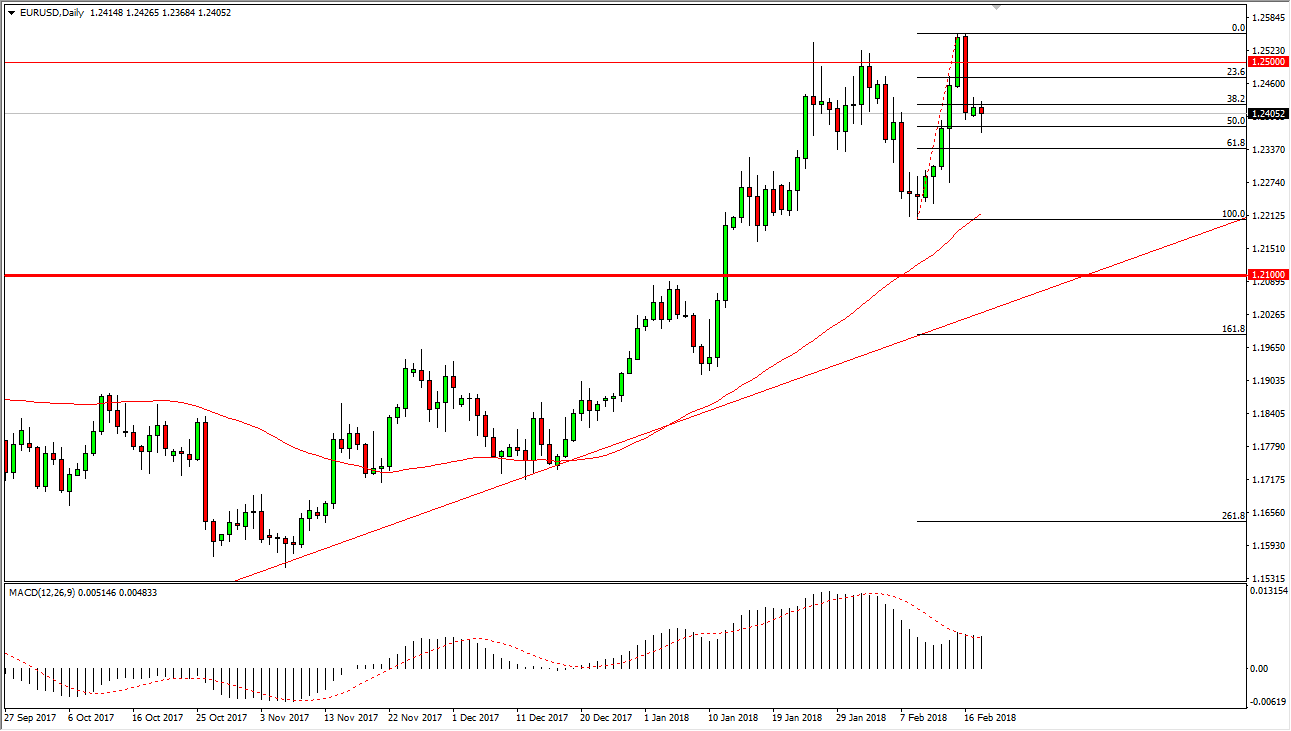

EUR/USD

The EUR/USD pair has pulled back a bit during the trading session on Monday, but by the time we closed out the session, we ended up forming a hammer. The hammer sits at the 1.24 level, an area that should be supportive based upon the action for the day, plus the 50% Fibonacci retracement level being at that area it doesn’t hurt either. Because of this, I believe that the market will eventually reach towards the 1.25 level again, and on a break above the top of the candlestick for the session on Monday I am more than willing to go long. I believe that we will not only reach towards the 1.25 handle but break above there and continue to go much higher. The market for me is far too well supported underneath to short at this point, and I believe that the longer-term uptrend should continue.

GBP/USD

The British pound also fell initially during the day on Monday but has seen enough support to turn around and form a hammer at the 1.40 level. I think at this point we are trying to fight in of bullish pressure to go higher, perhaps reaching towards the 1.41 level, and then eventually the 1.43 level. I believe that the market should continue to be very volatile, but I think in the longer-term I think that we will continue to go higher, perhaps breaking out above the 1.43 level and eventually reaching towards the 1.45 handle.

The 50-day exponential moving average is sitting just below recent consolidation, so I think it will continue to lift this market dynamically as well. I believe that selling is all but impossible, as the US dollar has a lot of headwinds facing it, not the least of which will be the US treasury market selling off.