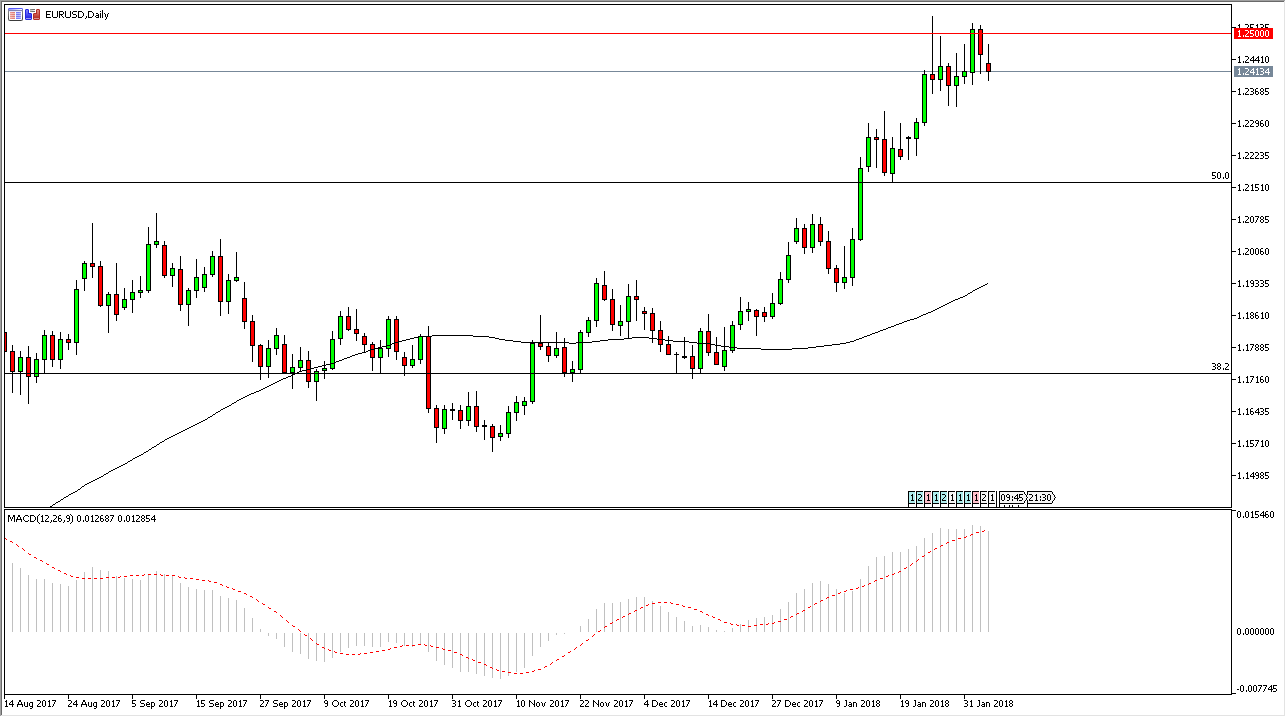

EUR/USD

The EUR gap lower at the open on Monday, turned around to fill that gap, and has rolled over to show signs of exhaustion. It looks as if the US dollar is trying to make a stand, and when I look at the US Dollar Index, it is testing serious support. I think that we could get a bit of a pullback because of this, but I would anticipate that there should be plenty of buyers below, especially near the 1.23 handle. I suspect that we may see a small dip lower, but eventually buyers will return to continue to press the issue to the upside. If we could turn around and break above the 1.25 handle, the EUR/USD pair should continue to go much higher that point, which I believe that eventually happens. In the meantime, I expect a lot of noise and value opportunities to appear.

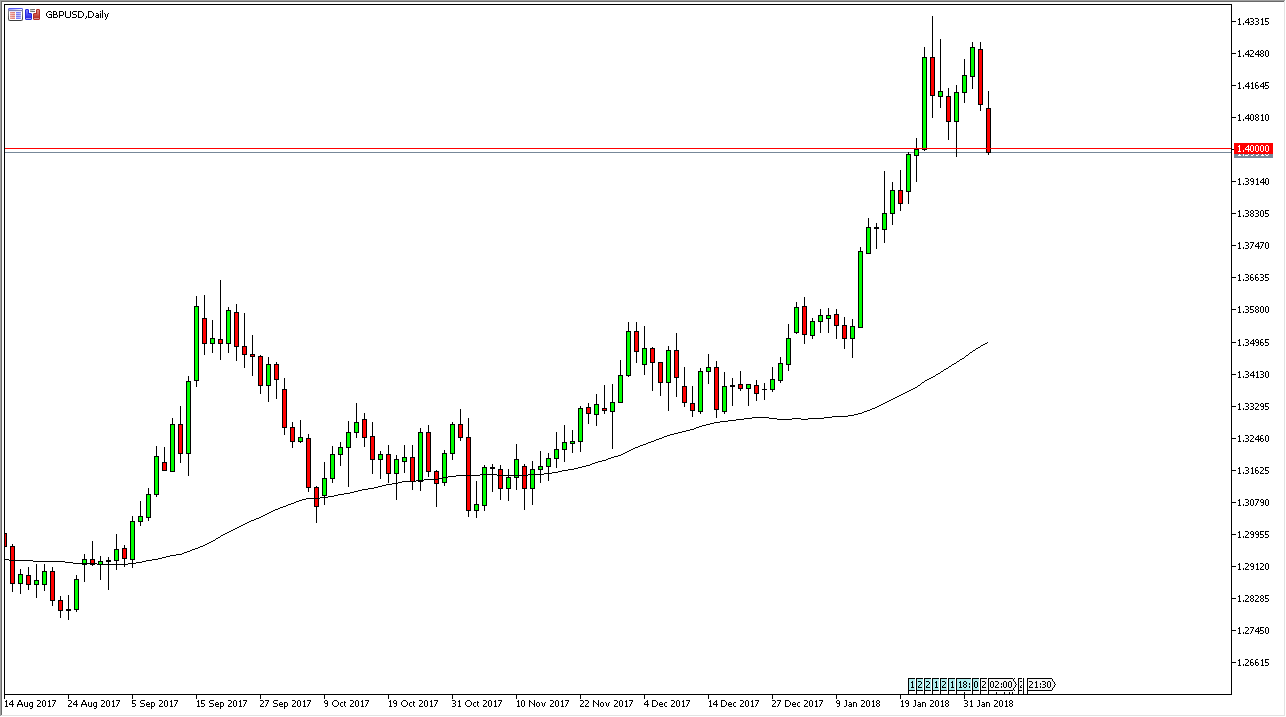

GBP/USD

The British pound has fallen rather significantly during the day on Monday, breaking down below the 1.40 level. It looks as if the market is trying to break down, and if it does, we could go as low as the 1.38 level rather quickly. I think there should be buyers in that general vicinity, and I still believe in the uptrend, but we are starting to see a lot of fear in the global markets, and that of course favors the US dollar. Eventually, people will look at this as an opportunity to take advantage of weakness, but I think that we need to see at least 24 hours of stability before doing anything about it. In the meantime, I would fully anticipate short-term bearishness in the market, and don’t see that changing quite yet. Longer-term, I still believe that we go looking towards the 1.45 level.