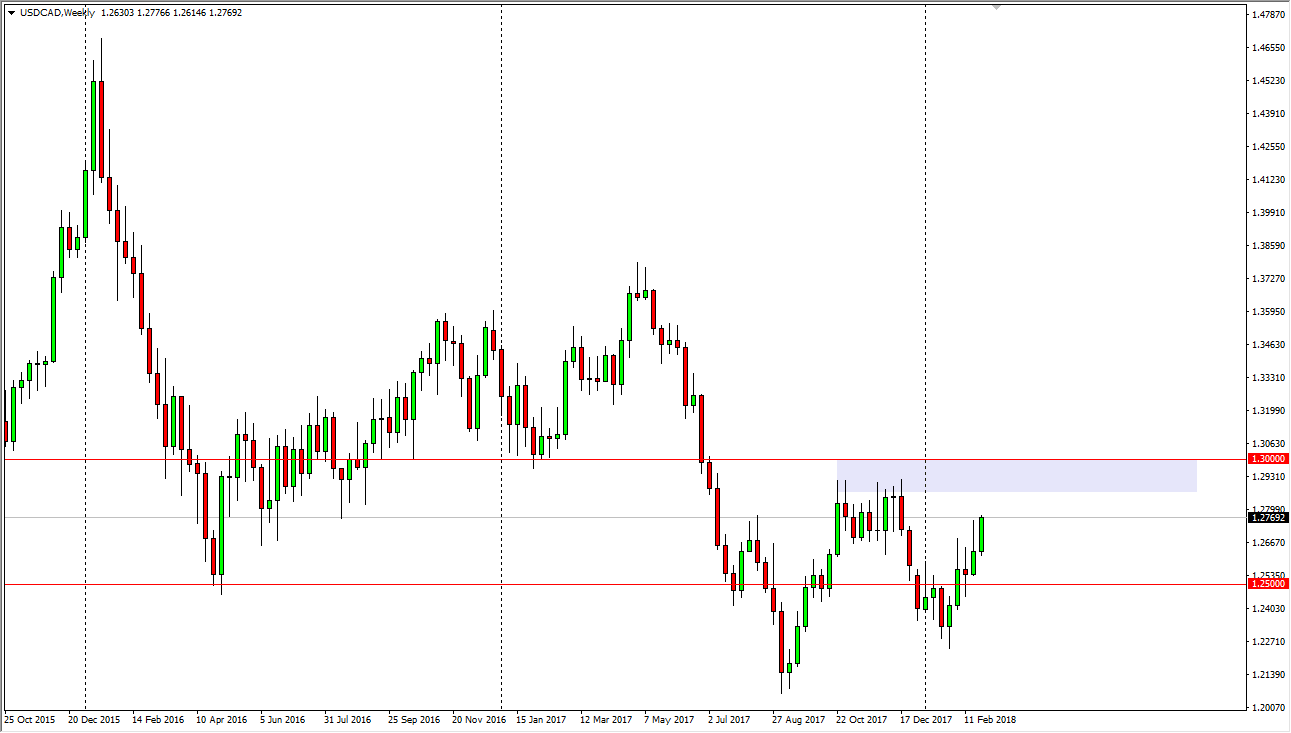

USD/CAD

The US dollar has rallied significantly during the February session, capturing a lot of the losses that we had seen previously. I believe that the oil markets have reached the highs for the year, and it’s likely that we will continue to rally a bit from here. I do recognize that the area above at the lavender rectangle represents a significant amount of resistance, extending to the 1.30 level above. I think it’s going to take a lot of work to get above there, so don’t be surprised at all if we see some type of roll over from here, offering value in the US dollar. I believe that a lot of the work to be done in this market is going to be done by the oil markets, and as they fall I think that will continue to put longer-term pressure on the Canadian dollar.

I see the 1.25 level underneath offering significant support, and although it will be noisy, nothing new for this pair, I do believe that eventually we will break above the rectangle, clearing the 1.30 level, and then perhaps heading to much higher levels. I anticipate by the time summer rolls around; this pair should be closer to the 1.35 level. This will be exacerbated by oil markets, a Canadian housing bubble that she had to pop, and higher treasury yields in the United States. This leads to a bit of a “perfect storm, I think it’s only a matter of time before the usual momentum picks up. The alternate scenario would of course be a breakdown below the 1.23 handle, something that I don’t things going to happen anytime soon. If it does, I would anticipate a return to the 1.20 level underneath, which is a major level for longer-term traders.