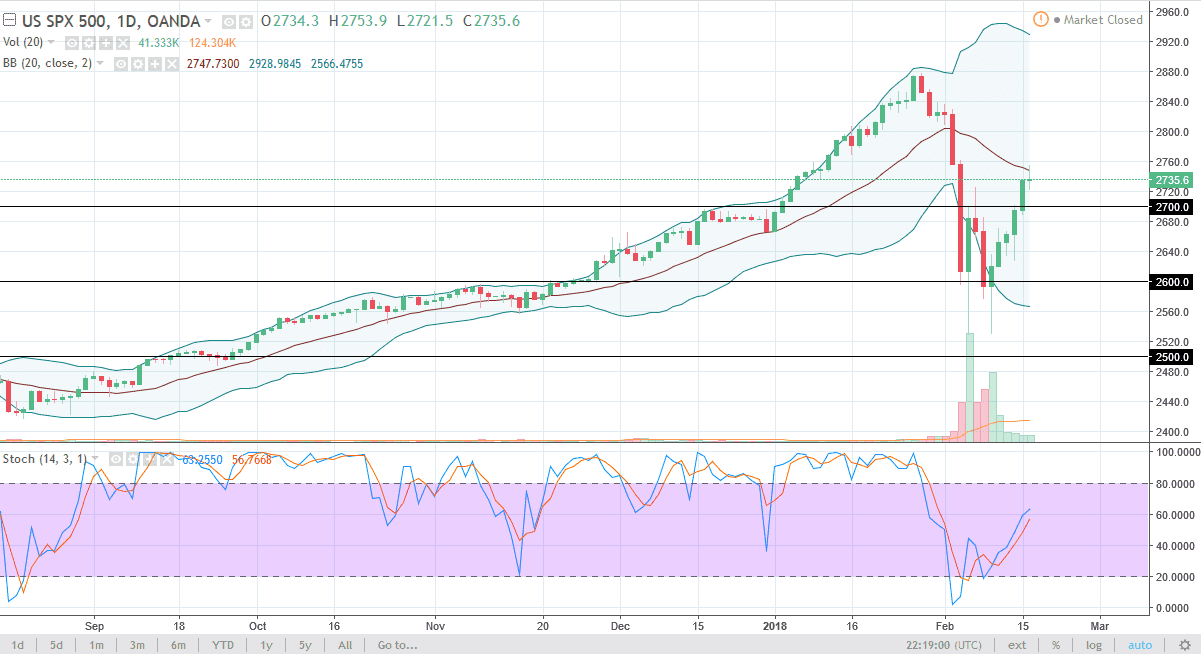

S&P 500

S&P 500 traders had a volatile day on Friday, testing the 2750 level, but rolled over. There was a lot of noise due to indictments in the Mueller case, but at the end of the day it wasn’t much of a bombshell, as nobody that would have mattered in the end was indicted. The candle does look like it is showing a bit of exhaustion, so I would not be surprised to see a short-term pullback, but I think there should be plenty of support near the 2700 level. Alternately, if we break above the top of the candle for the week, that should be a buying opportunity as well, sending this market looking for the 2800 level. Ultimately, this is a market that I think is going to continue to try to find buyers, but I would also anticipate a lot of volatility.

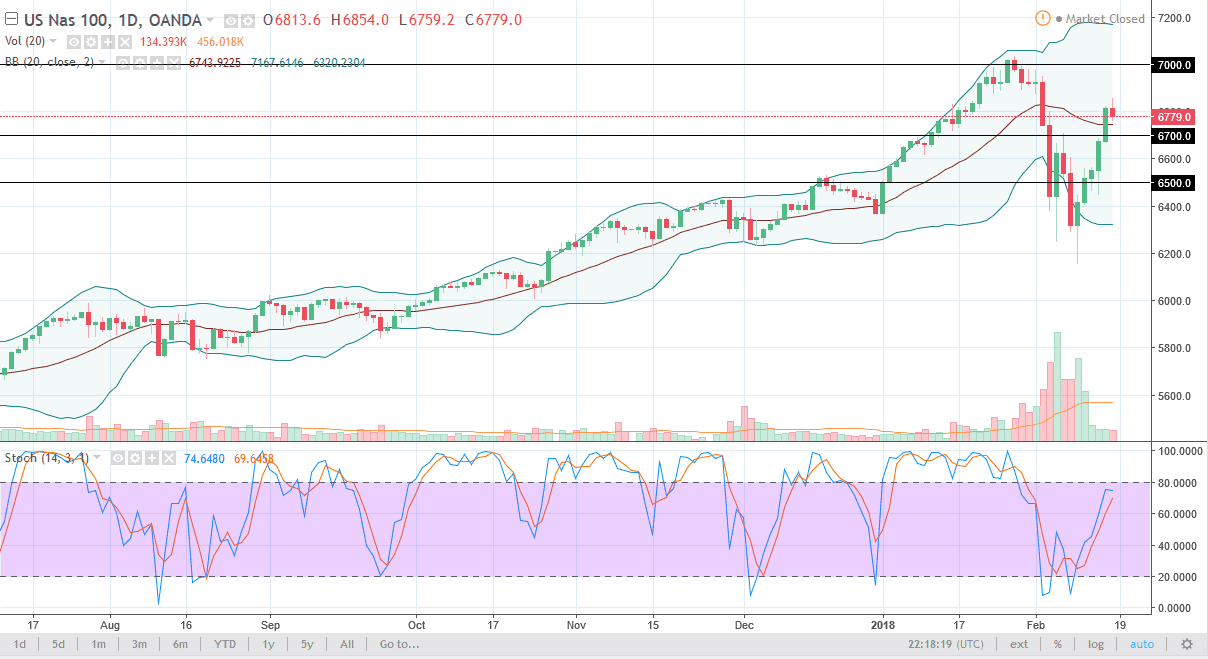

NASDAQ 100

The NASDAQ 100 has tried to rally during the trading session on Friday but ended up forming a shooting star. I think this suggests that we are going to drop down from here, perhaps looking for 6700 underneath which is previous resistance, and it should now be support. I think that breaking above the top of the shooting star is also a bullish sign, but I think at this point what we are looking at is more exhaustion than anything else, but I do believe that longer-term we are going to continue to reach towards the 7000 handle which was the recent highs. Ultimately, this is a market that I think will rally, but has gotten a bit ahead of itself over the last several sessions. I believe that there is a “floor” in the market at 6200 level, and we remain in an uptrend if we can stay above that level.