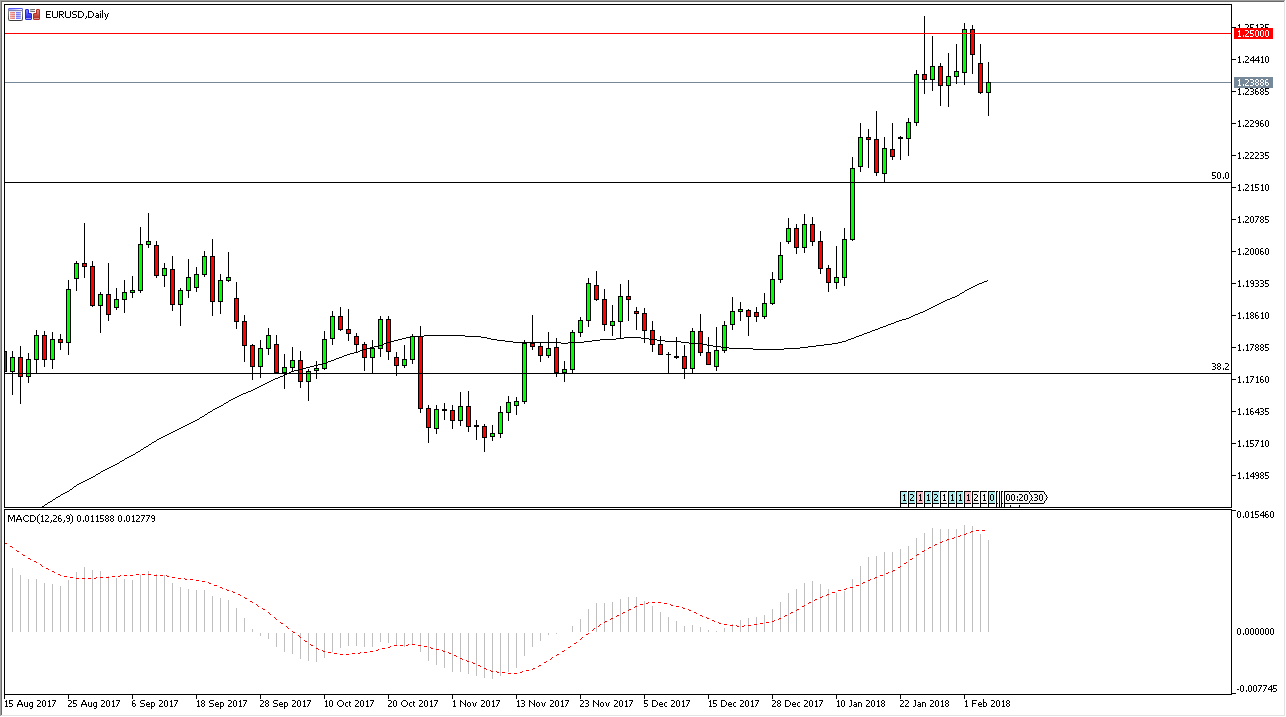

EUR/USD

The EUR/USD pair has been volatile during the trading session on Tuesday, breaking down a bit, but bouncing later in the day to show signs of life yet again. It looks as if the market is ready to continue to climb towards the 1.25 level, an area that is massive resistance. Once we clear that area, the market should be free to go much higher, and the longer-term outlook for the EUR/USD pair is the 1.32 handle from my longer-term analysis. With that being the case, I like buying dips and I think we have just seen a nice one. We will probably consolidate in the short term, as the 1.25 level has been massive resistance, but ultimately, I do think that the buyers build up enough pressure to send this market higher. If we do pull back from here, I anticipate that there is even more support near the 1.23 handle.

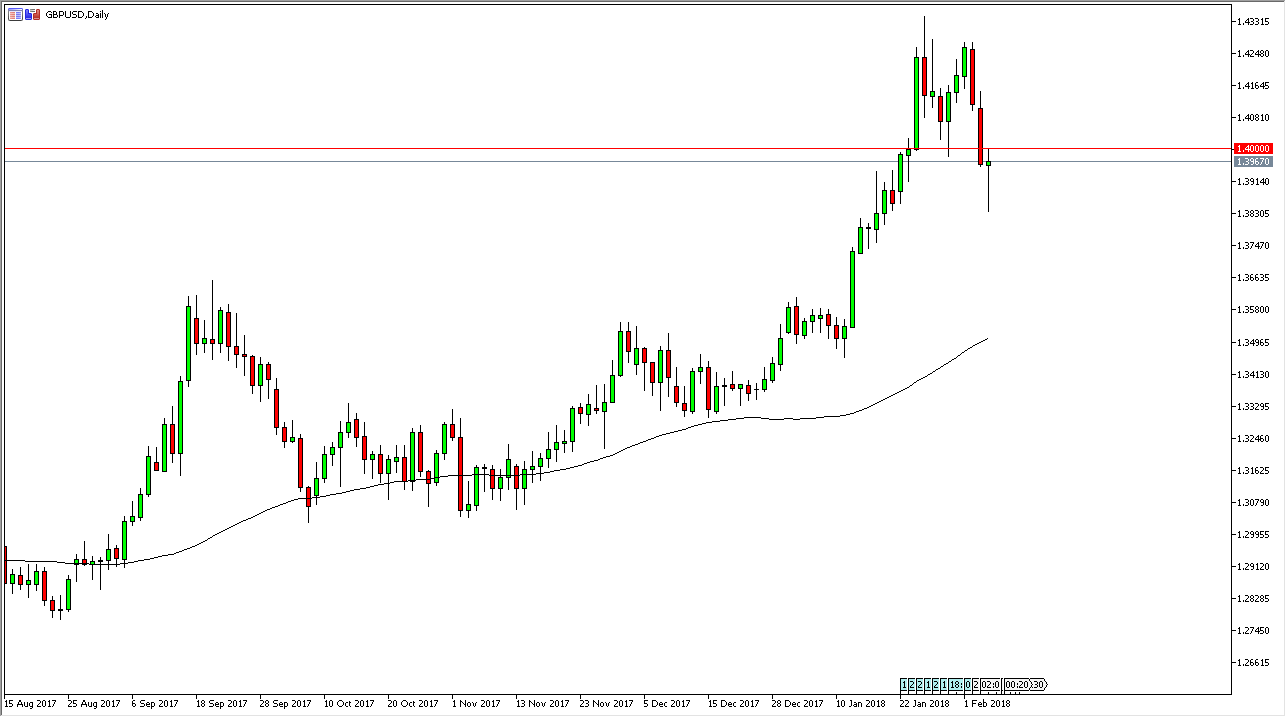

GBP/USD

The British pound initially saw a lot of bearish pressure during the trading session on Tuesday but bounced significantly to form a very supportive looking candle. If we can clear the 1.40 level, I think this will be a resumption of the uptrend, and that the market should continue to go towards the 1.43 level. Beyond there, I think we go much higher, but obviously we will have a significant amount of noise along the way, but I think that these dips offer value the people are trying to take advantage of. If we break down below the 1.38 handle, then we break down to the 1.36 level. However, that’s the least likely of scenarios, as we have seen so much in the way of negativity involving the US dollar, and of course people looking for risk assets.