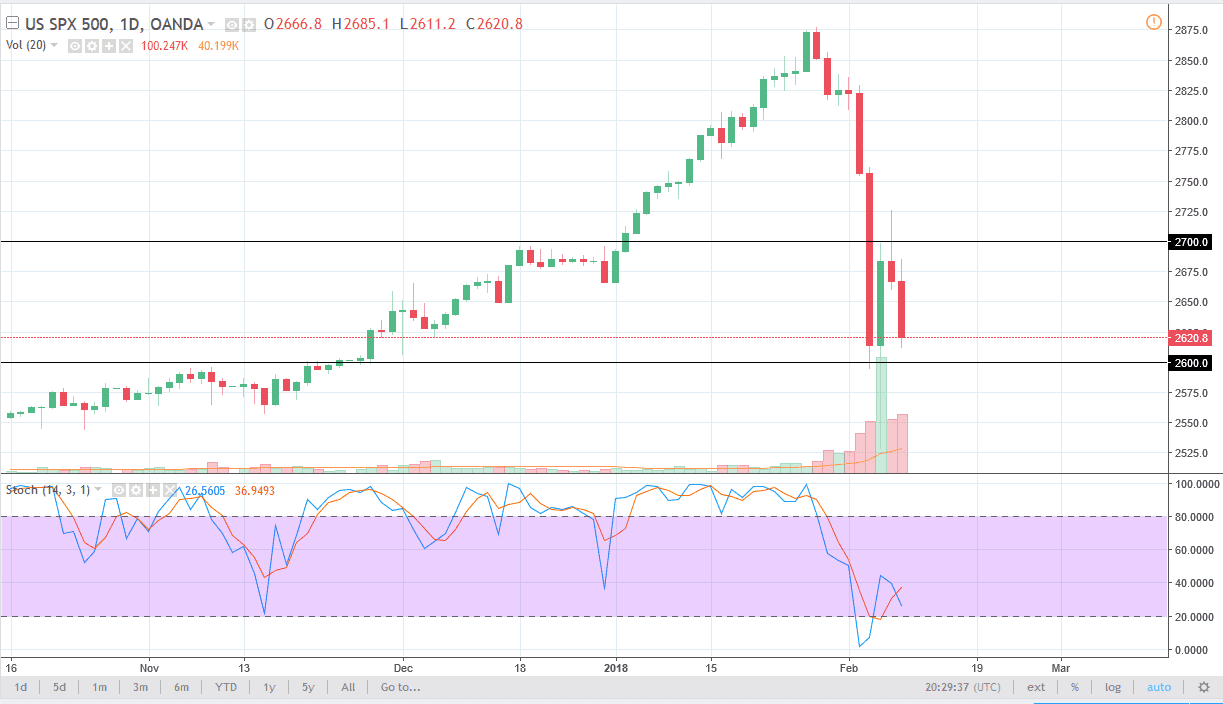

S&P 500

The S&P 500 has initially tried to rally during the trading session on Thursday, as we had trying to form a rally on Wednesday. However, we turned around and broke down below the shooting star that had formed for the Wednesday session, sending the market back towards the bottom of the range that we have been in over the last 3 days. I suspect that the 2600 level is very important, and at this point I think if we can stay above there, were more than likely going to see some type of consolidation. However, if we break down below that level, it’s likely that we go down to the 2500 level underneath, which is much more structurally important from the longer-term charts. I expect volatility regardless, and at this point I would be very cautious about jumping into the market.

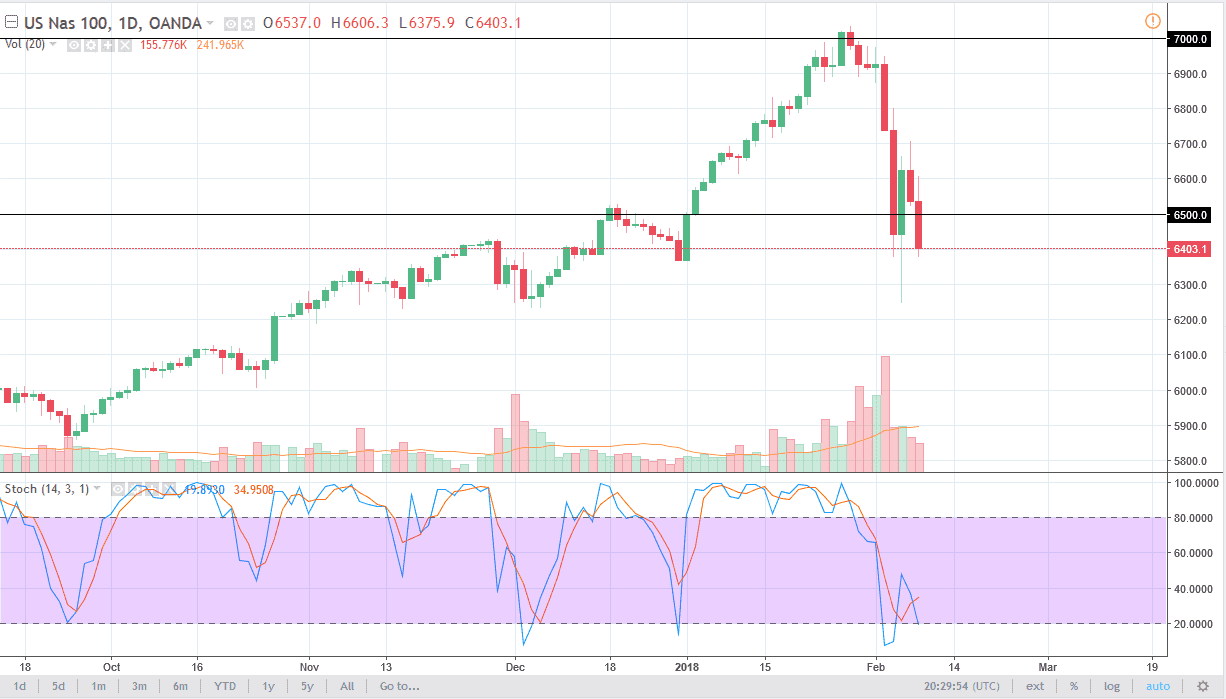

NASDAQ 100

The NASDAQ 100 fell during the trading session as well, slicing through the 6400 level at the end of the day. I believe that the market is going to continue to go lower, perhaps down to the 6300 level, and then possibly even break down below to the 6200 level. If we were to continue the move lower, I would be very concerned if we break down below 6000, as it would be a sign that the overall uptrend is breaking down. If we can bounce above the 6500 level, the market could reach towards the 6700 level above, and once we clear that area, we could go to the 7000 handle. This is a market that’s been in an uptrend for some time, but certainly looks as if it is struggling to find buyers at this point. It’s likely that we could sit on the sideline to protect trading capital in the meantime, as it looks like the sellers are quite done.