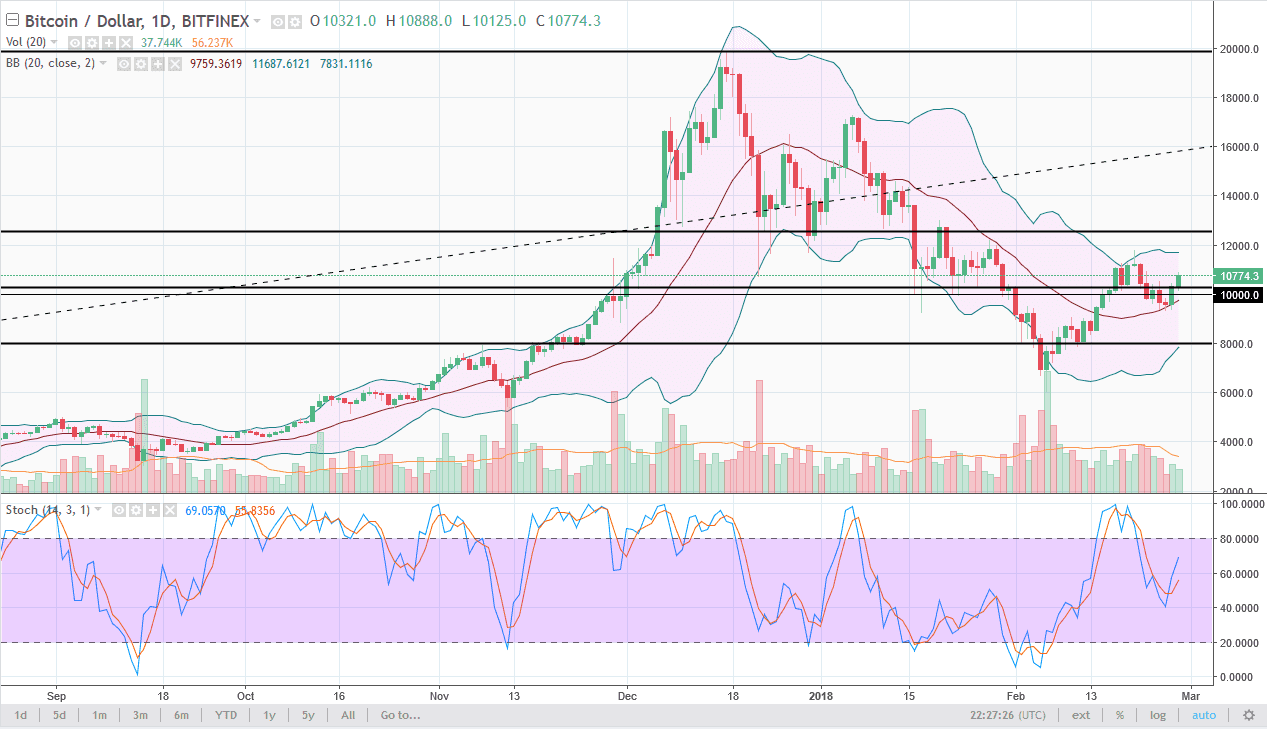

BTC/USD

Bitcoin markets rallied a bit during the trading session on Tuesday, breaking well above the $10,500 level, and it looks like we may make another attempt at the $12,000 level. I believe that area is significant resistance, and a break above there would be a very bullish sign. In the meantime, I think we are trying to build up a bit of momentum to finally make that break out, and I would point out that the middle band of the Bollinger Bands indicator continues to support this market. A break above $12,000 is a good sign, and I would be a buyer above there. If you are a longer-term investor, then you can buy little bits and pieces along the way, perhaps add to your position once you get above there. Otherwise, if we break down below the lows from the weekend, then I think the market probably drops down to $8000.

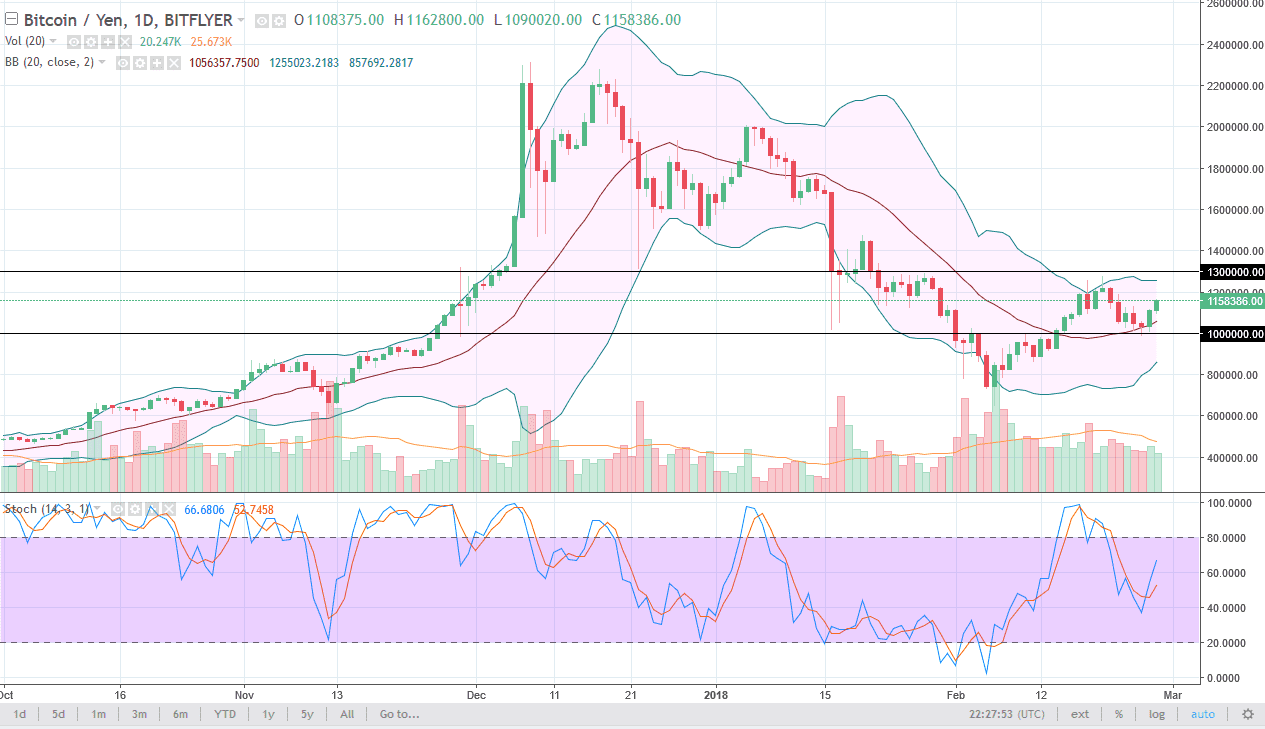

BTC/JPY

Bitcoin also rallied against the Japanese yen, which is crucial. Japan is 40% of Bitcoin volume, so this market must rally for the rest of the crypto currency markets to continue to go higher. We are currently trading between the ¥1 million level on the bottom, and the ¥1.3 million level on the top. If we can break above there, then I think we go to the ¥1.5 million level, and that the ¥1.6 million level. I believe the pullbacks offer value, but if we were to break down below the ¥1 million level, I think that could bring out a lot of short selling, perhaps reaching down towards the ¥800,000 level. I believe that larger traders are trying to build up a position, but it should also be noted that a bit of a downtrend line is just above at the 1.3 level as well. In other words, expect a lot of noise.