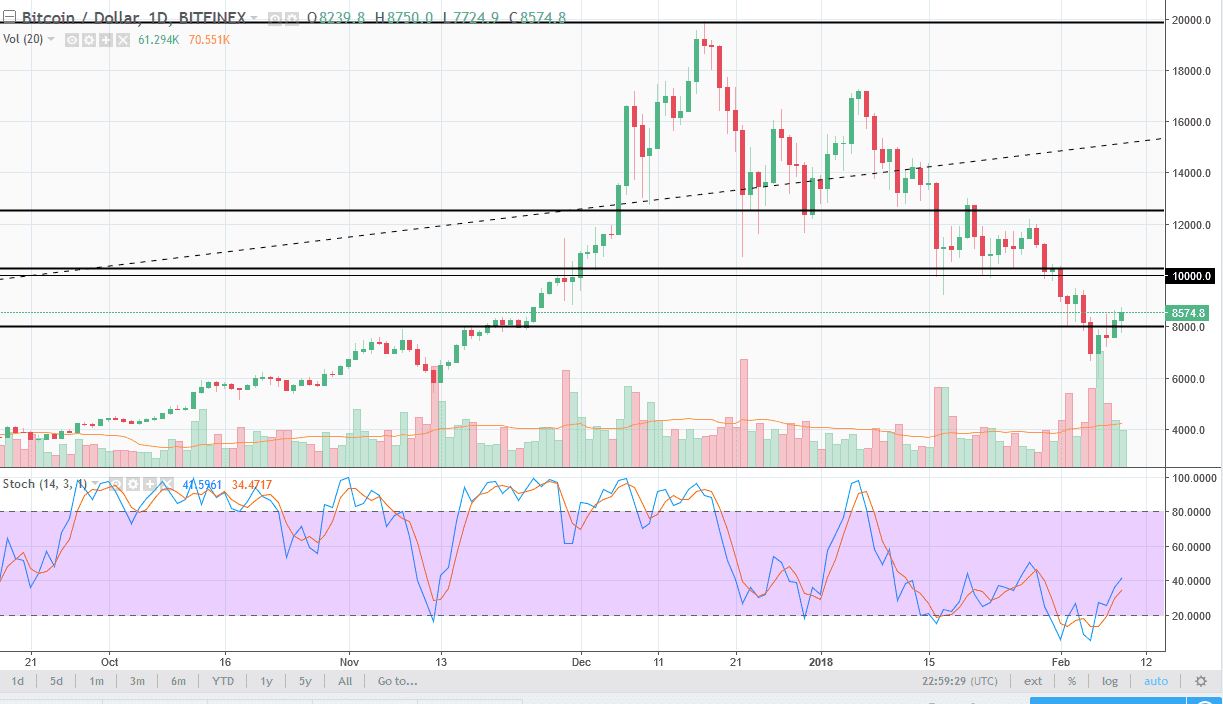

BTC/USD

Bitcoin markets initially fell during the trading session on Friday but found enough support at the $8000 level to turn around and show signs of strength again. We have formed a hammer for the day, which of course is a very bullish sign, and I think that we may try to go higher. However, we are not quite out of the woods until we decided to lead clear the $10,000 level. It’s hard to tell whether this is the real deal, or simply a “dead cat bounce”, and I think that even if it is the real thing, we will probably have several pullbacks. Take your time, there’s no need to jump in and put a bunch a risk into the market. I think that if we break a fresh, new low, there could be a massive amount of bearish pressure in this market. Ultimately, I believe that one of the biggest problems is that so many retail traders have been decimated.

BTC/JPY

The Bitcoin market pulled back a little bit during the trading session on Friday, but then rallied a bit. It now looks as if we are trying to test the ¥1 million level, an area that should cause a lot of noise. It was previously supportive, so it should now be resistive. If we can clear that area handily and with strong volume, then I think Bitcoin has a chance to start rallying against the yen significantly. At that point, we could be looking at the ¥1.4 million level, which was the top of the recent consolidation. Otherwise, if we find ourselves struggling at the ¥1 million level, we will probably pull back towards the ¥800,000 level. Again, I think it is best to jump into this market slowly if you get involved.