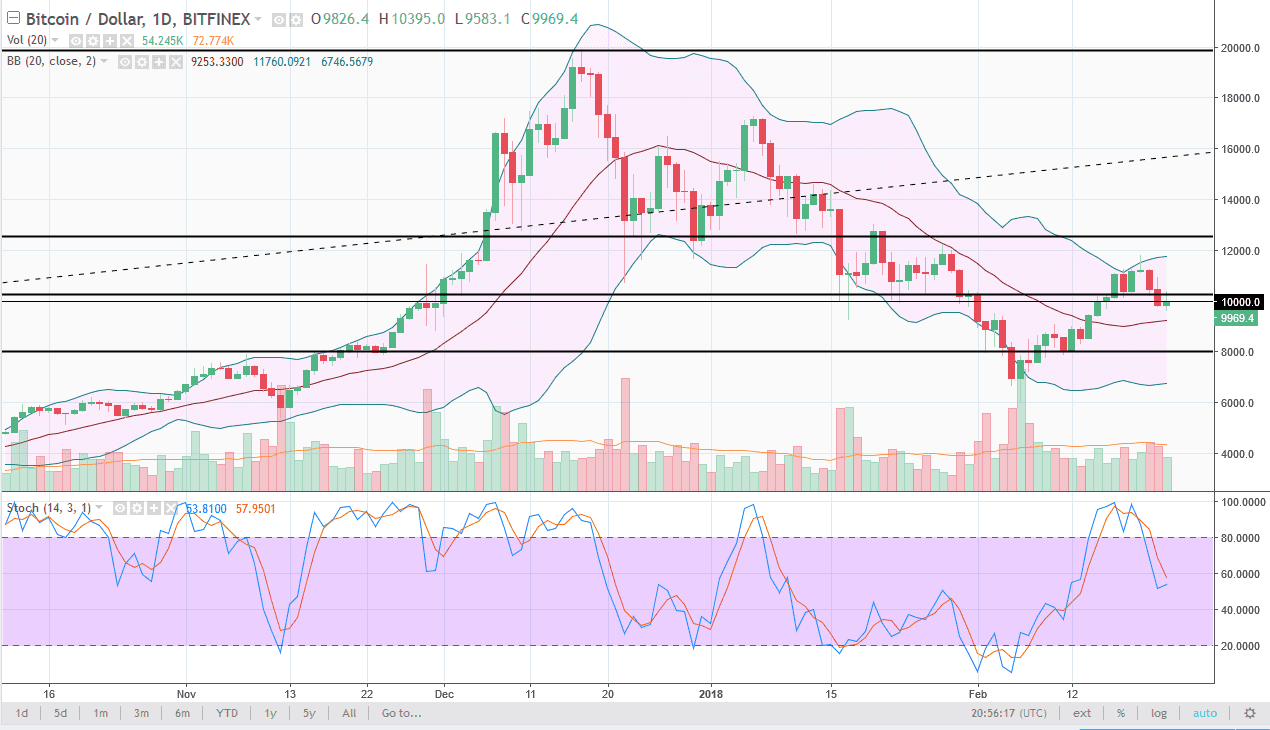

BTC/USD

The Bitcoin markets have gone back and forth during the trading session on Friday, as we continue to dance around the $10,000 level. This will be an interesting couple of days, because we are facing what I think is the first major test of the previous bounce. You can make a strong argument for a downtrend line coming involved as well, so I think the next impulsive move that could decide where this market goes for the next 6 months. Quite frankly, if we were to break down below the $8000 level it would be catastrophic at this point. If we do turn around and break above the shooting star and clear the $12,000 level, that could be very bullish, but I do recognize that there’s still work to do with the $13,000 level.

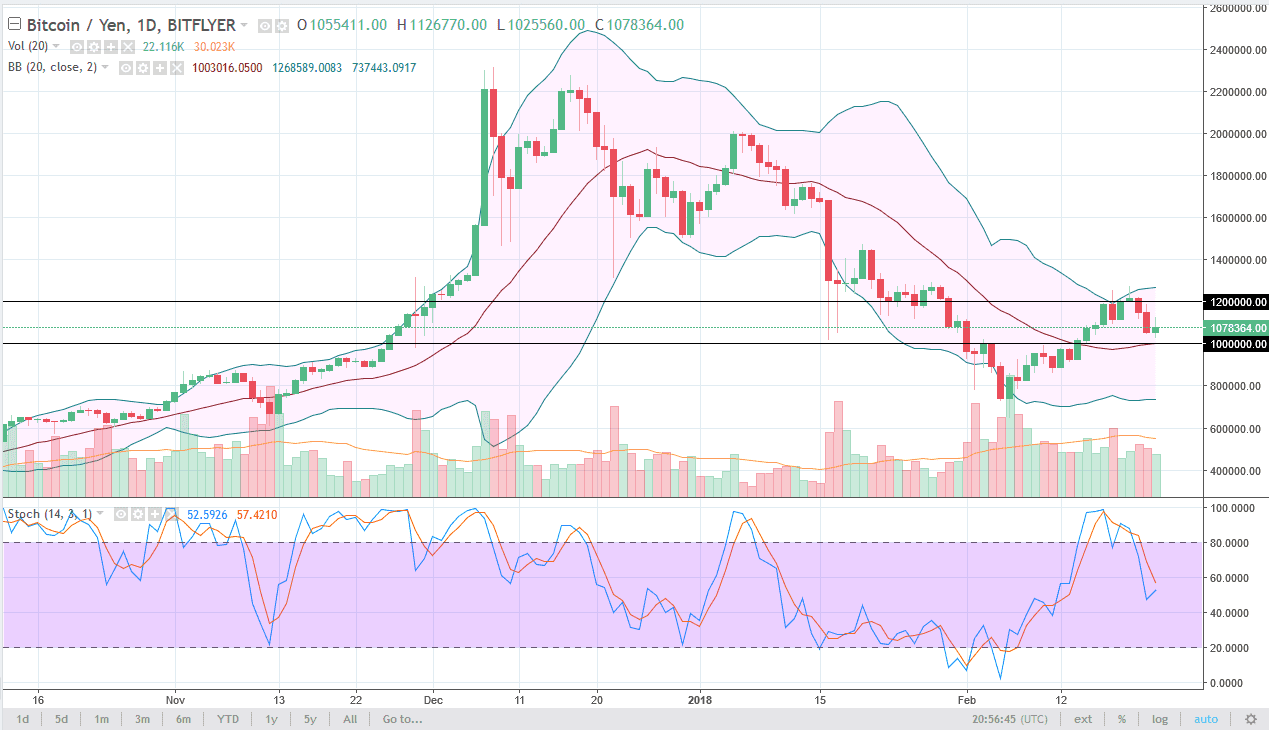

BTC/JPY

The Bitcoin market going back and forth against the Japanese yen also has been a factor in the market. The ¥1 million level underneath is supportive, and I think that if we break down below that level this market could roll over rather significantly. That matters, because Japan is 40% of the Bitcoin volume traded every day. If we roll over in Japan, we roll over everywhere. Alternately, if we can break above the ¥1.3 million level, the market could go much higher. In fact, it needs to happen so that the buyers can continue to build up momentum. A lot of psychological damage has been done to the retail market recently, and I think those effects will ripple going forward. The markets continue to be very noisy and skittish, so I think that we are probably going to go back and forth between the ¥1 million level and the ¥1.2 million level on the top.