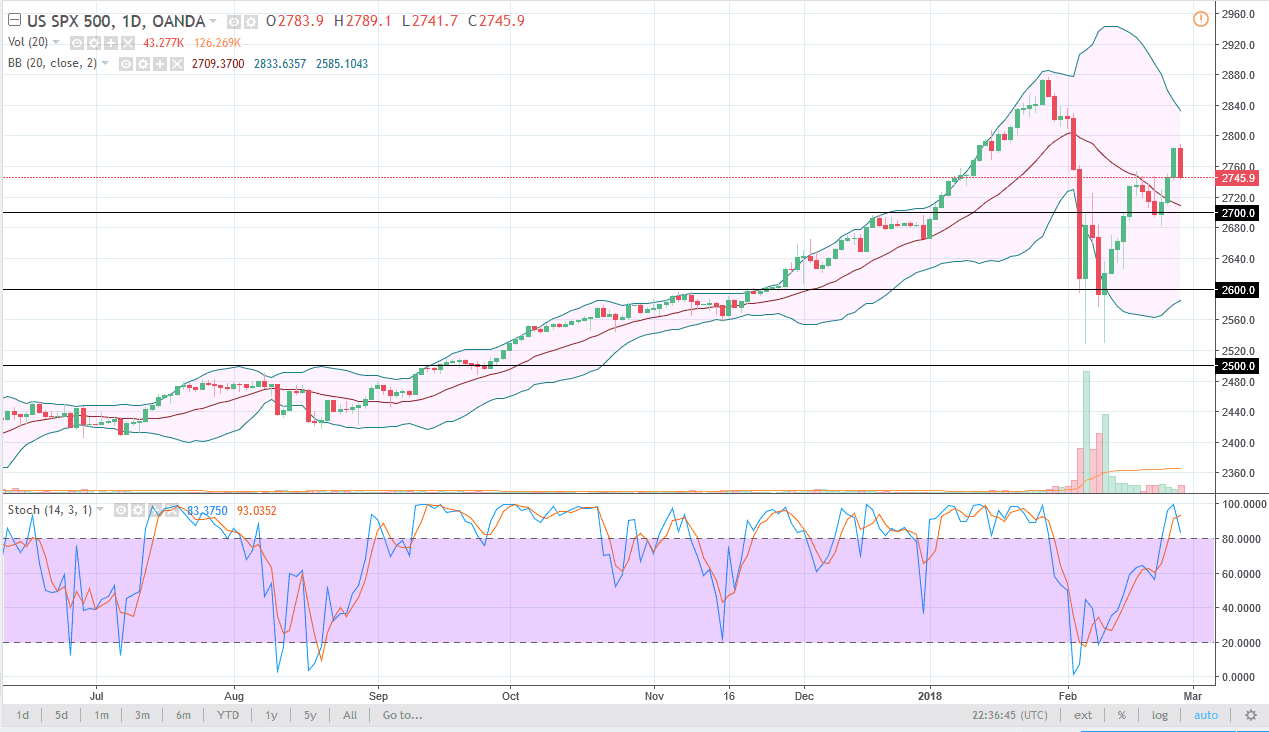

S&P 500

The S&P 500 fell during the trading session on Tuesday, showing plenty of resistance during the day. However, there is plenty of support just below, extending down to the 2700 level. There is more than enough support below here to the 2700 level to offer support, and I believe that buyers will jump into this market based upon value. The 2700 level continues to be important, and I think it’s only a matter of time before any type a pullback gets picked up as value-based upon the ridiculous move after Jerome Powell suggested that perhaps the Federal Reserve was in fact going to continue to raise rates. This is not new information, and I believe that it’s only a matter of time before people will start looking to take advantage the ridiculous reaction during the day.

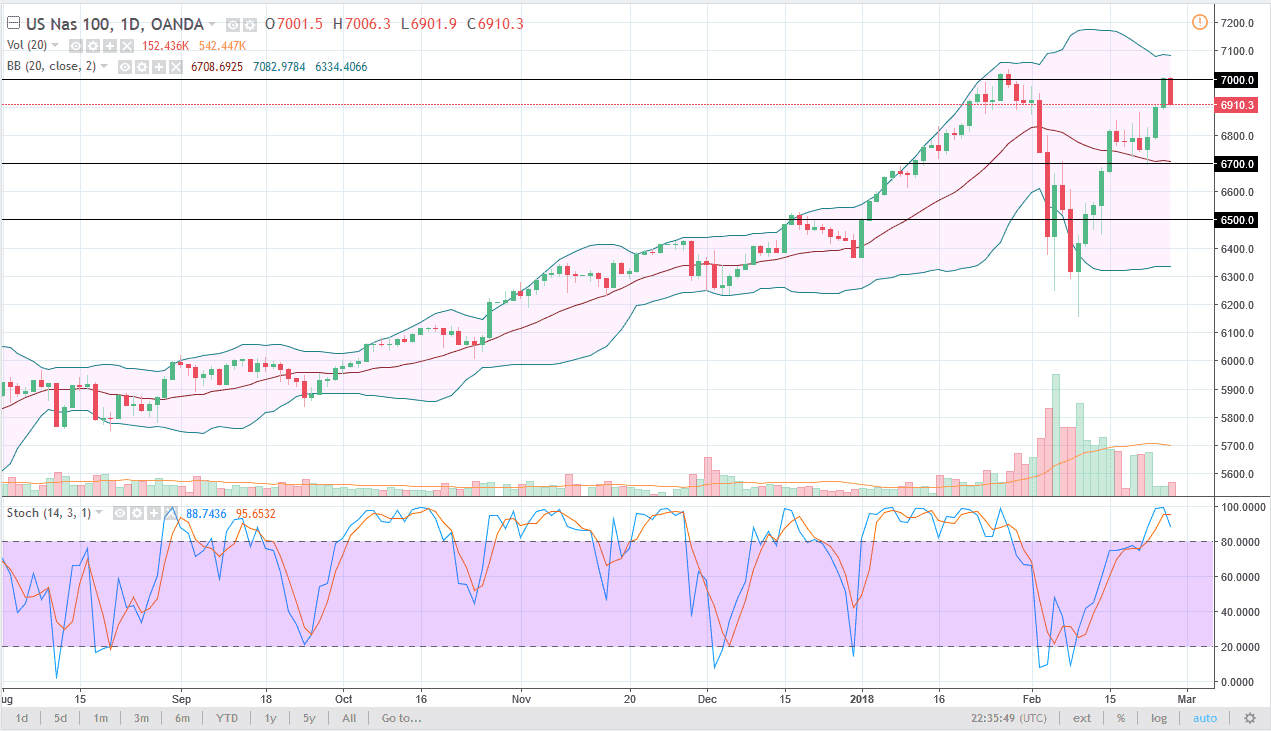

NASDAQ 100

The NASDAQ 100 pulled back during the trading session on Tuesday, as the 7000 level was a bit too much. Most of this was in reaction to Jerome Powell suggesting that the Federal Reserve was going to do what it had already said, so I think this is a market that is offering value. The 6900-level underneath is a beginning of support that extends down to the 6700 level. At the first signs of a bounce, I am more than willing to start buying this market, as I believe we are trying to build up enough momentum to finally break out above the 7000 handle, which of course has a certain amount of psychological resistance built in as well. If we can clear that level, it’s likely that we will continue to go higher for a longer-term move. I think at that point; the market would more than likely go to the 7500 level.